- Cavalier Resources (CVR) is set to list on the ASX on June 10 and brings with it the opportunity to invest in some highly prospective assets across three of WA’s most prolific mining and exploration regions

- The company’s assets range from near-mine-ready resources in Leonora to greenfield exploration opportunities in the emerging Forrestania region

- Cavalier’s Crawford gold project in Leonora is highly advanced to a mine-ready stage, and the company says the project has the potential for near-term mining operations and cashflow

- In fact, Cavalier plans to use the cash generated from Crawford to fund the exploration and continued development of its other WA assets well into the future without the need to raise capital on market, potentially reducing dilution to any existing IPO shareholder base

- With high-quality neighbours, decades of experience behind its executive team, and plans to fully self-fund its exploration and development within 18 months, Cavalier Resources has all the makings of a golden exploration opportunity

Gold and nickel explorer Cavalier Resources (CVR) is in line to join the ranks of ASX mining hopefuls with an upcoming initial public offering seeking up to $7 million ending in June.

With Western Australian assets ranging from near-mine-ready resources in Leonora to greenfield exploration opportunities in the emerging Forrestania region, the exploration junior has seen strong indicated demand for its IPO.

This likely comes as no surprise given beyond offering investors exposure to some highly prospective assets across three of WA’s most prolific mining and exploration regions, Cavalier intends to fully self-fund its exploration and development within 18 months of listing.

Yet, for Cavalier, the company’s potential is about more than just its asset portfolio and impressive landholding: the ASX newcomer is led by a skilled team with decades of experience in the mining and materials industry who have recently brought several IPOs to market.

Strategic assets, shrewd management

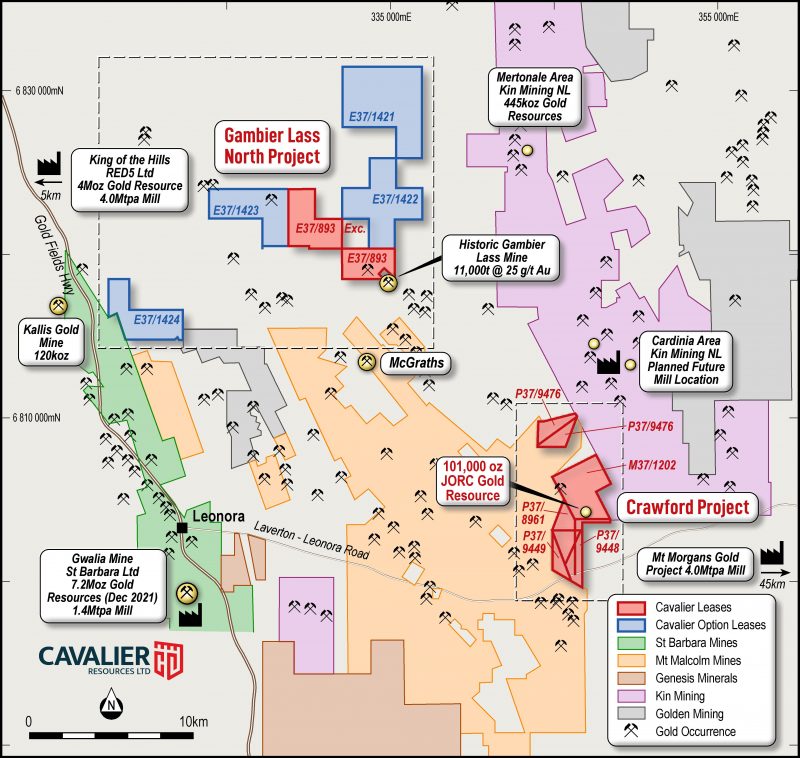

Cavalier’s flagship Leonora gold project is made up of two sub-projects: the Crawford gold project and Gambier Lass North.

At its Crawford project, Cavalier has already defined a shallow, mine-ready mineral gold resource of 101,000 ounces at 1 gram per tonne (g/t) within a 50-kilometre radius of three operating gold mills.

