- Rental prices have increased by nearly 2 per cent in the past quarter for properties all around Australia

- The price hike of the December quarter shows the highest calendar year growth rate since 2007

- Research from CoreLogic showed the national index recorded its highest annual growth rate since January 2007 in November at 9.44 per cent

- The rent of a unit between the regions and the capital city sees a 27 per cent difference, with the rural rent has increased 41.4 per cent in the past decade

Rental prices have increased by nearly 2 per cent in the past quarter for properties all around Australia.

The price hike of the December quarter shows the highest calendar year growth rate since 2007.

Research from CoreLogic showed the national index recorded its highest annual growth rate since January 2007 in November at 9.44 per cent despite the quarterly rate easing since its peak in March at 3.2 per cent.

“For more than 18 months we’ve seen demand for detached housing continue unabated as more renters work from home, either on a permanent or now hybrid working arrangement, which drives demand for more spacious living conditions,” Research Director Tim Lawless said.

“In addition to this trend, investors, while still active in the market, have been dwarfed by an over-representation of owner-occupiers entering the market, upgrading or buying holiday homes that aren’t being added to the rental pool.”

Looking regionally, where rent margins have been higher than the city, last quarter showed a 2.5 per cent rise for rural spaces alongside a 1.6 per cent rise in capital city rents.

The overall rural rent has therefore risen 12.1 per cent over the past year, taking the 10 year period regional house rent average to 33.2 per cent. More than 8 per cent higher than capital city rates.

The rent of a unit between the regions and the capital city sees a 27 per cent difference, with the rural rent has increased 41.4 per cent in the past decade.

Mr Lawless said the increase in regional population in Victoria and New South Wales since the beginning of the pandemic has affected the rental supply market.

“While demand has risen we generally haven’t seen much of a supply response. Australia’s rental market is mostly reliant on private sector investors to provide rental housing,” he said.

Units and houses

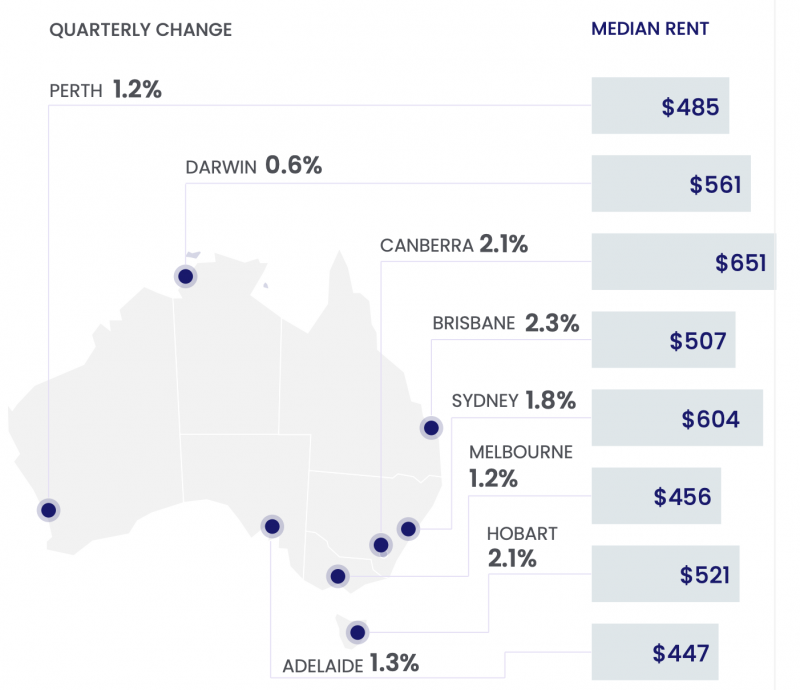

All capital cities saw a rise over the last quarter for both units and houses.

Brisbane had the strongest quarterly increase in house rental with a 2.7 per cent increase and an annual growth rate of 10.6 per cent.

Darwin’s house rent increased 0.6 per cent over the quarter, however, its growth in rent during the first six months of 2021 resulted in the highest annual house growth figures of any capital city at 15 per cent.

Melbourne, maybe the most COVID-19 affected city in Australia according to CoreLogic saw a unit rental increase of 1.6 per cent, the highest in the country.

“Brisbane’s rental market for houses has shown strength throughout the pandemic as demand outweighed supply, while Melbourne’s unit market has been weak through most of the pandemic to date due to low demand against relatively high vacancy rates,” Mr Lawless said.

COVID-19 restrictions and boarder closures hugely disrupted the rental market, as tourism and hospitality workers who have a proportionately higher percentage of renters have decreased.

Sydney and Melbourne have the lowest yields of any capital city at 2.42 per cent and 2.74 per cent respectively while Darwin has the highest at 6.05 per cent, followed by Perth at 4.37 per cent.

“Arguably the regions have less elasticity in rental markets, meaning, when demand rises, supply is less responsive than capital cities where investors are generally more active,” Mr Lawless concluded.