- Finfluencers have sounded a warning to their peers to beware of invitations to speak at stock conferences keen to capture a large Millennial audience

- High-profile finfluencers withdrew from one such event, the recent MarketLit conference only days before the event

- Some have told The Market Herald they were not told the true nature of the recent investment ‘summit’ featuring several small cap stocks and discovered this only via a media report

- Additionally, the investor relations firm organising the event did not check whether the finfluencers that spoke with The Market Herald had AFSLs or warned that they could be heavily fined for providing financial advice without a licence

Following The Market Herald’s special report about “finfluencers” this month, more information has emerged about how some organisations are using finfluencers, often young women, to help promote higher-risk products such as small cap ASX stocks.

It’s not, therefore, only investors who need to beware of some finfluencers.

They warned that financial influencers, many of them well-intentioned, also need to be wary of investor relations (IR) firms keen to add some youthful glamour and attract thousands of social media followers to their event audiences.

The reward for engaging finfluencers can be huge. Australian Millennials are keen to invest on the ASX and they are set to inherit $3.5 trillion from Baby Boomers over the next 20 years.

One example of such an event is The Capital Network’s (TCN) MarketLit, an online conference billed as the “first Millennial investment summit” held on July 2.

At least two popular finfluencers believe they were given insufficient information about the true nature of the conference.

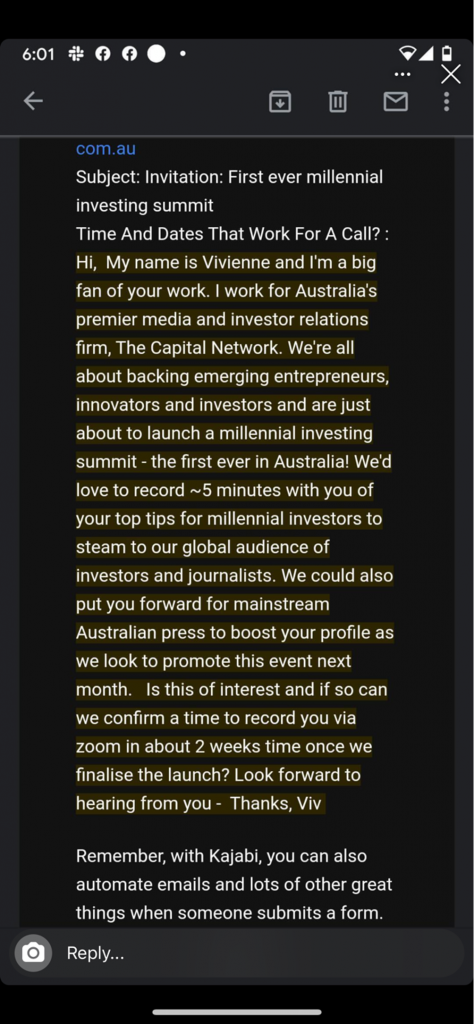

Ahead of the conference a number of finfluencers were contacted with a message that highlighted the focus on Millennials.

Tash Etschmann (@tashinvests), who has more than 80,000 followers on TikTok and 27,000 followers on Instagram, initially agreed to appear. She was one of the finfluencers featured in promotional material sent to journalists and was also featured on the Eventbrite booking page until four days before the conference, ahead of pulling out of the event.

The conference program included 15 small caps and one mid cap ASX-listed firm. Forty per cent of those firms are clients of The Capital Network.

Maddie Walton (@moneywithmaddie) said she thought TCN was reaching out to other finfluencers and that it sounded “really cool”. She had been told that the Australian Securities and Investments Commission (ASIC) would be involved and that it therefore “must be OK”.

As a finflucencer who is aware that she has to be “really careful and provide balanced opinions”, Ms Walton shares general information about tax, budgeting, share trading and cryptocurrencies with her more than 5400 followers on Instagram.

“I don’t want to do anything wrong by anybody and don’t want people to be ripped off,” Ms Walton told The Market Herald

She said it was only after a story appeared on June 28 in the media that she became aware of “the roll call”.

“That rang alarm bells for me. Investing in small caps is not I what do myself,” Ms Walton said.

The 23-year-old had planned to discuss superannuation and saving for retirement, and was concerned her followers might think she was also endorsing more short-term, speculative stocks by taking part in the conference.

“That’s fine if they (TCN) want to include small caps, but I wasn’t told,” she said.

“The level of disclosure was insufficient.

“They (TCN) were happy for me to pull out. But it’s a shame that people did pull out because the only way we can learn is from each other.”

Moreover, after promoting the event under the guise of female empowerment, the event organisers then sent to the finfluencers who withdrew an email which could be easily interpreted as patronising.

TCN Co-Founder & Executive Director Lelde Smits said her mission for MarketLit was “to create an event that highlighted diversity in financial markets and inclusivity through asking women and young investors to participate”.

Ms Smits said that from the moment the event was launched the list of all participants, including every company, was available publicly on TCN’s website and was disclosed through its press releases.

However, one of the participants who cancelled was sent an email she felt was condescending, including the lines (with TCN’s underlining):

“…it is deeply concerning to me that it was only our youngest female contributors who withdrew, citing concern and/or fear arising from AFR’s article. As a financial equality advocate this shows me society is still not supporting women in finance to feel included or safe, which is what I tried to do, and I feel sadness that you did not feel safe enough to continue.”

Queenie Tan (@investwithqueenie) who has 65,000 followers on TikTok, 21,100 on Instagram and 17,000 subscribers on YouTube, is among the finfluencers who withdrew from the conference.

Ms Tan, 24, did not want to discuss why she decided to pull out of the event but she did sum up the motivations of the finfluencers The Market Herald spoke to for this story.

“We are coming from a genuine place and want to help our followers,” she said, adding that finfluencers could play a positive role on social media.

“There’s a lot of financial hardship and finfluencers can show that it’s cool to save, not just spend money on expensive products like some other influencers encourage,” she said.

Additionally, The Market Herald confirmed last week that TCN did not ask some finfluencers if they held an Australian Financial Services Licence (AFSL) or understood the licensing issues of offering financial advice

An AFSL allows a person to provide financial product advice as opposed to financial advice that is general and easily verifiable.

MarketLit carried a disclaimer about the advice shared at the conference and told The Market Herald : “Every market expert and financial influencer was asked to only discuss personal experience, not provide financial advice”.

However, the finfluencers The Market Herald spoke to said there was no discussion or information provided about possible liability issues that could be faced by the young speakers targeted by TCN.

This has come to light at a time when financial services watchdog ASIC has been stepping up its monitoring of unlicensed financial product advice, according to Emma Johnsen, senior associate at Sydney law firm Marque.

“ASIC has been making more announcements as warnings and has been maintaining a hard line towards unlicensed financial product advice,” Ms Johnsen said.

“There have been more complaints from individual investors since the start of the pandemic and finfluencers are definitely on ASIC’s radar.”

Marque partner Nathan Mattock said that if the influencer recommended a financial product, this would come within ASIC’s remit.

“If unlicensed online investment advice is provided without an Australian Financial Services Licence (AFSL), the individual could be found to be given unlicensed advice and be prosecuted by ASIC,” Mr Mattock said.

“Holding yourself out as a financial adviser without an AFSL can lead to a fine of up to A$133,200 and a possible prison sentence of up to five years.”