With the world’s largest tungsten deposit waiting to be brought back into production after a 25-year hiatus, Almonty Industries (AII) has been working steadily to ensure the completion of the pre-production requirements for the Sangdong mine in South Korea.

As one of the most significant mining revitalisation projects in the tungsten industry — and in South Korea — Almonty’s Sangdong mine will fundamentally change the global supply chain of this strategic metal once operational. Korea imports 94.7 per cent of all tungsten from China, which produces over 80 per cent of all tungsten produced globally. Importantly, South Korea is the largest per capita consumer worldwide.

The advantage of having a domestic supply to meet a large domestic demand puts Almonty in favour with government entities that, instead of stonewalling, have openly endorsed and funded the Sangdong mine revitalisation.

Friends in high places

The Ministry of Trade, Industry and Energy in Korea announced a suite of supportive measures in July 2021 to stimulate local production of materials, parts and equipment.

The proposal pledges up to 7 trillion won (A$7.8 billion) through 2022 to implementing the measures, including bank loan subsidies and exempting the fees required for industrial standard certification.

The Korean government also allocated 1.56 trillion won of the annual budget to the ministry for 2022, up 21 per cent from the previous year, indicating extensive backing for Korean industries and trade practices to strengthen in the domestic sphere.

With this backing including Almonty’s tungsten project, the Tier-1 Sangdong project holds the sought-after position of being fully permitted and shovel-ready in a supportive jurisdiction.

A lack of a diverse and secure global supply of tungsten casts a favourable light on any suppliers outside of China.

Almonty has impressive support from conservative legacy institutions, allowing it to successfully secure financing for the Sangdong project from reputable partners.

The company has confirmed a 15-year offtake agreement with The Plansee Group that guarantees US$590 million cashflow, in combination with a senior project finance loan from German state-owned KfW IPEX-Bank to finance 70 per cent of the CAPEX throughout the project’s development.

These endorsements aren’t insignificant — The Plansee Group has maintained a supply agreement with Apple for years and provided components for oxygen production to NASA which travelled to Mars with the rover ‘Perseverance’. As the specialist financiers of the German and European export industry, KfW IPEX-Bank is a powerhouse institution lending tens of billions to support projects across the globe.

What is demonstrated by one of the most incredible financing agreements seen in recent years is that the supply of a commodity as scarce as non-Chinese origin tungsten overrides any concerns regarding the cost.

The Future Is Tungsten

Apple, Tesla, IBM, Boeing, Samsung, HP — the list of global companies that rely on tungsten as a key metal for semiconductors is extensive and serves to highlight the link between a tech-obsessed nation like Korea and a mining project.

“The battery and semiconductor industry offers massive additional growth potential for the tungsten market and specifically for Almonty in South Korea. As the largest per capita consumer users of tungsten globally and with some of the largest semiconductor and battery manufacturers in the world located in South Korea, we are very pleased to be investigating this key growth initiative to supply the green energy revolution which should add further layers of value to the Sangdong Tungsten Mine and Almonty as a company.”

Almonty Chairman, President and CEO Lewis Black

These major manufacturing companies based in South Korea are currently operating in a supply climate dominated by China. This domination has supported an element of insecurity in the supply of critical metals including tungsten.

The transparency of supply attached to the future output of Sangdong, combined with the logistical simplicity of transporting the tungsten from the mine to waiting customers, puts Almonty in an enviable position to sit at the top of the tungsten tree in East Asia.

According to a report released by the Korean Institute for Industrial Economics and Trade in 2018, the semiconductor manufacturing industry was deemed the least self-sufficient. Tungsten is a critical element used in semiconductors, an essential component of electrical devices that manage the flow of electricity.

“There are 400 to 600 steps in the overall manufacturing process of semiconductors that require hundreds of materials and equipment, Korea’s self-sufficiency rate is merely 27 percent due to its reliance on stable supply chain abroad,” the Industry Ministry assessed in a 2021 report.

This kind of situation is not isolated to South Korea, with huge demand for tungsten coming from the US where annual tungsten consumption representing an estimated value of US$600 million.

The Final Countdown

So how far away is Almonty from being able to meet demand of this size?

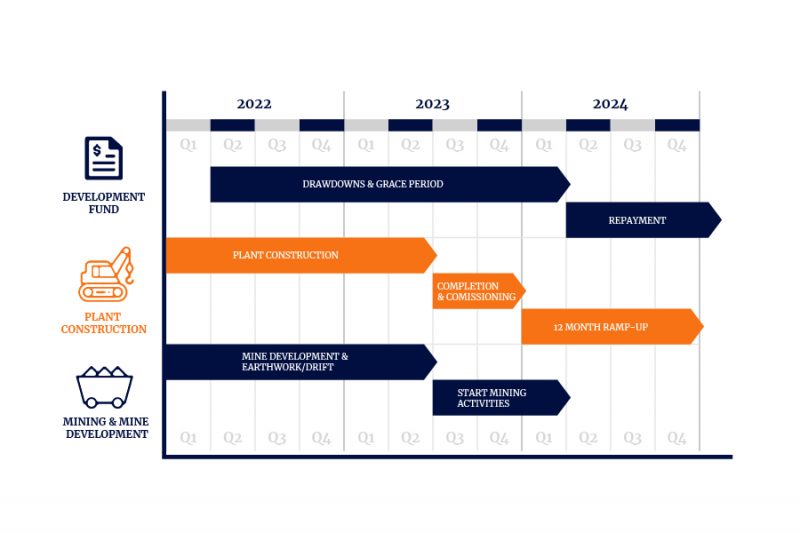

The company has provided a timeline for production with first ore expected in 2023. This massive modernisation project has seen the digging of large underground shafts, establishing on-site residential facilities, and the intention to construct a vertically integrated nano tungsten oxide downstream processing plant (Sangdong Downstream Extension Project) to supply the South Korean battery anode manufacturing industry.

The fruits of this labour will fundamentally change the future of tungsten supply globally, and with an expected mine life of over 90 years the Sangdong project has a lot to offer once production begins.

The mine has an inferred resource of 52.8 metric megatons (a unit of measurement equal to one million metric tons), and with prices for the metal rising to match demand, Sangdong is set once again become the jewel in the crown of South Korea’s mining industry.