- High Grade Metals (HGM) has signed an agreement to purchase private company Jade Gas, giving it access to the coal gas sector in Mongolia

- The company intends to purchase all of the issued capital in Jade

- Jade’s current projects are located in the South Gobi region, 200 kilometres from the Chinese border

- HGM is also aiming to raise up to $6 million through the issue of ordinary shares at three cents each

- The transaction is subject to a number of conditions, including satisfactory completion of due diligence, shareholder approval and ASX approval

- Company shares will remain in voluntary suspension until the transaction is completed or terminated

- HGM last traded at eight cents per share on July 15, 2019

High Grade Metals (HGM) has signed an agreement to purchase private company Jade Gas, giving it access to the coal gas sector (CSG) in Mongolia.

The company intends to purchase all of the issued capital in Jade. The agreement is still in need of approval from shareholders and will need regulatory approvals

Who is Jade?

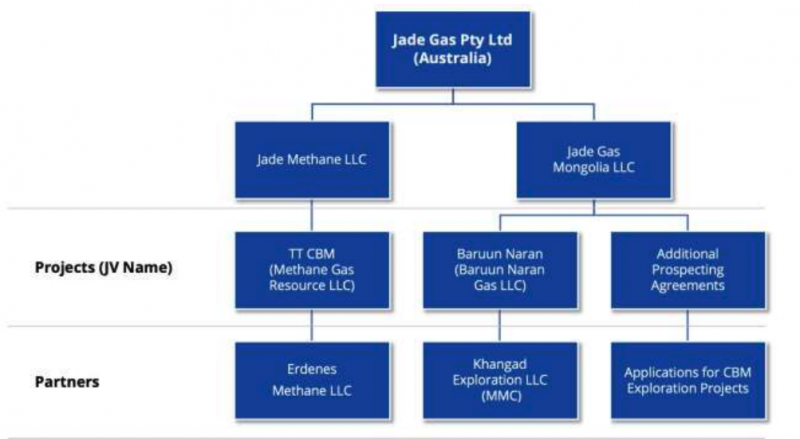

Jade is an Australian company focused on the CSG sector in Mongolia. Its current projects are located in the South Gobi region, around 200 kilometres from the Chinese border.

Jade’s key asset is a 60 per cent interest in Erdenes Methane, subsidiary of Erdenes Mongol, who hold a production sharing agreement with Mineral Resources (MIN) and the Petroleum Authority of Mongolia (MRPAM) to explore and exploit coal seam gas over a major coalfield known as Tavan Tolgoi.

Source: High Gradee Metals

What Does Jade own?

Joint venture with Erdenes Methane

A joint venture company, Methane Gas Resources (MGR), has been established to undertake the work in Mongolia. MGR is owned 60 per cent by Jade Methane, Jade’s subsidiary, and 40 per cent by Erdenes Methane.

The production sharing agreement (PSA) with MRPAM provides the right to explore and exploit CSG over the area of the Tavan Tolgoi coalfield. The PSA allows for up to 10 years of exploration and a further 30 years of CSG exploitation.

Joint venture with Khangad Exploration

Jade has an agreement with Khangad Exploration, in which Jade’s subsidiary, Jade Gas Mongolia, must solely fund the project to the completion of a Definitive Feasibility Study.

The project is located in South Gabi, approximately 10 kilometres further west from the licence area being worked on by MGR. Limited work has been undertaken on the CSG potential at this project.

Capital raise and consolidation

HGM is also aiming to raise up to $6 million through the issue of ordinary shares at three cents each. The consolidation is currently proposed on a five-for-one basis.

Board shake-ups

Once the transaction is completed, the company will appoint two Jade directors, Joseph Burke and Daniel Eddington, to the Board of HGM.

What’s next?

The transaction is subject to a number of conditions, including satisfactory completion of due diligence, shareholder approval and ASX approval.

Company shares will remain in voluntary suspension until the transaction is completed or terminated. HGM last traded at eight cents per share on July 15, 2019.