- AppsVillage (APV) gets conditional approval to dual list on the TSX Venture Exchange in Canada as part of its goal to expand exposure to a wider range of investors

- To meet the TSXV IPO conditions, APV raised around CAD$2.9 million (A$3.15 million) from institutional investors through a convertible loan agreement

- The CLA will convert into units of the company at a price of CAD$0.05 (A$0.054) per unit at roughly 60 per cent above the currently traded share price on the ASX

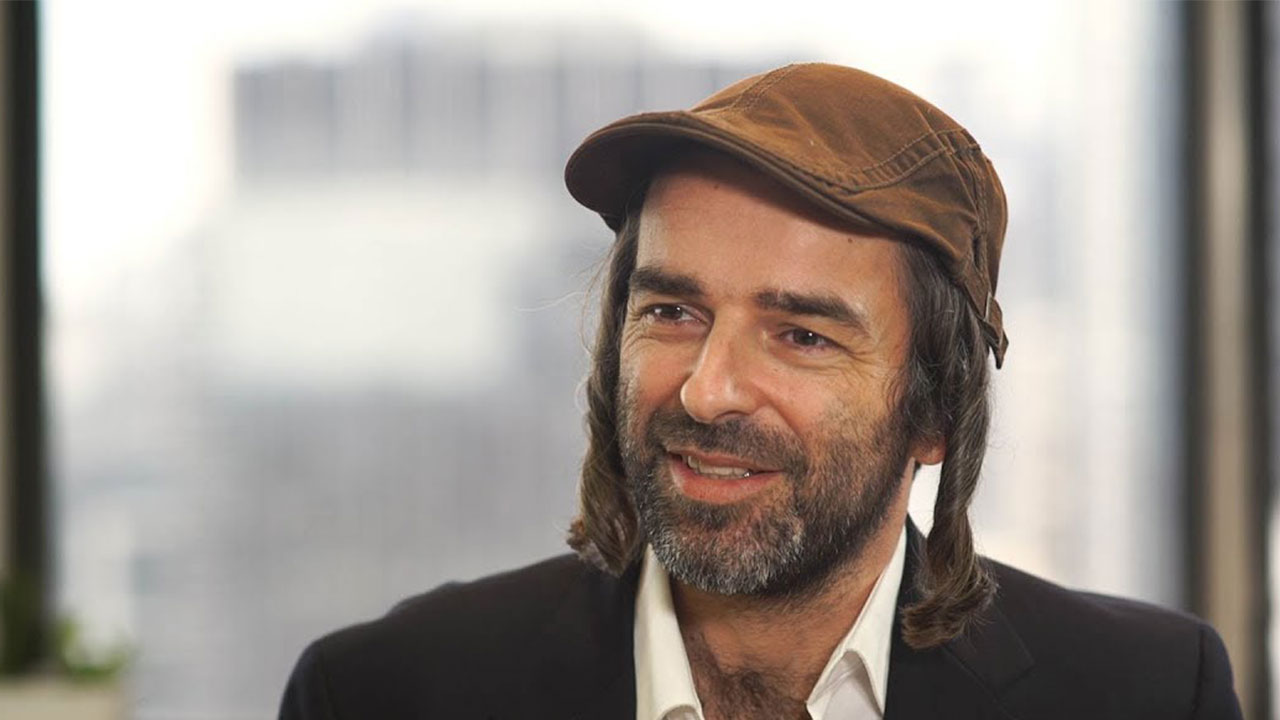

- CEO and MD Max Bluvband is participating in the CLA for US$100,000 (A$140,134) and he “truly looks forward to our ribbon-cutting ceremony in Toronto”

- Company shares have been trading 27.3 per cent higher at 4.2 cents

Shares in AppsVillage (APV) have spiked after the company received conditional approval to dual list on the TSX Venture Exchange in Canada as part of its goal to expand exposure to a wider range of investors.

AppsVillage creates an AI-powered advertising and marketing platform for small and medium-sized businesses, allowing them to execute automated large-scale advertising and marketing campaigns both online and on social media platforms such as Facebook, Google, and TikTok.

To meet the TSXV initial public offering (IPO) conditions, the AI-based advertising and marketing company will raise around CAD$2.9 million (A$3.15 million) from institutional investors through a convertible loan agreement (CLA).

The CLA will convert into units of the company at a price of CAD$0.05 (A$0.054) per unit, roughly 60 per cent above the currently traded share price on the ASX.

Each unit consists of one fully paid ordinary share and one warrant, with each warrant being exercisable into one share at CAD$0.05 (A$0.054) and expires within five years.

AppsVillage CEO and Managing Director Max Bluvband participated in the CLA for US$100,000 (A$140,134) and will seek shareholder approval to convert his loan into equity.

Once it meets the requirements set by the TSXV, APV expects to start trading under the ticker code: “RABI”.

“This convertible loan agreement, undertaken at a higher price than the current share price is a term that reflects investor confidence in the company and our capability to deliver on the growth plan for the company,” Mr Bluvband said.

“My participation as an investor is a testament to my confidence in our vision and I truly look forward to our ribbon-cutting ceremony in Toronto.”

Company shares were up 27.3 per cent to trade at 4.2 cents at 2:47 pm AEDT.