- Rare earths producer Hastings Technology Metals (HAS) has received $40 million from its largest shareholder, L1 Capital, via a strategic placement of 16 million shares

- The new shares will be issued at 25 cents each, representing a 5.7 per cent discount to the last traded price

- Under the placement, Hastings will also issue L1 Capital with a one-for-two, free-attaching unlisted option with an exercise price of 32.5 cents that will expire two years from date of issue

- Funds raised will be. used to accelerate key work streams and mine site works at its flagship Yangibana Rare Earths Project in the Gascoyne region of Western Australia

- HAS shares were up 1.89 per cent, trading at 27 cents each

Rare earths producer Hastings Technology Metals (HAS) has received $40 million from its largest shareholder, L1 Capital, via a strategic placement of 16 million shares.

The new shares will be issued at 25 cents each, representing a 5.7 per cent discount to the last traded price, and will rank equally with the company’s existing shares.

Under the placement, Hastings will also issue L1 Capital with a one-for-two, free-attaching unlisted option with an exercise price of 32.5 cents that will expire two years from date of issue.

Hastings has said that the placement puts the company in a strong financial position, with a cash balance of $131 million upon placement settlement.

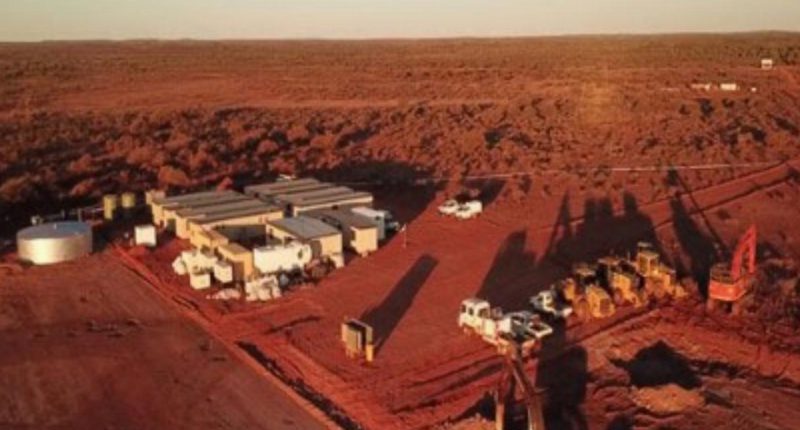

Funds raised will be used to accelerate key work streams and mine site works at its flagship Yangibana Rare Earths Project in the Gascoyne region of Western Australia.

The company will use the funds to procure long-lead-time equipment, front-end engineering plant design and various mine site works that include camp installation, access road construction and civil plant base earthworks.

Executive Chairman Charles Lew said the placement “demonstrates confidence and commitment” from shareholders like L1 Capital.

“As outlined in our recent updated project economics announcement, we are well advanced in discussions with a range of funding partners in finalising the appropriate capital structure that best positions the Company for bringing Yangibana into production by 2024,” Mr Lew said.

“This placement enables Hastings to continue the current pace of project development ensuring we deliver the next large scale rare earth mine into a very strong market for our product.”

Settlement of the new shares is expected to occur on March 31.

HAS shares were up 1.89 per cent, trading at 27 cents as of 12:23 pm AEDT.