- Galaxy Resources (GXY) has begun the basic engineering phase for its James Bay development, aiming to achieve first production in early 2024

- It follows the completion of the preliminary economic assessment (PEA) for the integrated lithium mine and processing plant in Quebec, Canada

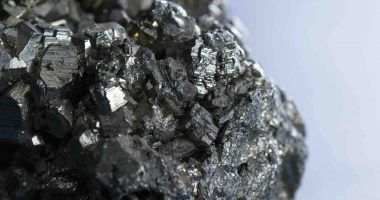

- The assessment estimated an 18-year life of mine, based on an annual production of 330,000 tonnes per annum of spodumene concentrate

- Galaxy would need to commit US$244 million (around $320 million) for initial development costs but would be able to pay this back in less than three years

- CEO Simon Hay says the PEA demonstrates James Bay is a viable, near-term supplier of spodumene for the electric vehicle supply chain in North America and Europe

- Shares have been up 0.89 per cent to $2.26

Galaxy Resources (GXY) has begun the basic engineering phase for its James Bay development, aiming to achieve first production in early 2024.

It follows completion of the Preliminary Economic Assessment (PEA) for the integrated lithium mine and processing plant in Quebec, Canada.

The assessment estimated James Bay to have an 18-year life of mine, based on an annual production of 330,000 tonnes per annum of spodumene concentrate.

Galaxy would need to commit US$244 million (around A$320 million) for initial project development costs and thereafter US$290 (approximately A$380 million) per tonne of concentrate produced.

Based on these figures, the project would have a pre-tax payback period of 2.2 years and a post-tax pay-back period of 2.8 years.

CEO Simon Hay said the completion of the PEA is a major milestone for the fully integrated project and the company’s engagement with potential downstream owners and suppliers.

“Galaxy is pleased to release the PEA outcomes for James Bay which clearly demonstrate that the Project is a viable, near-term supplier of spodumene to feed the emerging electric vehicle value chains in North America and Europe.”

“Our skills and experience in developing and operating Mt Cattlin have been utilised to optimise the James Bay design. As a result, the Project is a low-cost operation and will sit in the lowest quartile regionally for capital intensity and operating costs.”

Galaxy’s wholly owned and operated Mt Cattlin mine, located in Ravensthorpe, Western Australia, produces spodumene and tantalum concentrate.

“Forecast financial outcomes are compelling and with downstream facilities needing to secure long-term spodumene supply from reliable and proven miners Galaxy is confident that the James Bay project will be highly attractive, particularly to North American and European value chain participants,” the CEO added.

Shares have been up 0.89 per cent at $2.26 at 1:15pm AEDT.