- Hazer Group’s (HZR) commercial demonstration project (CDP) at the Water Corporation’s Woodman Point Water Recovery Facility in WA experiences significant cost pressures

- According to the company, the COVID-19 pandemic caused disruptions to global supply chains for equipment and increased freight costs

- Hazer now expects the final project cost to sit between $20 and $22 million — an increase of 17 per cent over previously advised costs

- The company remains fully funded to complete the CDP, which is targeted for Q4 2021

- Company shares last traded at $1.05 on June 15

Hazer Group (HZR) has announced its commercial demonstration project (CDP) has experienced significant cost pressures, following an update on the facility.

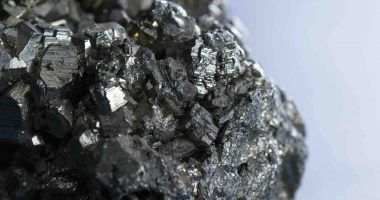

Hazer’s CDP is being constructed at the Water Corporation’s Woodman Point Water Recovery Facility in WA, enabling natural gas and similar methane feedstocks to be converted into hydrogen and high-quality graphite, using iron ore as a process catalyst.

During the last quarter, the company completed civil site preparation, awarded contracts for the reactor and high-temperature heat-exchanger materials, and took delivery of the iron-oxide catalyst.

The company says significant effort was dedicated to ensuring the materials selection and fabrication specifications of the reactor and high-temperature equipment met safety criteria for this first-of-its-kind design.

However, the company says the CDP has been hit with significant cost pressures.

The COVID-19 pandemic caused disruptions to global supply chains for equipment and increased freight costs. The number of suppliers needed to meet the technical requirements of the project were also restricted.

In addition to these external factors, the anticipated engineering requirements to optimise the design costs rose, and along with it materials specification and fabrication methods for the Hazer reactor were incurred, with knock-on effects to the design of associated equipment and piping.

On top of this, the company said costs in Western Australia rapidly increased for labour, equipment, and services due to the strong resource industry, upping the project’s budget.

Hazer says it now expects the final project cost to sit between $20 and $22 million — an increase of 17 per cent over previously advised costs, and 29 per cent over the original June 2020 project budget.

“I am very pleased with the depth and quality of the work the team has done over the last months and the efforts of the team to contain costs in a challenging environment of rapidly increasing prices,” said Hazer Group CEO Geoff Ward.

The company remains fully funded to complete the CDP, which is targeted for Q4 2021.

Company shares last traded at $1.05 on June 15.