- Amani Gold (ANL) undertakes a $7 million private placement to develop its Giro Gold project in the Democratic Republic of Congo

- ANL reports receiving strong support from investors for the oversubscribed two-tranche placement of seven billion shares to be issued at 0.1 cents each

- Each participant will be also offered a one for one free attaching listed option exercisable at 0.15 cents, subject to shareholder approval

- The money is set towards development and commercialisation of its Giro Gold project, working capital and placement fees

- Shares are trading in the grey at 0.2 cents at 11:46 am AEST

Amani Gold (ANL) is undertaking a private placement to raise $7 million for the development of its Giro Gold project in the Democratic Republic of Congo.

In a statement released today, the company announced it had received commitments from sophisticated and professional investors for the oversubscribed placement which will comprise seven billion shares issued at 0.1 cents each.

Each participant will be offered a one for one free attaching listed option exercisable at 0.15 cents valid to January 2024.

The placement is set to be completed in two tranches with 1.8 billion shares issued by September 16 and the remainder in tranche two, subject to shareholder approval.

The listing options are also subject to shareholder approval, which will be sought at the company’s annual general meeting scheduled for November.

Shining Mining, in which non-executive director Maohuai (Simon) Cong has an interest as a director and shareholder, has put forward a commitment of $1.75 million under tranche two. Such participation is also subject to shareholder approval.

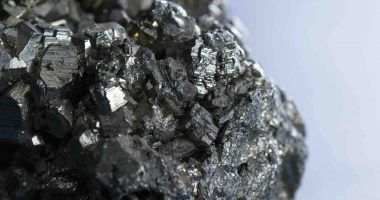

ANL plans to put the money raised towards the development and commercialisation of its Giro Gold project which lies within the under-explored greenstone belt, Kilo-Moto.

This area also hosts Randgold Resources’ 17 million-ounce Kibali group of deposits.

Current assessments underway at the project include a number of desktop studies in relation to the Kebigada deposit where ANL is currently finalising plans for a diamond drill program to undertake infill drilling.

The company is also reportedly undertaking consideration of potential business development and corporate opportunities.

Funds from the placement are also set to provide working capital and pay the costs of the placement which includes a six per cent raise fee on gross proceeds. These will be paid to multiple brokers of the placement.

Additionally, funds will be reserved for repayment of a $2.1 million convertible note held by Neo Gold which matures on January 24, 2022.

Shares were trading in the grey at 0.2 cents at 11:46 am AEST.