- Atomo Diagnostics (AT1) has seen its revenue jump up nearly 900 per cent over FY20 as demand for COVID-19 antibody tests skyrockets

- The medical diagnostics company also saw its gross profit jump from $100,000 in FY19 to $3.2 million this year

- At the end of the 2020 financial year, Atomo had $27 million in the bank and had wiped off all of its debt

- The company’s statutory loss for FY20 did increase though, as it took into account IPO and other financial expenses

- Going forward, Atomo said it will focus on expanding its COVID-19 and HIV products in Australia and the U.S.

- Shares in Atomo are trading down a slight 1.11 per cent at 44.5 cents each

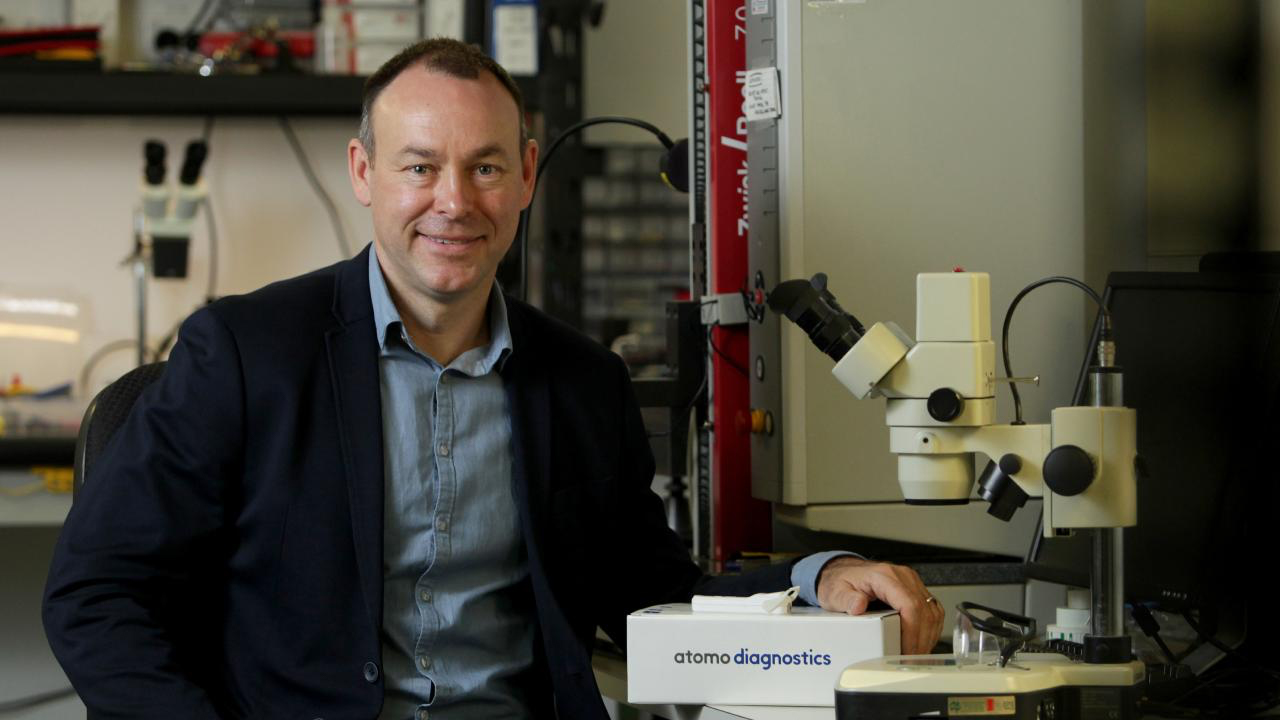

Medical diagnostics company Atomo Diagnostics (AT1) has seen its revenue jump nearly 900 per cent over FY20 as demand for COVID-19 antibody tests skyrockets.

Amid the pandemic, Atomo has sold over one million of its COVID-19 antibody tests — with millions more expected to sell across FY21.

Financial results

The demand for COVID-19 tests, and the company’s HIV products, saw Atomo’s revenue jump from $540,000 in FY19 to $5.37 million in FY20, an increase of 895 per cent.

The company’s gross profit also increased a whopping 3217 per cent, from $100,000 in FY19 to $3.2 million over the last financial year. It’s gross margin also rose to 60 per cent over FY20.

At the end of the 2020 financial year, Atomo had $27.1 million in the bank and had managed to wipe off all of its debt by April. It’s a significant improvement from the end of FY19, when the company had just $1.9 million in the bank.

However, despite the significant revenue and gross profit growth, the company’s net statutory loss did increase over the 2020 financial year, from $5.1 million to $9.2 million.

The rise is being blamed on IPO expenses — Atomo announced a $30 million IPO in April — depreciation and amortisation, as well as over $5 million in financial costs.

The diagnostics company also spent a lot less on research and development over FY20, down 48 per cent from the previous period. However, the company said it did spend $2.3 million on manufacturing and product development over the year.

FY21 outlook

Moving forward, Atomo said its focus remains on growing the use of its COVID-19 test in the U.S., Australia and other markets — an achievable target considering the pandemic sadly shows no signs of slowing just yet and a vaccine remains elusive.

Amid the demand, the company believes it will be able to increase its total device capacity to 1.3 million per month.

Despite today’s extremely positive full-year results presentation, shares in AT1 are actually trading down slightly ahead of the beginning of trade today.

Shares in Atomo are worth 44.5 cents each, down 1.11 per cent at 9.41 am AEST.