- European Lithium (EUR) will draw another A$2 million from a debt facility created in July

- The Austrian explorer says the funds will be used to speed along a definitive feasibility study at the Wolfsberg project, South of Vienna

- The study is expected to cost $1.56 million in the coming quarter, with remaining funds to be used for general working capital

- EUR is executing the transaction by giving convertible notes to Winance Investment

- European Lithium lifted its trading halt this week, and shares are down 7.5 per cent to trade at 7.4 cents each

Austrian explorer European Lithium (EUR) has pulled a further A$2 million from its debt facility to progress its maiden project.

EUR will pull the funds from an agreement created in July of last year, with independent firm Winance Investment.

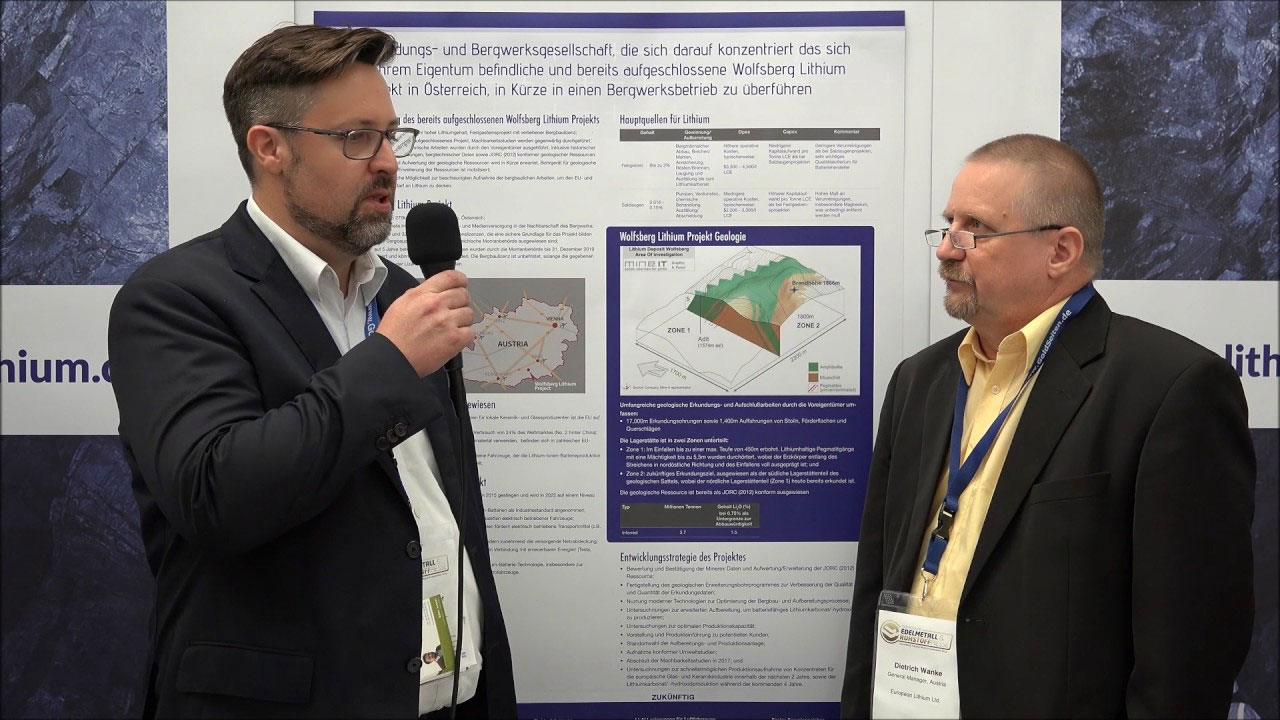

The European explorer says the funds will be used to speed up a definitive feasibility study at the maiden Wolfsberg project, south of Vienna.

“Winance’s commitment towards European Lithium and belief in the Wolfsberg project has been substantiated by the independent analysis and studies conducted recently,” Winance Chief Financial Officer, Waqas Ibrahim said on Thursday.

“Winance is entirely satisfied in the development of the project and adept strategies implemented by management.”

EUR is anticipating the study to cost $1.56 million in the coming quarter, with plans to spend an additional $435,000 for general working capital.

The Wolfsberg project is located in Carinthia, 270 kilometres south of Austria’s Vienna. Wolfsberg is located near an established industrial town as well, with access to the European motorway and railway network.

Wolfsberg comprises 32 exploration licences over 11 mining areas, issued by the Austrian mining authority.

“Winance has decided to extend our support to European Lithium and provided reasonable assurance to the management that Winance is still holding the majority of the shares resulting from the conversion of the first tranche,” Waqas Ibrahim added.

The $2 million drawdown is occurring through an issue of 2,000 convertible notes given to Winance.

Board changeup

EUR also underwent a change on its board of directors this week as well.

On Thursday, the European explorer welcomed new Non-Executive Director Tim Turner. Tim is the senior partner of accounting firm HTG Partners.

“We’re extremely pleased to have Tim join us and look forward to welcoming him to our board,” EUR Chairman Tony Sage said

“Tim has many years’ experience on listed company boards and has strong industry knowledge.”

Tim Turner is replacing Stefan Müller on the board.

“I would like to express my gratitude to Stefan for his work and commitment to the company, particularly in respect to the company’s exposure in the German and Austrian markets,” Tony added.

EUR lifted its trading halt this week, and shares are down 7.5 per cent to trade at 7.4 cents each.