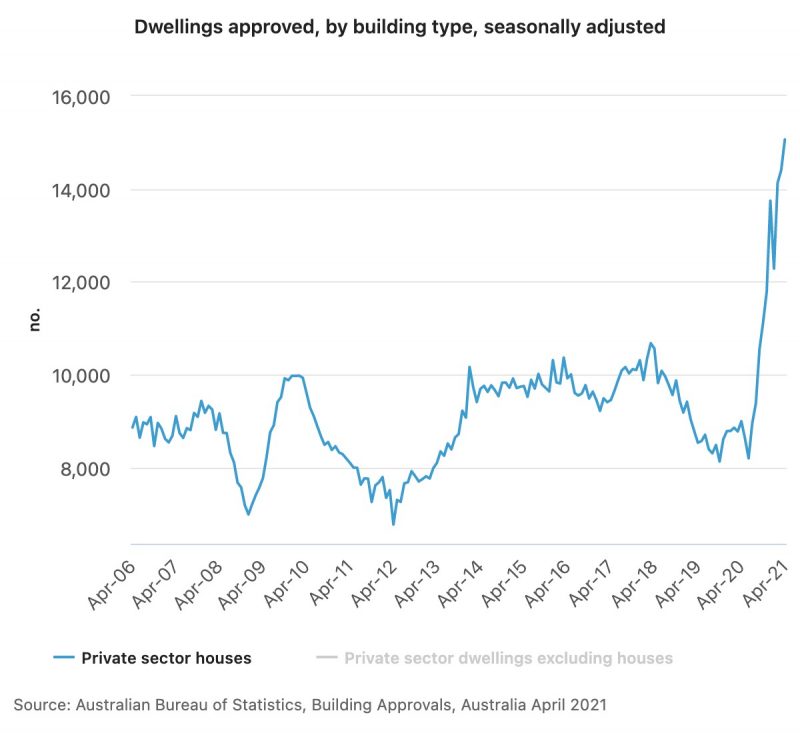

- Despite a fall in overall dwelling approvals, private sector house approvals reached a new record high in April, according to Australian Bureau of Statistics (ABS) data

- The rise means private dwelling approvals are 63.7 per cent higher than the same time last year

- The number of dwellings approved fell 8.6 per cent in April (seasonally adjusted), following an 18.9 per cent rise in March, with the fall driven by private sector dwellings excluding houses, which dropped 28.6 per cent

- Although the HomeBuilder grant ended on April 14, it did not have an impact on the April data, as the building approval process typically occurs after the submission of the HomeBuilder application

- Although new home sales fell in April, HIA economist Angela Lillicrap said the results suggest that a significant number of new homes are still entering the construction pipeline for customers post HomeBuilder

Despite a fall in overall dwelling approvals, private sector house approvals reached a new record high in April, according to Australian Bureau of Statistics (ABS) data.

“While there was a fall in overall approvals, the April result highlights the continued strong demand for detached housing, with private sector house approvals reaching a new record high in April, up 4.6 per cent,” ABS director of construction statistics Daniel Rossi said.

The rise means private dwelling approvals are 63.7 per cent higher than the same time last year.

Although the HomeBuilder grant ended on April 14, it did not have an impact on the April data, as the building approval process typically occurs after the submission of the HomeBuilder application.

The number of dwellings approved fell 8.6 per cent in April (seasonally adjusted), following an 18.9 per cent rise in March, with the fall driven by private sector dwellings excluding houses, which dropped 28.6 per cent.

“There is an unprecedented volume of building starts set to occur in 2021,” HIA economist Angela Lillicrap explained.

“HomeBuilder and low interest rates have facilitated in a surge in demand for detached homes that will see a record number of detached homes built this year and into 2022.”

Although new home sales fell in April, Lillicrap said the results suggest that a significant number of new homes are still entering the construction pipeline for customers post HomeBuilder.

“Low interest rates, strong house price growth and an increased preference for detached homes and regional areas will continue to drive demand for new houses over the months to come,” she said.

Total dwelling approvals rose in New South Wales (12.3 per cent), Western Australia (5.5 per cent) and South Australia (3.4 per cent), in seasonally adjusted terms. Total dwelling approvals fell in Victoria (-23.5 per cent), Queensland (-14.3 per cent) and Tasmania (-2.5 per cent).

“Since the introduction of HomeBuilder in June 2020, private house approvals have risen 84 per cent, with South Australia hitting a new record high in April, and New South Wales reaching the highest level since December 1988,” Rossi said.

The ABS data showed that the value of total residential building fell 7.1 per cent, comprising a 7.6 per cent fall in new residential building and a 3.8 per cent fall in residential alterations and additions.

The new results come as data released last month showed work done on detached houses and renovations surged in the March quarter.