- The Australian Competition and Consumer Commission (ACCC) warns of an upcoming gas supply shortfall for the east coast market in 2022

- The consumer watchdog says the entire east coast gas market could face a two-petajoule (PJ) supply shortfall

- While lower gas prices are typically welcomed by commercial and industrial gas users, many are struggling to obtain offers for supply beyond 2022

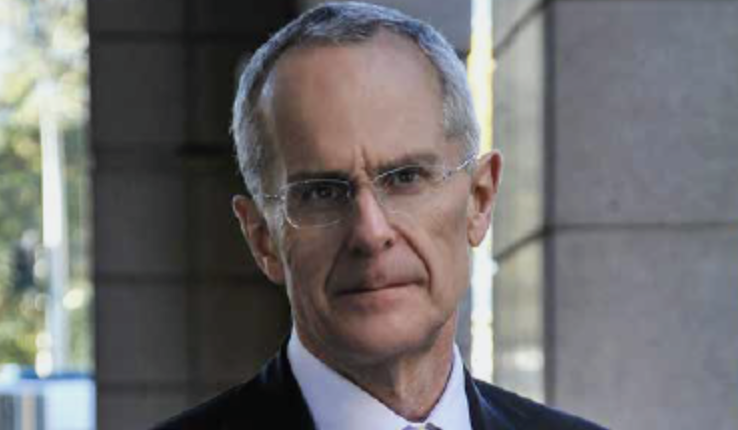

- ACCC Chair Rod Sims says the situation highlights the importance of a Heads of Agreement between the government and gas producers signed this year

- Under the agreement, gas exporters must offer uncontracted gas to the domestic market on internationally competitive terms before it is exported

The Australian Competition and Consumer Commission (ACCC) has warned of an upcoming gas supply shortfall for the east coast market in 2022.

The consumer watchdog said this morning the entire east coast gas market could face a two-petajoule (PJ) supply shortfall, with a shortfall of up to six PJ in the southern states, if gas producers export their surplus gas.

The latest gas report from the ACCC said though domestic spot and liquefied natural gas (LNG) prices were low through to February 2021, they have since risen “considerably”. At the same time, there has been a drop in the number of offers for supply being made for 2022 and beyond.

This could have “serious ramifications” for gas users, according to the ACCC.

What’s more, it looks like Queensland’s gas market won’t be in a position to cover a shortfall in surrounding states, as it has done in the past.

The ACCC said Queensland producers were currently forecasting to supply only just enough gas for the domestic Queensland market, meaning they wouldn’t be able to supply gas to other states should they need it.

ACCC Chair Rod Sims said the “precarious” gas supply situation for 2022 highlighted the importance of a Heads of Agreement the Australian government signed with LNG exporters in January this year.

Under the agreement, LNG exporters must offer uncontracted gas to the domestic market on internationally competitive terms before it is exported.

However, LNG suppliers will need to provide relevant material to the ACCC to demonstrate their compliance with the agreement. According to Mr Sims, they’ve yet to do this.

“The initial material LNG producers provided to us did not adequately demonstrate compliance with the new Heads of Agreement, and they will need to lift their game,” Mr Sims said.

“The initial responses from LNG producers were concerning given that in the near future Australia’s southern states may depend on their surplus gas. We expect to see better compliance from LNG exporters over the next 12 months.”

Part of the issue is that while lower gas prices are typically welcomed by commercial and industrial gas users, many are struggling to obtain offers for supply beyond 2022.

The ACCC said this difficulty in securing supply offers could partially be caused by uncertainty around its Gas Code of Conduct and its LNG netback price series review.