- Hastings Technology Metals (HAS) is acquiring Cadence Minerals’ 30 per cent interest in the Yangibana joint venture tenements in WA

- Once the $9 million purchase is finalised, Hastings will have a 100 per cent interest in the entire Yangibana rare earths project

- The acquisition gives Hastings an immediate increase in ore reserves and life of mine by up to one year and there’s “substantial opportunity” to increase the mineral resources

- HAS shares are down 4.76 per cent to trade at 20 cents on market close

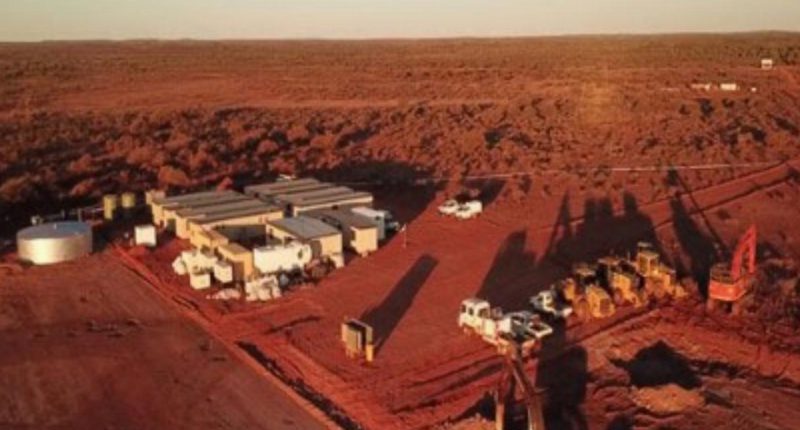

Hastings Technology Metals (HAS) is set to acquire Cadence Minerals’ 30 per cent interest in the Yangibana joint venture tenements in Western Australia’s Gascoyne region.

The company will acquire the 30 per cent stake for $9 million worth of shares at a price to be determined based on a 30-day volume-weighted average price.

Following this, Hastings will now have a 100 per cent interest in the entire Yangibana rare earths tenement package.

It will also fully control the existing mineral resource estimate of 27.42 million tonnes at 0.97 per cent total rare earth oxides (TREO) for 266,000 tonnes of rare earth oxides (REOs). This includes 2.34 million tonnes of mineral resources and 730,000 tonnes of ore reserves that were attributable to Cadence.

Hastings said the addition of ore reserves will increase the Yangibana project’s mine life by about one year to a total of 16 years.

Furthermore, the company believes there’s “substantial opportunity” to extend and increase the mineral resources of multiple areas within the project.

Executive Chairman Charles Lew said he was please to acquire the remaining working interest in the Yangibana project.

“The acquisition provides Hastings an immediate increase in ore reserves and life of mine by up to one year,” Mr Lew said.

“Furthermore, it allows Hastings to perform mine project planning without the need to consider complex tenement boundary arrangements, consultation and potential issues with ore blending a JV material into the beneficiation plant.”

HAS shares were down 4.76 per cent to trade at 20 cents on market close.