- ECS Botanics (ECS) has signed its fourth medicinal cannabis supply agreement for the 2021 calendar year

- The agreement was signed between ECS Botanics’ (ECS) subsidiary, Murray Meds, and Melbourne-based Releaf Dispensaries

- Under the agreement, Murrray Meds will supply Releaf with jars of its premium trimmed and dried cannabis flower

- The agreement will generate around $590,000 revenue for ECS over an 18-month term

- This agreement is an extension of ECS’s existing relationship with the company, which already stocks ECS’ food and wellness products at its St Kilda dispensary

- ECS Botanics is down 1.96 per cent and trading at 5 cents per share

ECS Botanics’ (ECS) subsidiary, Murray Meds, has signed a dried cannabis supply agreement with Melbourne-based Releaf Dispensaries.

The agreement with Releaf Dispensaries, a wholly-owned subsidiary of Releaf Group, will generate around $590,000 revenue for ECS over an 18-month term. This marks the fourth medicinal cannabis supply agreement signed in the 2021 calendar year for ECS.

Releaf is Australia’s first dedicated clinic and dispensary, formed to simplify the consultation process and access to medicine for patients in need of a fully integrated health care service.

The company says the agreement will allow it to expand its franchise operations in Australia, New Zealand and the UK.

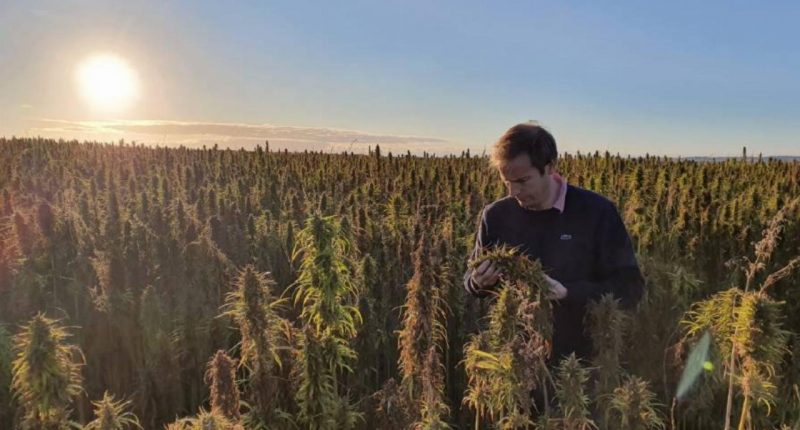

Under the agreement, ECS will supply Releaf with jars of its premium trimmed and dried cannabis flower. This agreement is an extension of ECS’s existing relationship with the company, which already stocks ECS’ food and wellness products at its St Kilda dispensary.

The agreement can potentially be renewed for a further period of time, if agreed by both parties, or terminated with 10 days’ notice if either party breaches the agreement.

According to Cannabiz, a flower shortage has hit Australia, with the company noting that flower as a percentage of medicinal cannabis product demand has risen from 3 per cent in the first quarter of 2020, to 24 per cent by the end of 2020.

“THC flower is in high demand and we are pleased to be partnering with Australia’s leading medicinal cannabis clinics and dispensary groups,” said ECS Managing Director, Alex Keach.

“The accelerating rollout of Releaf’s medicinal cannabis clinics and dispensaries across Australia is also making access easier for patients and driving demand. Releaf has an aggressive rollout franchise strategy and we look forward to supporting their growth”.

Looking forward, ECS has a detailed plan of activities set to launch over the next six months, including additional cannabis sales agreements and partnerships, an expansion of its manufacturing capacity and a ramp up of more CBD at its Tasmanian facility.

Despite the news, ECS Botanics is down 1.96 per cent, trading at 5 cents at 9:20 am AEDT.