There’s a versatile material garnering global attention, but some investors may not be aware of the opportunity just yet.

Introducing kaolin. The material can be used in a huge range of products — from paper to inks, plastic to ceramics — and Australia has an advantage over may other jurisdictions.

Both explorers and shareholders are on the hunt for high-quality kaolin, eager to profit off this adaptable, valuable commodity.

So as global demand and the wider market for kaolin continue to grow, which companies are best placed to turn this white clay into cold, hard cash?

As with any resource, it’s likely to all come down to whoever has the lowest cost of production rate.

What is it?

Kaolin is used across the paper and ceramics industry, however, it also has applications in fibreglass, rubber, plastic, pharmaceuticals and cosmetics markets.

The paper industry was the biggest consumer of kaolin in 2017, but in the years since, the mineral is more frequently being bought up by those in the ceramics business.

This is because kaolin provides a stunning gloss and whiteness to whatever end product it’s incorporated with.

Additionally, the versatile mineral can also be transformed into high purity alumina (HPA), which, in turn, is used in smartphones, watches and lithium-ion batteries.

The global market for kaolin is already close to US$5 billion (around A$7.12 billion) and that figure is only expected to grow over the coming five years.

Even more important? Australia, and in particular Western Australia, is poised to have a commanding role in this growing resource’s market.

Suvo Strategic Minerals (ASX:SUV)

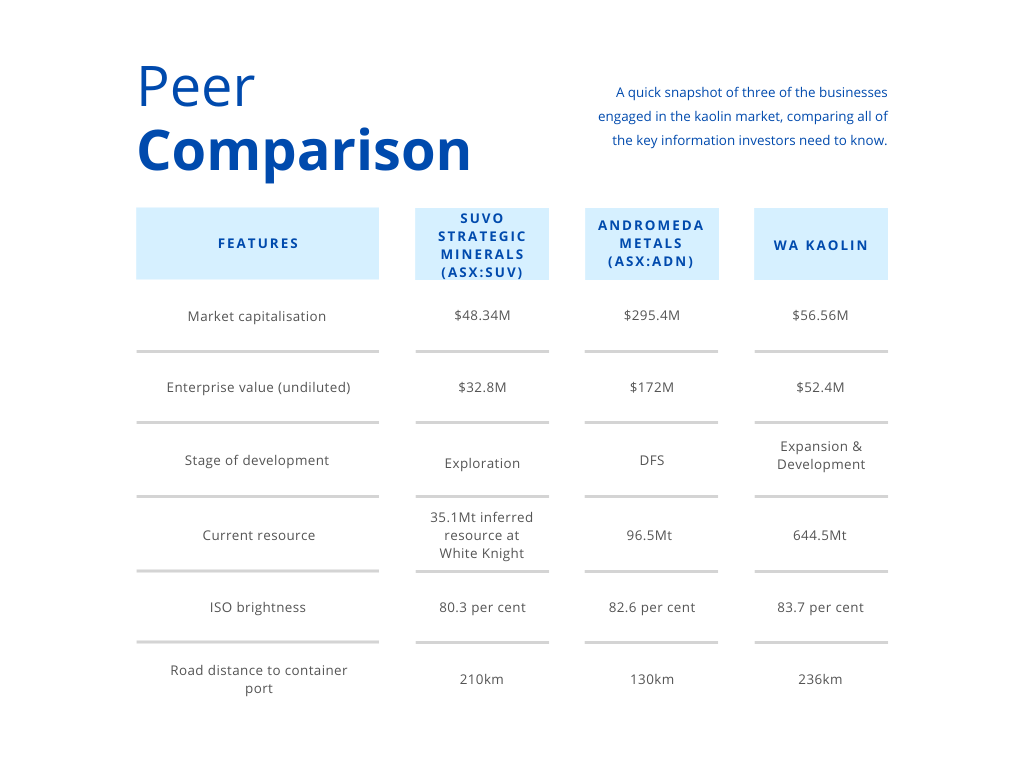

One of the companies invested heavily in kaolin is Suvo Strategic Minerals. The ASX-lister owns the White Knight Kaolin Project in WA’s wheatbelt region.

