- Dacian Gold’s (DCN) production fell below guidance in the June quarter, but full-year production was still in line with expectations

- Production at the Mount Morgans Gold Operation (MMGO) near Laverton in Western Australia was impacted by geological variations at the Herffernans open pit which, in turn, slowed mining rates

- Additionally, Dacian has lowered its production guidance for the 2021 financial year and increased the expected all-in sustaining cost

- The gold explorer attributed this to the expansion of Mt Marven and Morgans North open pits as well as a review of the Jupiter mine plan and the MMGO operating plan

- Dacian Gold’s share price is down 22.8 per cent to 30.5 cents per share

Dacian Gold’s (DCN) production fell below guidance in the June quarter, but full-year production was still in line with expectations.

Gold production at the Mount Morgans Gold Operation (MMGO) fell below Dacian’s guidance of 33,000 to 36,000 ounces for the June quarter to 31,883 ounces.

Dacian fully-owns the MMGO which is comprised of the Jupiter open pit mine with its Heffernans and Doublejay sub-pits, the Westralia underground mine, including the Beresford and Allanson deposits and a processing plant.

The lower than expected quarterly production was largely attributed to slower than planned mining rates at the Heffernans open-pit due to geological variations.

Dacian did still achieve its full-year production guidance of between 138,000 and 144,000 ounces, producing 138,814 ounces of gold over the 2020 financial year.

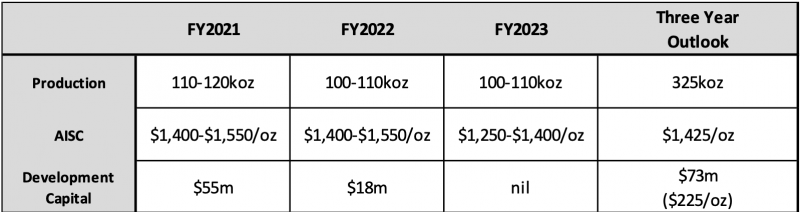

The company has also revised down its production guidance for the 2021 financial year by 10,000 ounces to between 110,000 and 120,000 ounces of gold.

This was in part put down to both the cessation of mining activities at the Westralia underground mine in August 2020, four months earlier than expected.

Additionally, Dacian expand the Mt Marven and Morgans North open pits and carry out a review of the Jupiter mine plan and MMGO operating plan.

Dacian now anticipates production will occur over the 2021 financial year at an all-in sustaining cost (ASIC) of $1400 to $1550 per ounce, as opposed to the previously forecast ASIC of $1250 to 1350 per ounce.

Over the next three years, the company expects to produce an average of 110,000 ounces of gold annually at an AISC of $1425 per ounce.

Managing Director Leigh Junk said the investments made on the MMGO will optimise cash flows in the long term.

“Dacian has been busy on multiple fronts, striking the right balance between investing in its operations, to managing the risk profile across deposits, to maximising cash flows over the long term, as well as unlocking the significant exploration potential we see across our tenement package.

“Our optimisation work at MMGO has established a solid baseline on which to deliver our three-year plan and execute our exploration and growth strategy.

At the end of June 2020, Dacian has $64.1 million in debt and $57.3 million in total cash and equivalents.

During the June quarter, Dacian made a $5.9 million debt repayment and in the September quarter expects to make a $25 million repayment from cash reserves and operating cash flow to the project loan facility

Over the first half of the 2021 financial year, Dacian plans to complete a refinancing to a corporate style debt facility.

Dacian Gold’s share price is down 22.8 per cent to 30.5 cents per share at 2:35 pm AEST.