What’s more, the Crawford deposit remains open along strike and at depth, and Cavalier is planning infill and extensional drilling across this asset as soon as it lists on the ASX.

For Cavalier, this project means the company has the potential for a near-term mining operation and short-term cash flow to allow Cavalier to explore and develop its projects for many years after listing.

Cavalier said it intended to cash in at Crawford with early confirmatory drilling complementing a deep-dive review expected to result in a pre-feasibility study (PFS), all within months of listing.

This means Crawford could provide the funds to allow Cavalier to explore and develop its other projects for many years after listing — potentially eliminating the need to raise capital on market. For Cavalier’s IPO shareholder base, this means there is potentially little-to-no dilution on the way for CVR shares.

Meanwhile, the company’s other strategic assets in the Leonora area mean it offers investors more than just a short-term gold grab: the Gambier Lass North project, for example, has returned high-grade gold intercepts including a six-metre hit at 3.29 g/t gold and a three-metre hit at 3.04 g/t gold.

Cavalier is planning to infill a 700-metre strike to create a maiden mineral resource on the project post-listing.

Just 35 kilometres north of Kalgoorlie, Cavalier has unveiled gold mineralisation at its Hidden Jewel project and plans to kick off reverse circulation (RC) drilling on three key untested drill target areas over the near term.

Finally, but not least, Cavalier’s Ella’s Rock project, just east of the world-class Forrestania greenstone belt, represents a significant untested gold and nickel opportunity for the company.

Guiding the company through its planned IPO is Executive Chairman Ranko Matic, who currently serves as a director of Panther Metals (PNT), Australian Gold and Copper (AGC), Lycaon Resources (LYN), and East Energy Resources (EER).

Mr Matic has helped oversee more than 40 IPOs and other re-capitalisations and re-listings over two decades.

He is supported by Cavalier Executive Technical Director Daniel Tuffin, a mining entrepreneur and the Managing Director of Auralia Mining Consulting, who has a wealth of local experience and serves on the boards of Panther Metals (PNT) and Mt Malcolm Mines (M2M), and non-executive director Anthony Keers.

Both Mr Tuffin and Mr Keers each have over 20 years of experience as mining engineers.

What’s in it for investors?

Location can often be the difference between success and failure in the mineral exploration industry: strategy, equipment, and funding can count for naught if a company is digging in the wrong spot.

Cavalier’s Leonora gold project is surrounded by producing mines that require new sources of mill feed — particularly the shallow, easy-to-dig oxide resource at the Crawford gold project.

Gambier Lass North lies near Red 5’s (RED) four-million-ounce King of the Hills gold resource and four-million-tonne per annum (Mtpa) mill.

Just 25 kilometres west of the Crawford project lies the 7.2-million-ounce Gwalia Mine and 1.4Mtpa mill in Leonora, owned by gold miner St Barbara (SBM).

Head 45 kilometres east and you’ll find Dacian Gold’s (DCN) Mt Morgan gold project and 4Mtpa processing plant. Both mills are accessible via a sealed highway.

The Hidden Jewel gold project lies just 20 kilometres north of Norton Gold Fields’ 5Mtpa Paddington mill — also accessible via a sealed highway.

Finally, the Ella’s Rock nickel and gold project lies 20 kilometres southeast of Western Area’s Cosmic Boy nickel plant.

With high-quality neighbours, decades of experience behind its executive team, and plans to fully self-fund its exploration and development within 18 months, Cavalier Resources has all the makings of a golden exploration opportunity.

How can investors get on board?

Cavalier Resources is chasing a June listing, with a plan to issue 25 million shares at 20 cents each as part of its IPO.

While the company is seeking $5 million, it has provisions to accept up to $7 million through the IPO, giving it an indicative valuation of between $8.6 million and $10.6 million upon listing.

The IPO opened on April 11 and is slated to close on May 20, with shares to be issued on May 27. If all goes according to plan, Cavalier will list on the ASX on June 10.

Sanlam Private Wealth and Dalton Equities are acting as joint lead managers for the raise.

This means Cavalier’s IPO will be supported by the same management team and lead managers as Panther Metals’ successful IPO in December last year.