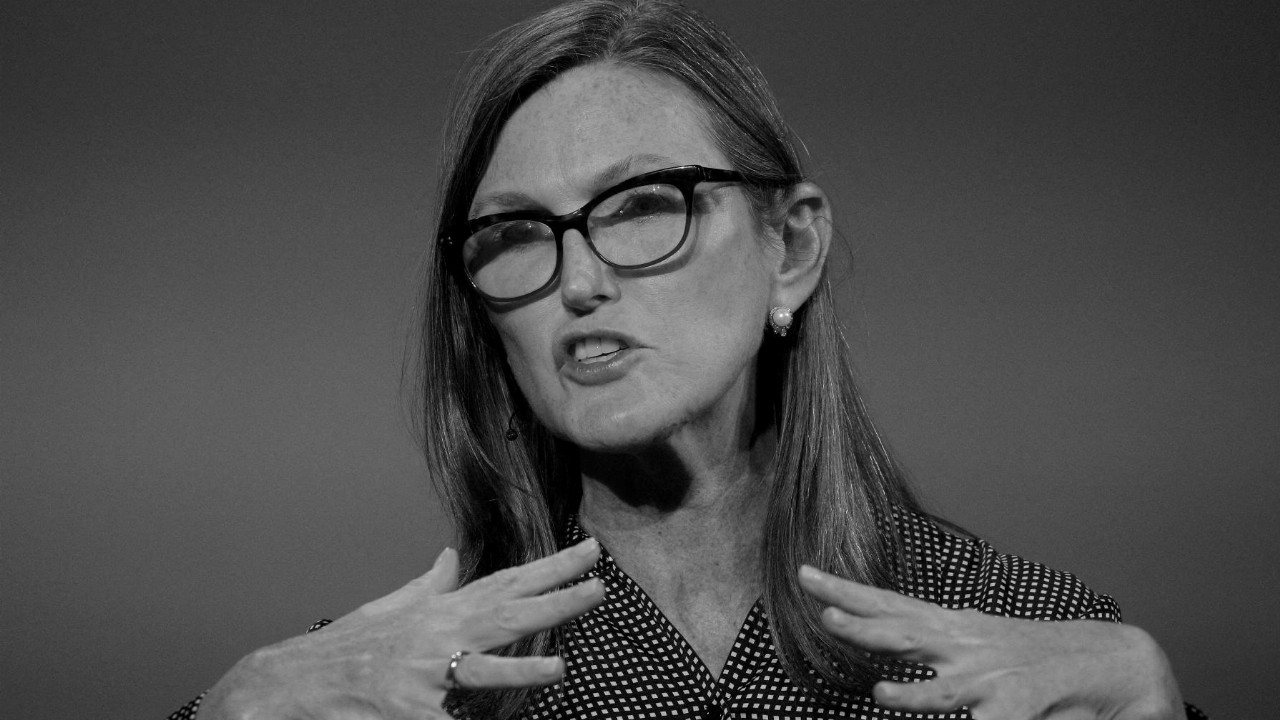

In a 2018 video, Cathie Wood, founder of Ark Invest, declared “monogenic stem cell therapy” a $2 trillion revenue opportunity, with “polygenic” versions of the treatment worth “however many trillions” more.

It was typical of the grand pronouncements the fund manager often makes. Wood became the poster child of the speculative tech boom last year and a cult figure to legions of investors and fans. But she has been forced to defend her stockpicking strategy in recent months after many of the companies in her funds were pummelled in a massive market correction.

It is unclear what Wood, who majored in economics and finance, was referring to in that video. Monogenic stem cell therapy is not a concept scientists recognise.

Derrick Rossi, a prominent stem cell biologist whose research contributed to the messenger RNA COVID-19 vaccines, said he did not “know what she’s talking about”. He added: “Regardless, her revenue projections are very, very hard to believe, for any type of therapy — like several orders of magnitude hard to believe.”

Search Google for “monogenic stem cell therapy” and the only thing that comes up are Wood’s comments.

Wood was actually talking about gene editing, according to one person briefed on her remarks, which is something different. She is also a cheerleader for this emerging field of medical science, telling CNBC in December that three listed companies in the space — Intellia, Crispr Therapeutics and Editas — represent a “trillion dollar plus opportunity” (although in this instance she was talking about their potential combined market value, which stands at roughly $12 billion, rather than revenue).

The CNBC interview, too, contained statements that could charitably be described as not quite right. Wood said “we have already seen functional cures for three blood-related diseases” in the gene editing space. No companies have secured regulatory approval for such treatments, nor are they expected to any time soon. Some very early success in clinical trials does not a cure make.

Wood said Intellia had recently “announced a functional cure” for ATTR amyloidosis, which she described as an “exotic blood disease”. ATTR is a protein misfolding disorder, not a blood disease, and the company is nowhere near announcing a cure for it. The trial data she referred to were derived from just six patients. Intellia is more cautious in its pronouncements and will only say its drug “could potentially be the first curative treatment” for the illness.

Wood’s breathless promotion of this exciting but unproved technology to her huge fan base helped fuel a biotech bubble in 2020 that burst spectacularly last year. Her Ark Genomic Revolution fund rode the surge in valuations but is down almost 60 per cent from its peak in February 2021 and registered roughly $2.5 billion of outflows over the same period. Her flagship Ark Innovation fund, which also holds some gene editing stocks, has fallen by a similar amount.

Investors will have lost money. Who cares? Buyer beware and all that. Yet the bursting of the biotech bubble, in particular, should worry us all. The boom in 2020 prompted some companies that are years away from starting human studies to launch opportunistic IPOs. Plenty of others now need to raise cash on public markets to fund their trials of life-changing drugs, many of which could come to fruition much more quickly than gene editing therapies. But because of the ramp up in valuations and the subsequent crash, they face an uphill struggle that will slow them down.

Ark is a big proponent of “precision” medicine, the idea that patients can be matched with drugs targeting the specific genetic drivers of their disease. If Wood really wants to be part of the genomics revolution, she could help by being a bit more precise herself.

David Crow is the Financial Times’ US news editor. His previous roles include US political news editor, coronavirus correspondent, banking editor and senior US business correspondent. He also worked on the main news desk in London. Before joining the FT in 2012, he was managing editor of City AM.