- AppsVillage Australia (APV) locks in another US$500,000 (A$674,000) in funding through a loan signed with 12.64 Fund

- The company says the funding will help APV dual list on the TSX Venture Exchange in Canada

- AppsVillage struck the initial funding deal with 12.64 Fund for US$500,000 back in May, with the option to bolster this funding by an extra US$1 million

- The company says it has now received an extra US$500,000 under the increased loan amount

- Shares in AppsVillage are soaring 32.43 per cent higher right before market close, trading at 4.9 cents each at 3:59 pm AEST

App builder AppsVillage Australia (APV) has locked in another US$500,000 (A$674,000) in funding through a loan signed with a fund operated by Israeli investment bank A-Labs Advisory & Finance.

The funding will help APV dual list on the TSX Venture Exchange in Canada as the company works to expand its exposure to a wider range of investors and increase its trading volume.

AppsVillage initially struck a deal with 12.64 Fund, which is operated by A-Labs, back in May to secure a US$500,000 convertible loan.

Under the terms of this loan, this initial US$500,000 could be bolstered to US$1.5 million (A$2 million) at the discretion of 12.64 Fund.

Today, AppsVillage told shareholders the two parties have agreed to exercise this option to boost the convertible loan amount, though at this stage only by an extra US$500,000 — meaning the loan is now worth US$1 million (A$1.35 million).

AppsVillage said it has received the extra US$500,000.

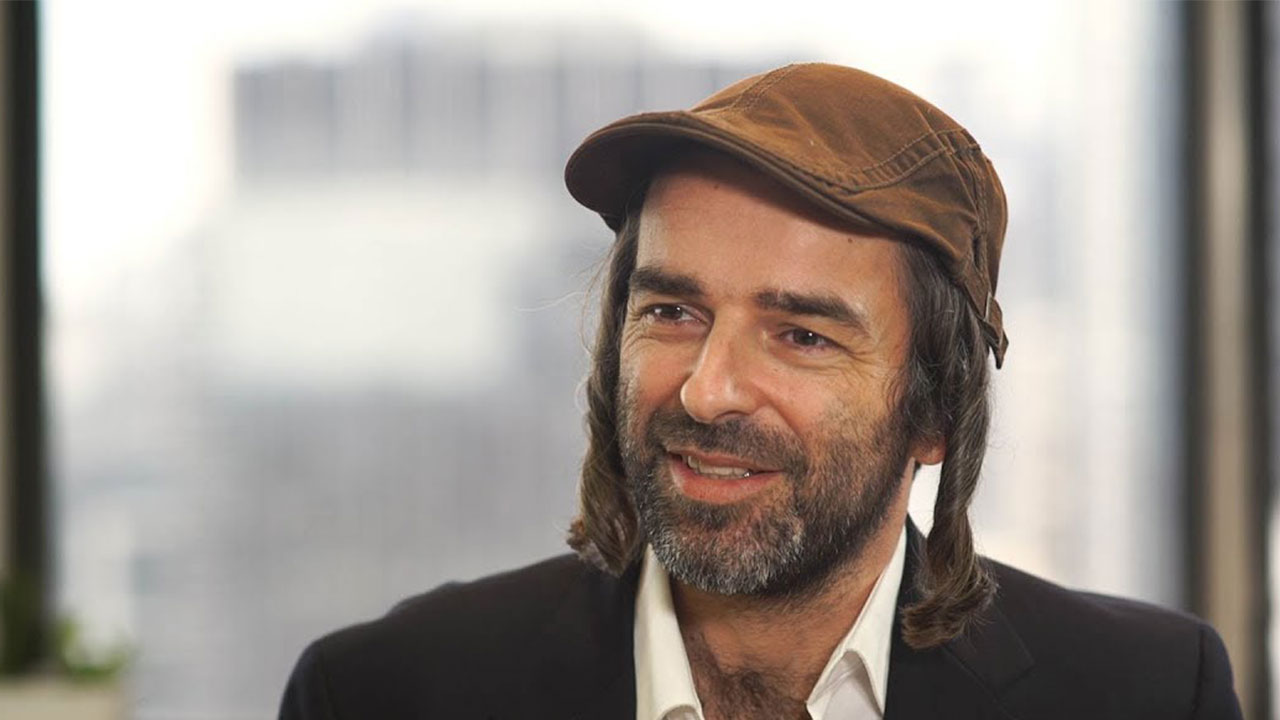

CEO Max Bluvband said the company is building a “strong register” and hopes to complete some fundraising simultaneously with its TSX-V listing.

AppsVillage previously told shareholders it has received conditional approval from the TSX-V to dual-list on the exchange, and it is now working with TSX-V authorities to meet necessary listing requirements.

According to APV, A-Labs has been responsible for several NASDAQ and TSX-V initial public offerings over recent years.

AppsVillage helps small-to-medium businesses (SMBs) design, build, and launch their own mobile apps to service their unique customer base.

Through the APV platforms, SMBs can build apps to offer exclusive deals, send push notifications, allow for easier business-customer communication, and more, all while having access to Facebook ads and necessary search engine optimisation (SEO) tools.

Shares in AppsVillage were soaring 32.43 per cent higher right before market close, trading at 4.9 cents each at 3:59 pm AEST. The company has a $4.5 million market cap.