The share price of fintech giants Afterpay (APT) and Zip Co (Z1P) tumbled into the red on Thursday as rising interim income failed to offset deepening losses.

While APT clawed its way back to finish 1.39 per cent up, Z1P failed to reverse its luck and ended the session nearly 8 per cent in the red.

Both buy now, pay later (BNPL) stalwarts posted mammoth customer and merchant growth at the end of 2019, but ongoing expansion costs kept them from turning a profit.

On top of that, an increasingly crowded Flexipayment market is challenging BNPL businesses to find a niche and make it their own.

So, what do these interim results mean for Australia’s fintech favourites? And how does it position them to pursue profitability beyond FY20?

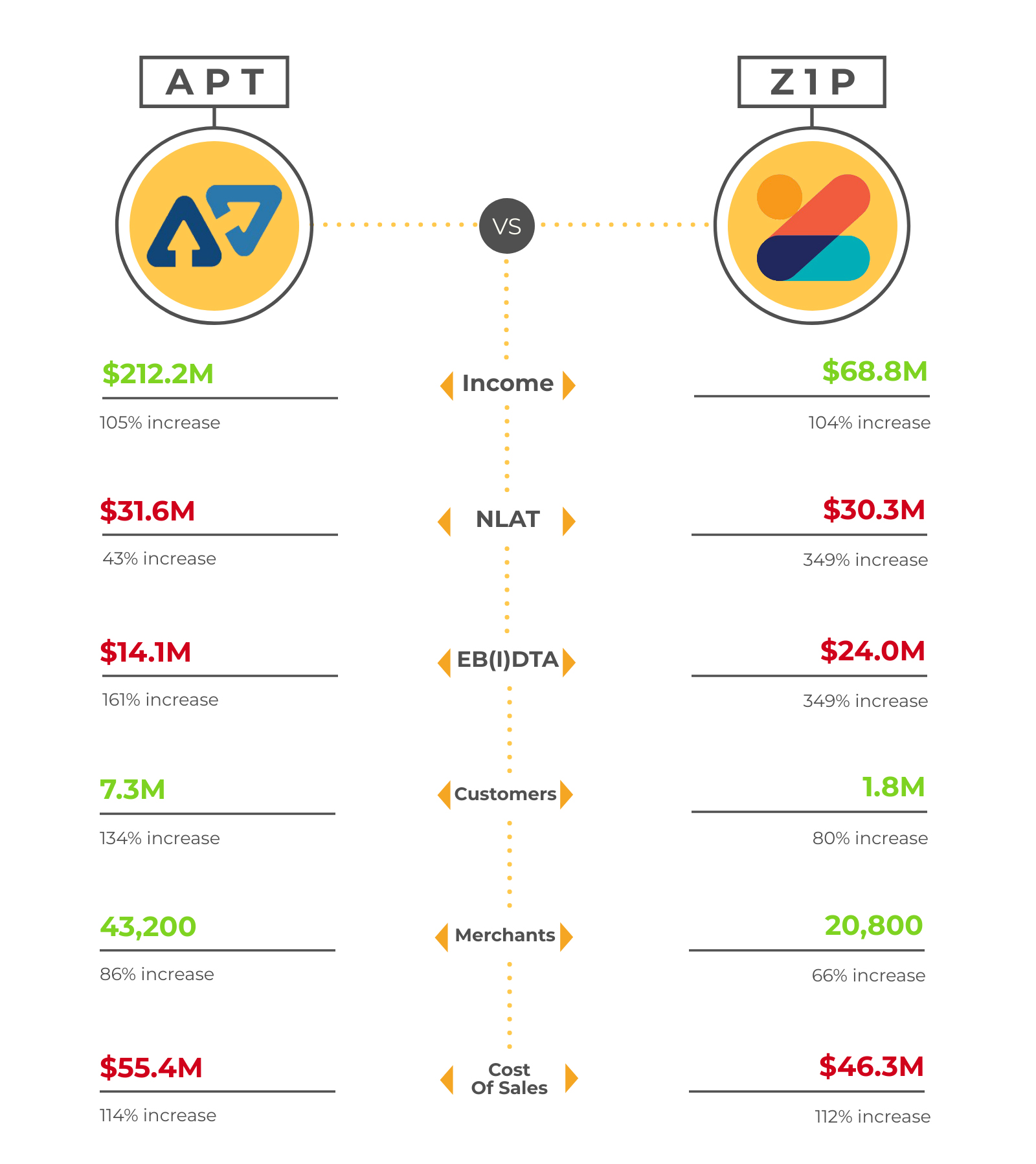

BNPL by the numbers

Keen to understand how Australia’s largest BNPL machines compare? Here’s how some of their key interim report stats stack up.

