- Fatfish Group (FFG) is looking to gain further traction in South East Asia by acquiring a 55 per cent stake in Malaysia-based Pay Direct Technology

- Pay Direct operates QlicknPay — a payment gateway currently certified to process transactions via Mastercard, Visa, Paypal and FPX

- QlicknPay processes more than $32 million worth of transactions each month and powers more than 500 businesses

- Fatfish will pay $470,000 in exchange for the majority interest, which will be funded from the company’s existing capital

- Shares in Fatfish Group finished trading last week at $0.12 each

Fatfish Group (FFG) is looking to gain further traction in Southeast Asia by acquiring a 55 per cent stake in Malaysia-based Pay Direct Technology.

Founded in 2017, Pay Direct operates QlicknPay — a payment gateway currently certified to process transactions via Mastercard, Visa, Paypal and FPX, an online banking payment network sponsored by Malaysia’s Central Bank.

QlicknPay processes in excess of $32 million worth of transactions each month and powers more than 500 businesses, including London-based international currency transfer platform Wise and TeaLive, Southeast Asia’s largest lifestyle tea brand.

Under the terms of the agreement, Fatfish will pay $470,000 in exchange for the majority interest, which will be funded from the company’s existing capital.

The transaction is expected to reach completion over the next three months.

It’s part of Fatfish’s plan to further develop its business in the Southeast Asian market — one which views payment gateway technologies as “an important underlying payment infrastructure component that could accelerate FFG’s Buy Now Pay Later (BNPL) services roll-out,” according to a statement released this morning.

“FFG sees tremendous synergies between its BNPL businesses and Pay Direct, which would allow strategic access to online merchants and financial institutions that could be partners to FFG’s BNPL services,” the company said.

The acquisition follows a separate announcement released last week, in which Fatfish said it had increased its combined interest in Singapore-based BNPL provider Smartfunding from 78.7 to 89.4 per cent.

Through a rights issue approved by Singapore’s Central Bank, Fatfish took up a share subscription worth $300,000, which increased its holding from 19.9 to 39.95 per cent.

At the same time, its Swedish-listed subsidiary Abelco Investment Group submitted a $200,000 subscription, which took its holding to 49.4 per cent.

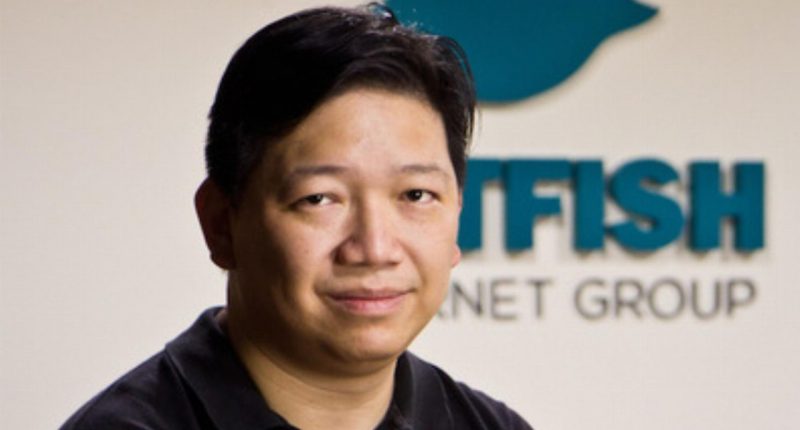

Fatfish’s chief executive Kin W Lau said the collective direct and indirect stakes will allow the company to drive Smartfunding forward by providing it with the support it needs to succeed.

Shares in Fatfish Group finished trading last week at $0.12 each.