- Firefly Resources (FFR) has signed an agreement to purchase the Yalgoo Gold Project in the Murchison Region of Western Australia

- The gold explorer will purchase all issued capital in the projects owner Aurum Minerals for $2.91 million worth of Firefly shares

- Several mineral resource estimates have been completed at the project but not to current reporting requirements

- As such, one of Firefly’s priorities is to establish a JORC 2012 compliant Mineral Resource and another is to carry out regional-scale exploration

- Firefly also announced a capital raising of approximately $2.3 million to fund upcoming exploration programs at Yalgoo

- This will include a $1.15 million investment from Aurum through a share subscription

- Firefly’s share price is up 45 per cent to 5.8 cents per share

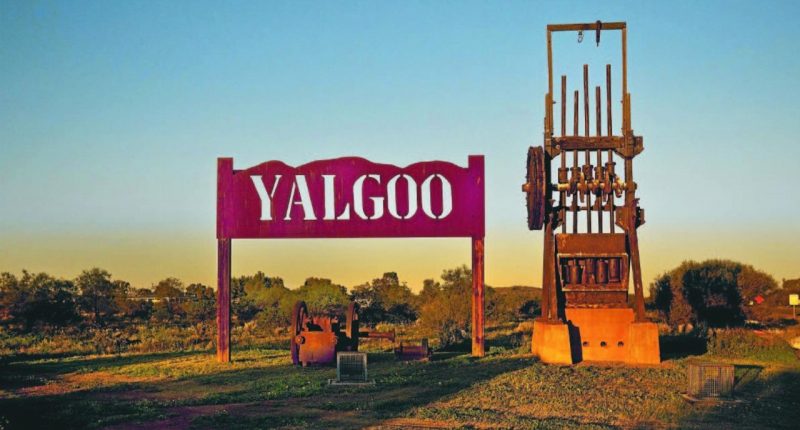

Firefly Resources (FFR) has signed a binding agreement to purchase the Yalgoo Gold Project in the Murchison Region of Western Australia.

The gold explorer, formally Murindi Metals, will purchase all issued capital in the projects owner Aurum Minerals for $2.91 million worth of Firefly shares.

Yalgoo lies between the Ramelius Resources’ Magnet gold mine and Silver Lakes Resources’ Deflector copper-gold mine. Several mineral resource estimates have already been completed at the project but not to current reporting requirements.

Managing Director Simon Lawson said the acquisition comes after a year focused on portfolio optimisation grounded in Western Australian gold projects.

“The Yalgoo Gold Project joins our earlier stage Forrestania Gold Project and Paterson Copper-Gold Project as a key part of our strategy to deliver gold ounces and scale potential to our shareholders.”

“The cornerstone asset within the Yalgoo Gold Project is the centrally-located Melville gold deposit. Melville hosts an existing historical resource over a completely un-mined gold deposit that we intend to rapidly upgrade to JORC 2012 compliance.”

“Our immediate focus is on a number of existing high-grade intercepts both inside and outside the historical Melville resource, as well as down-dip and along-strike that we intend to leverage with the aim of strengthening and potentially adding ounces to the planned Melville resource update. In addition, the existing and under-drilled gold prospects along-strike from Melville have exciting and very real potential to further enhance this key asset.”

Firefly also announced a capital raising of approximately $2.3 million to fund upcoming exploration programs at Yalgoo. This will include a $1.15 million investment from Aurum through a share subscription.

“We are excited to welcome members of the Aurum team onto our register as major shareholders with their placement commitment being a strategic cornerstone investment in our company. In addition, an Aurum representative will join us on the Firefly board and further details regarding the appointment will be provided in a subsequent announcement,” said Mr Lawson.

Firefly will seek to raise the remaining $1.17 million through a share placement and a non-renounceable entitlement offer.

Firefly’s share price is up 45 per cent to 5.8 cents per share at 2:34 pm AEST.