- Ironbark Zinc (IBG) has formally extinguished the life-of-mine production royalty on its Citronen Project in Greenland

- The company first announced the buyback of the net smelter return royalty in February and has now settled the transaction

- Ironbark will now pay the remaining cash balance of $266,000 and issue 122 million company shares to Pearyland Royalties

- Pearyland Royalties will hold 11.4 per cent of issued capital in Ironbark, making it a new major shareholder group

- Ironbark Zinc is up 3.45 per cent and trading at three cents per share

Ironbark Zinc (IBG) has formally extinguished the life-of-mine production royalty on its Citronen Project in Greenland.

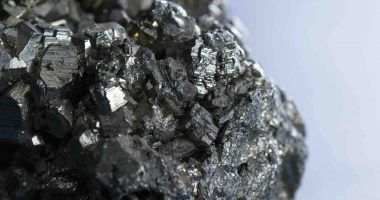

The company’s wholly owned Citronen Project is an advanced zinc-lead development, located in northern Greendland.

On February 2, Ironbark announced that it had completed a buyback of the 2.5 per cent net smelter return royalty, which Pearyland Royalties held over the project. The buyback and related extinguishing of the royalty was subject to a due diligence period, which has now reached its end.

The company and Pearyland Royalties executed the documentation to formally extinguishing the royalty, thereby settling the transaction.

Ironbark will now pay the remaining cash balance of $266,000 and issue 122 million fully paid ordinary shares to Pearyland Royalties. Once this takes place, the number of shares in the company on issue will increase from 949,750,027 to 1,071,750,027.

Pearyland Royalties will hold 11.4 per cent of the issued capital in Ironbark, making it a new major shareholder group in the company.

Ironbark Zinc’s Managing Director, Michael Jardine, thanked all involved for working tirelessly to settle the transaction within the agreed timeline.

“I would also like to extend a welcome to Pearyland Royalties Co. Limited who, in electing to take a large majority of their consideration in equity, have come alongside our existing shareholders as believers in the Citronen Project,” he said.

“The company continues to push ahead with its major goals for 2021 —completing the updated BFS and moving the EXIM LOI to a more formal stage — and concluding this transaction substantially improves the likelihood of achieving our ultimate ambition, to move Citronen from development into production,” he added.

Ironbark Zinc is up 3.45 per cent, trading at three cents per share at 1:03 pm AEDT.