Afterpay: The global BNPL sensation

As Australia’s largest BNPL machine, Afterpay is well and truly leading the flexipayments charge.

The company delivered $4.8 billion in underlying sales in today’s interim report. Interestingly, that’s over double the figure from the previous corresponding period.

Similarly, the group’s total income and net transaction margin increased twofold.

However, a sharp spike in several key metrics couldn’t keep a larger loss at bay. Consequently, Afterpay posted a $31.6 million loss after tax.

But APT chalks these losses up to a range of investment expenses, like hiring talent and developing its marketing material. The company also says it encountered some one-off costs as it expanded internationally.

“While this will impact group profitability in the short term, we expect to achieve higher profitability in each market as they mature over time, in line with our ANZ experience.”

Afterpay Chief Executive, Anthony Eisen

Customer base continues to grow

Moreover, APT’s greatest area of growth is its customer base. In the first half of FY20, the group averaged 16,800 new customers every day.

Much of this growth can be seen in the U.S., where the American customer base now exceeds APT’s Aussie clients. During this time, U.S. active customers skyrocketed 443 per cent to create a 3.6 million-strong userbase.

In the meantime, the Australian and New Zealand market also grew. Afterpay ANZ now hosts over 35,000 merchants — a 63 per cent increase since December 2018.

And while online shopping continues to dominate the Aussie retail offering, Afterpay is still making money off brick-and-mortar stores. In fact, in-store transactions made up just under a quarter of APT’s underlying sales during the last half.

As a result, roughly 14,200 more stores are now equipped to process purchases in four easy payments.

Where to from here?

Success in its Australian, American and English markets has made Afterpay hungry to expand. As a result, the company is eyeing a 2020 launch in Canada.

Additionally, APT is aiming to sign nearly 10 million global customers by the end of the financial year. The strong interim results mean Afterpay is now looking to exceed its mid-term targets. In fact, the company is looking to reach $20 billion in underlying sales by mid next year.

And while Canada is the primary target on the cards, Afterpay says it’s preparing for new markets, with “others to come” in due course.

Above all, however, APT maintains its strong growth mentality. It’s also seeking to expand vertically so it can provide payment options for travel and health platforms. And, according to Afterpay, underpinning it all is “a solid balance sheet [and] strategic partnerships”.

Zip Co: The credit card disruptor

Australia’s second-largest BNPL, Zip Co, is experiencing similar financial trends. As a young Flexipayment platform, it’s yet to turn a net profit.

This morning, however, Zip delivered a record first half and more than doubled its year-on-year transaction growth rate.

Conversely, total earnings before tax, depreciation and amortisation (EBDTA) slipped to a loss of $24 million last half. Similar to APT, much of this slump can be attributed to one-off costs like the $60 million acquisition of South African payment platform, PartPay.

But the news did little to offset a deepening net loss after tax. Zip’s interim NLAT stats increased from $6.8 million at the end of 2018 to hit $30.3 million last half.

A new kind of payment platform

Despite the heavy losses, Zip Co is standing firm in its BNPL brand. While expansion remains a key part of its strategy, Zip is investing throughout FY20 in a bid to beat the common credit card.

The platform allows users to pay bills and make purchases across sectors, eclipsing categories like retail, home, grocery and travel. Essentially, there’s an emphasis on diversifying its merchant portfolio.

As it attracts more customers and merchants, Zip says it wants to improve its payment experience. It’s expanding its online and app platforms, and recently introduced a facial ID feature, which is completely automated.

On top of that, the BNPL giant has developed a credit portfolio for small and medium-sized businesses. The initiative allows managers to receive an interest-free loan of up to $25,000 to help grow their platforms.

During the second half of 2019, Zip secured partnerships with brands like Big W, Ola and Bunnings. It now boasts a 21,000-strong Australian and New Zealand merchant base and is the only BNPL engine partnered with Amazon in Australia.

Beyond FY20

When it comes to global expansion, Z1P is right on APT’s heels. The company intends to launch into the U.K. by the end of 2020. In the meantime, it’s continuing to develop its stake in two U.S. and South African Flexipayment platforms.

“One in three Australians now recognises the Zip brand.”

Zip Co interim report, based on Roy Morgan Brnd Research

Today, roughly 1.8 million customers are actively using the Zip Co platform. That represents an 80 per cent increase on the previous corresponding period. On top of that, Zip Co expects to have 2.5 million customers on board by mid-2020.

Knowing all this, it’s no secret that Afterpay and Zip Co’s exponential customer and merchant growth precludes an incredibly large, incredibly diverse market.

But can these BNPL giants move beyond their current losses towards profitability? Only time will tell.