- Deals featuring a corporate seller have grown significantly in the share of overall commercial investment volume in Australia during the last year

- The rise has been fuelled mostly by ‘sale and leaseback’ transactions rather than outright disposals, according to a recent Knight Frank report

- The report said the sale and leaseback deals suggest businesses are selling to free up capital for other uses

- Corporate asset sales totalled $3.7 billion, accounting for 11.8 per cent of total investment volume — up from 5.7 per cent in the year to March 2020

- By sector, industrial, retail, and data centres assets have accounted for a large share of deals involving a corporate seller

Deals featuring a corporate seller have grown significantly in the share of overall commercial investment volume in Australia during the last year.

The rise has been fueled mostly by ‘sale and leaseback’ transactions, according to a recent Knight Frank report, which noted companies are seeking to restructure and restore their balance sheets while also taking advantage of record low returns.

While private and institutional real estate investors control the majority of commercial buildings, many firms have long-term property holdings that they have purchased and expanded for their operations.

However, several corporations have been tempted to sell down their real estate assets in the last year, the report said.

As a result, the number of investment agreements including a corporate seller has grown dramatically since the outbreak of the pandemic.

Corporate asset sales totalled $3.7 billion in the year to June 2021, accounting for 11.8 per cent of overall investment volume, compared to 5.7 per cent in the 12 months before the pandemic, according to the report.

The rise has been fueled primarily by ‘sale and leaseback’ transactions rather than outright disposals, implying that companies are selling their property holdings not because they are no longer needed, but rather to free up money for other purposes, the report noted.

Over the year to June 2021, ‘sale and leaseback’ agreements amounted for 61 per cent of sales with corporate sellers, up from 46 per cent a year earlier and the highest level since Q1 2013.

Knight Frank Australia chief economist Ben Burston said companies have taken advantage of favourable market conditions to sell assets.

“With the notable exception of the retail sector, property yields have generally continued to drift lower over the past few years consistent with the shift downward in interest rates since mid-2019,” he said.

“Yield compression has been particularly pronounced in the industrial sector, with demand for logistics assets boosted by the acceleration of growth in e-commerce and the trend towards online shopping.

“The growth of the sector has spurred the development of larger and more sophisticated buildings with long leased income streams and yields for these types of assets are now moving below 4.0% in Sydney and Melbourne.”

Mr Burston said the economic recovery has been stronger than anticipated and should continue to ease the pressure on corporate balance sheets.

“However, the prolonged low interest rate environment in Australia and globally, and the likelihood that this will continue indefinitely, will ensure yields remain low,” he said.

“Intense competition for property assets, including from major global investors with a low cost of capital and commensurately low target returns, will continue to drive strong pricing.

“This will be particularly evident in industrial and logistics assets and alternative assets such as data centres, which will continue to motivate corporate property holders to take advantage through asset sales.”

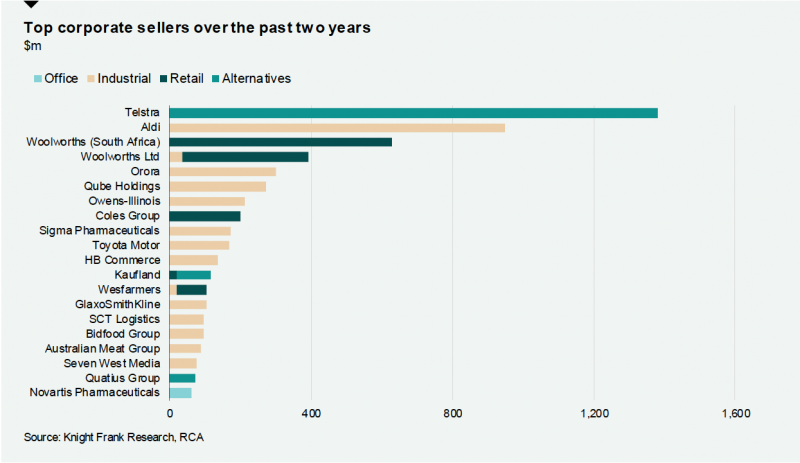

Industrial, retail, and data centres assets have accounted for a substantial percentage of sales involving a corporate seller, backed up by a number of major transactions, the report found.

Two such sales were Qube Holdings’ pending sale of the Moorebank Logistics Park in Sydney to Logos for $1.65 billion and the sale of the David Jones store on Elizabeth Street in Sydney to Charterhall for $510 million in December.