White Knight plays host to a maiden JORC inferred resource of 35.1 million tonnes with an average ISO Brightness of more than 80 per cent.

The brightness of kaolin is significant, as the ceramics industry will pay more for kaolin, the whiter it fires. As a result, Suvo is in pole position compared to its peers.

Suvo is still in the early stages of development though and the company has yet to advance White Knight to the pre-feasibility stage.

Recently, however, the materials stock appointed a kaolin and halloysite global expert to its board, paving the way for White Knight’s development.

In late August, Dr Ian Wilson joined Suvo as a Non-Executive Director. He brings 45 years’ experience in industrial metals and has worked with the world’s biggest kaolin producer, Imerys.

“Attracting someone of the calibre of Ian to our Board validates the significant potential we have with our White Knight Kaolin project,” Suvo Executive Chair Robert Martin commented.

Even though it just relisted on the ASX, the new appointment is a vote of confidence in the company’s portfolio and prospects.

WA Kaolin

In comparison, WA Kaolin is in a very different position. The privately-owned company, which is gearing up to list on the ASX, owns the Wickepin Kaolin Project.

The company is focused on turning the resource into a market suitable feedstock, with a goal of moving its plant and producing 200,000 tonnes per annum within 12 months and 400,000 tonnes per annum in 36 months.

It already has customers in place for 100 per cent of its current offtake and is confident the demand for its product will continue to outstrip supply.

As a result, WA Kaolin is eager to take its business public. In a prospectus published in mid-October, the company revealed it was looking to raise $22 million to support its ASX listing and project development.

But time will tell if it’s not too late to the party.

Andromeda Metals (ASX:ADN)

And finally there’s another Australian company looking to profit off this prospective resource.

Andromeda Metals has built a portfolio of halloysite-kaolin plays across the country, spanning over 5374 square kilometres and 19 exploration licences.

To support its ambitions, Andromeda is developing the Great White Kaolin Project, situated in 635 kilometres west of Adelaide in South Australia — an area it’s described as “globally significant.”

At the project’s Carey’s Well deposit, Andromeda has identified a 20.2 million tonne kaolin resource estimate, 7.4 tonnes of which falls in the measured category.

Now, Andromeda is focussed on completing Great White’s definitive feasibility study, with hopes to get the project shovel ready for 2022.

Looking ahead

The beauty of kaolin is that it’s a ‘blue-sky’ industry. There’s plenty of uses for this white clay already, but it’s becoming an increasingly important tool in a range of emerging industries.

For instance, kaolin could play a key role in the developing electric vehicle industry. High purity halloysite-kaolin makes the perfect feedstock for high purity alumina, which is integral for creating the electric vehicle batteries.

As a result, kaolin’s value is on the rise. According to a Grandview research report, by 2027, revenue from kaolin sales is poised to reach US$6.28 billion (roughly A$8.94 billion)

Over the next seven years, the pure white clay carries a 3.1 per cent compound annual growth rate (CAGR), meaning it’s primed for future growth.

Who will be winners?

With part of kaolin’s value tied to its quality, pricing for the white clay is on the rise. In turn, increasing global appetite is set to weigh on supply, sending costing skywards.

So the challenge for producers isn’t finding buyers. The challenge instead is to have the lowest cost of production. The winners in logistics in particular are likely to be the best investments.

Ultimately, it’ll lead to significant upside as this bright white resource continues to shine.

Correction: in an earlier version of this article’s table, we stated Andromeda Metals’ road to port was 635 kilometres, instead of 130 kilometres. It also stated its current resource was 20.2 million tonnes, instead of Andromeda’s overall 96.5-million-tonne resource. This information has since been updated.