- BCI Minerals (BCI) has secured the rights to a large new tenement area, which could make its Mardie Salt Project the largest salt operation in Australia

- BCI has bought the southern part of a 112 square kilometre tenement from Leichhardt Industrials for $3.5 million

- After 12 months, BCI has the option to buy the northern part of the tenement for $2.5 million, and if that happens, it’ll make Mardie the largest salt operation in Australia and one of the largest evaporative salt operations in the world

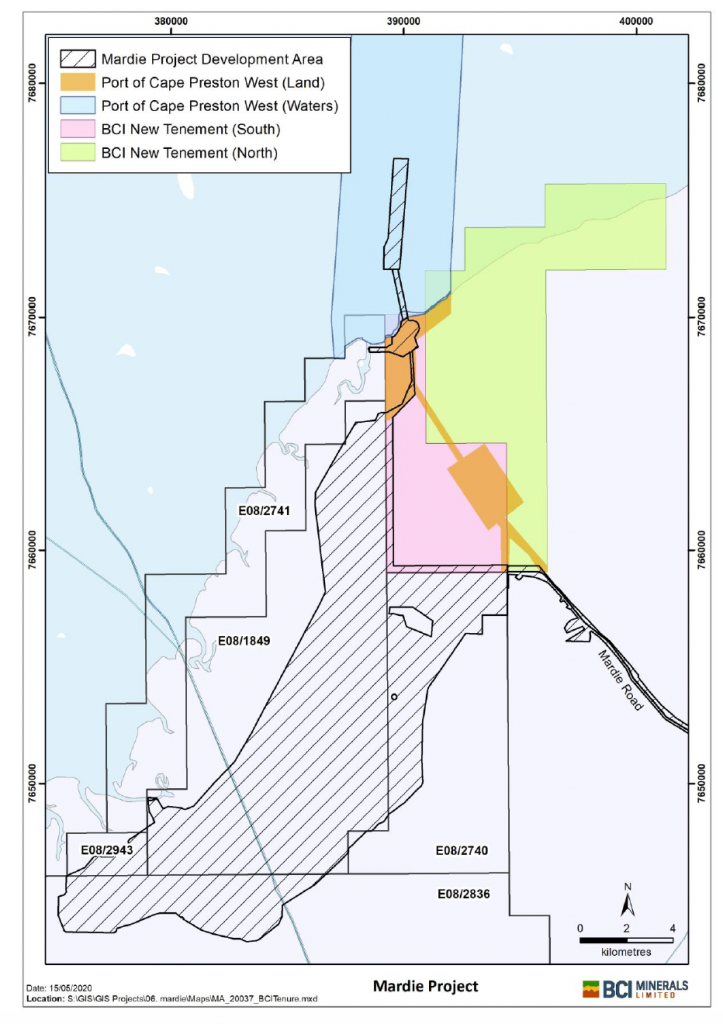

- The area is adjacent to the company’s Mardie Salt and Potash project it’s currently developing in Western Australia’s Pilbara region, which includes a significant area of mudflats suitable for evaporation ponds and crystallisers

- The company’s share price finished 3.44 per cent with shares priced at 15 cents each at market close

BCI Minerals (BCI) has secured the rights to a large new tenement area which could make its Mardie Salt Project the largest salt operation in Australia.

The company has bought the southern part of a 112 square kilometre tenement from Leichhardt Industrials for $3.5 million.

After 12 months, BCI has the option to buy the northern part of the tenement for $2.5 million, and if that happens, it’ll make Mardie the largest salt operation in Australia and one of the largest evaporative salt operations globally.

The area is adjacent to the company’s Mardie Salt and Potash project it’s currently developing in Western Australia’s Pilbara region, which includes a significant area of mudflats suitable for evaporation ponds and crystallisers.

If BCI triggers the option to purchase the north tenement, they’ll have to hand Leichhardt a set of documents and reports relating to environmental and technical work undertaken by them in the area of the proposed Cape Preston East port.

The company is continuing to progress designs and approvals for the current project footprint, and the Definitive Feasibility Study remains on schedule for completion in June 2020.

Discussions on tenure and funding are progressing well with the Pilbara Ports Authority, Northern Australia Infrastructure Facility and other potential debt providers.

The company’s share price finished 3.44 per cent with shares priced at 15 cents each at market close.