- New UNSW research suggest that the booming housing market poses a threat to the wider national economy

- It calls for a Royal Commission and a larger Reserve Bank of Australia remit to combat the effect rising house prices has on productivity and inequality

- Honorary Professor Duncan Maclennan says the existing housing market is dysfunctional on all levels and poses a risk to the Australian economy

- The report highlights the case for building more affordable housing and shifting policies that inflate demand for housing to ones that expand supply

- “Short political time horizons and cross-border and cross-sector blame games will not help younger and poorer Australians,” says Prof Maclennan

Australia’s housing market poses a threat to the country’s economic future, with rising home prices increasing inequality and lowering productivity, according to UNSW research.

To address the impact, research from UNSW Sydney’s City Futures Research Centre suggests a Royal Commission and a larger Reserve Bank of Australia (RBA) remit.

The study calls for significant changes to reshape Australia’s housing sector to restore economic productivity, decrease financial risk and minimise increasing inequality.

National household debt has more than doubled over the last three decades, rising from 70 per cent of GDP in 1990 to over 185 per cent in 2020, exposing a ticking economic time bomb if interest rates rise in the future, according to the report.

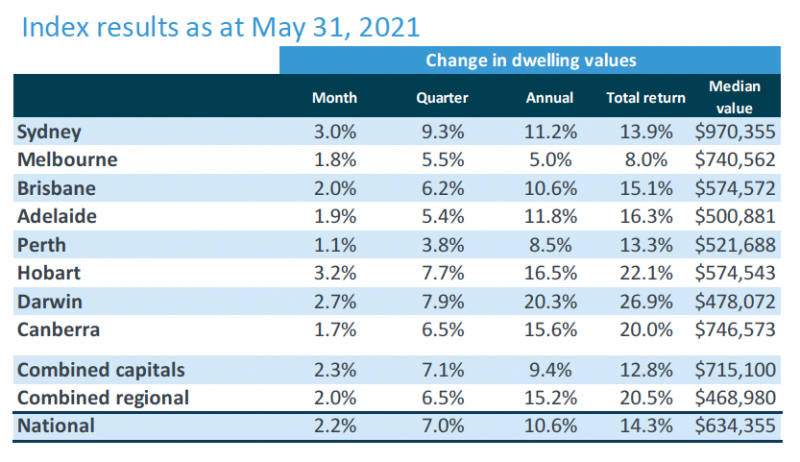

Furthermore, housing prices, which rose 10.6 per cent in the year to May 2021 and are expected to continue to climb in the following year, further pushing homeownership out of reach for many.

Honorary Professor Duncan Maclennan of the UNSW City Futures Research Centre, the report’s principal author, said the existing housing market is dysfunctional on all levels and poses an inherent risk to the Australian economy.

According to Prof Maclennan, the research affirms that Australia’s housing system is failing an increasing number of young people and that it requires rapid reform.

“Australia’s approach to housing policy has fuelled income and wealth inequality and created significant economic instability,” Prof Maclennan said.

“This is becoming a huge drag on productivity, and warping Australia’s capital investment patterns.

“The scale and complexity of the problem demands [in particular] that a Royal Commission be established to investigate how to defuse the time bomb and create a more effective and equitable market for all Australians.”

The current surge in home prices, in particular, has created a new and worrying dynamic for younger Australians, who are increasingly being priced out of the market, according to Prof Maclennan.

“Surging property prices have left some wealthier and older Australians better off, but younger and poorer Australians, who are the future buyers, are much worse off,” said Everybody’s Home national spokesperson Kate Colvin.

“It’s time to shine a light on the fundamental flaws in our nation’s housing policies and create a concrete plan of solutions that work to address growing housing inequity, like building more social and affordable housing.”

The study also suggests that housing stimulus efforts be shifted to help the social rental sector, which would have potentially less immediate inflationary implications.

It also calls for the RBA formal accountabilities to be expanded to include housing market stability in order to aid in the maintenance of a more rational housing market.

“The Commonwealth Government’s policy actions are boosting inflationary pressures, and the RBA has effectively washed its hands of responsibility for house prices, arguing higher prices are good for the economy,” Prof Maclennan said.

“But when people are paying more and more for rent and to service their mortgages, they have less and less to spend on other goods and services.”

The study also emphasises the economic argument for more affordable housing and a move away from policies that increase demand for housing and towards policies that increase supply.

According to the research, Australia’s housing portfolio is worth an estimated $8.1 trillion, while home construction employs five per cent of the workforce, therefore greater attention should be paid to safeguarding the industry.

“The Commonwealth is right to highlight sluggish housing supply but wrong to assume that State and local planning is the cause. Shortages of infrastructure, skilled labour and raw materials all matter too,” Prof Maclennan said.

“States do need to audit housing supply chains and bring all their powers to bear to make them faster and more flexible.

“Short political time horizons and cross-border and cross-sector blame games will not help younger and poorer Australians.”

A Royal Commission on Housing Future Australia, a new national housing strategy and agency, and a permanent housing committee as part of the National Cabinet are among the recommendations in the study to stabilise Australia’s broken housing market.