- ASIC has moved to shut down an unlicensed mortgage lender, Remedy Housing, which lists former rugby star Trevor Leota as a co-founder on its website

- Over a five-month period, around 123 potential customers deposited a total of $1,484,250 into a bank account in the name of Remedy Housing

- ASIC is alleging engaging in credit activities while not holding an Australian financial services license to an Australian credit license

- it also alleges it engaged in misleading or deceptive conduct, made false or misleading claims and obtained property by deception

- On June 17, the Court found there was a need to protect aggrieved persons and then made further orders restraining Remedy Housing from operating on June 24

Australian Securities and Investments Commission (ASIC) has obtained Federal Court orders against an unlicensed mortgage lender Remedy Housing.

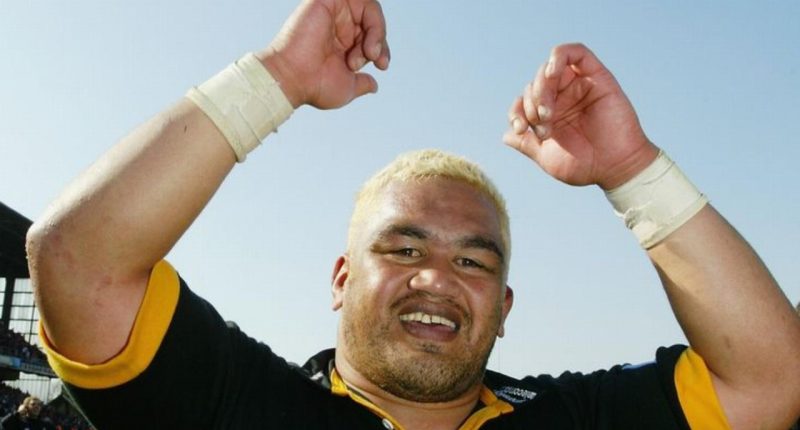

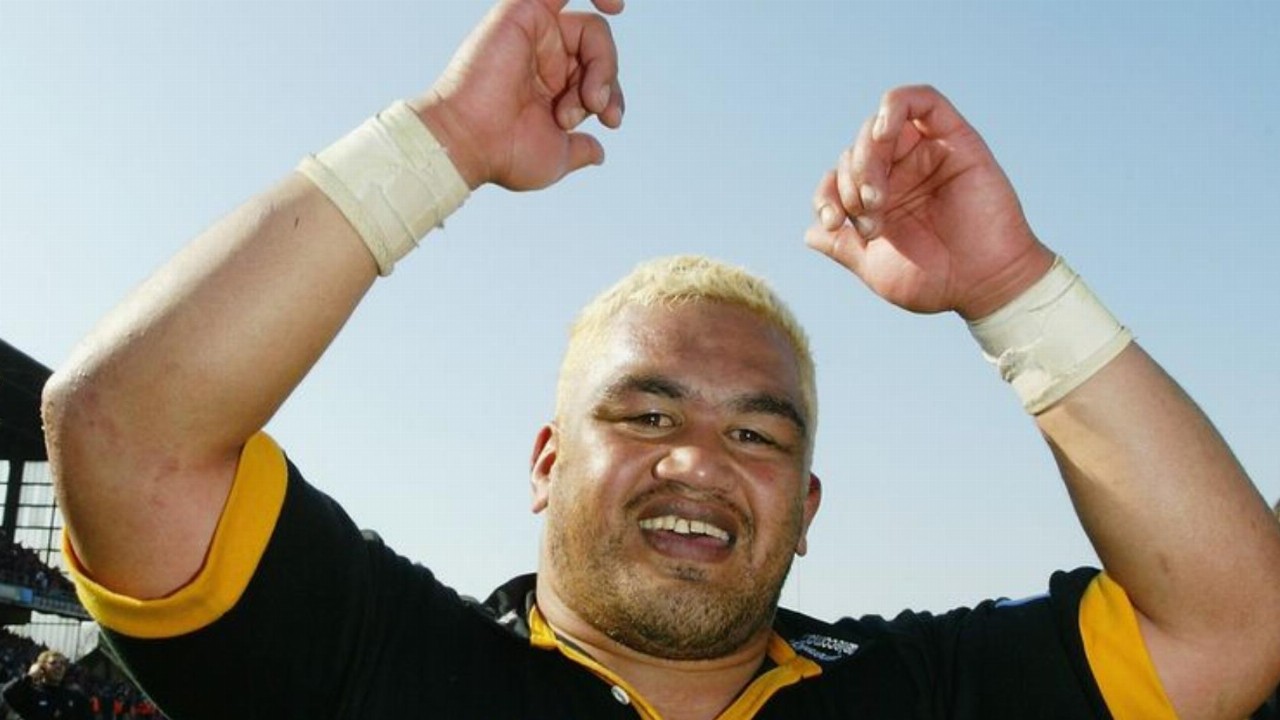

Remedy Housing lists former international rugby star Trevor Leota as a co-founder on its website. Mr Leota played hooker for Wasps and internationally for Samoa in the 90s and early 2000s, and is the face of the company on its website.

Primarily operating with customers from the Pacific Islander community, the company claims on its website and social media channels that it can provide consumers “interest-free mortgages” with a $10,000 deposit, according to ASIC.

A quote attributed to Mr Leota on the website said “I am widely recognised as one of the hardest tacklers in the game. Now I am tackling the harder issues with housing in New Zealand & Australia”.

ASIC reported that between November 7, 2019 and March 10, 2021, around 123 potential customers deposited a total of $1,484,250 into a bank account in the name of Remedy Housing.

ASIC successfully obtained interim orders and injunctions from the Federal Court against Brent Lindsay Smith, Mahmoud Khodr, Trevor Leota and Remedy Housing.

Mr Smith and Mr Khodr manage Remedy Housing as directors and secretaries, respectively, with Mr Leota involved in the business, according to ASIC.

ASIC is alleging that the defendants and Remedy Housing are carrying on a financial services business and engaging in credit activities without holding an Australian financial services licence or an Australian credit licence as well as engaging in misleading or deceptive conduct.

It also alleges it made false or misleading representations regarding financial services and products that involve interest in land, gave false or misleading information when engaging in credit activity and that it obtained property and financial advantage by deception.

A family recently told Nine’s A Current Affair they were promised an “interest free mortgage” and a guarantee that if they were not in their home in 12 months, they would full receive a full refund.

A year later, they are still renting and haven’t got their house or a refund, with Mr Smith telling clients over Facebook that hackers were to blame.

Mr Smith said he would pay Maria back, but when A Current Affair visited the company’s office, it found a Notice to Tenant of Repossession notice earlier in the month.

On June 17, the Court found there was a need to protect aggrieved persons and then made further orders restraining Remedy Housing from operating on June 24, ordering them to take its website down and social media sites.

Its website and Instagram page were still up and operational on June 25, while its Facebook account was unavailable.

These orders were made pending the final hearing into Remedy Housing’s conduct, in which ASIC is seeking a permanent injunction preventing the Remedy Housing firm from running.