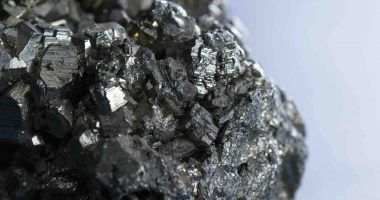

- Horizon Minerals (HRZ) has agreed to sell its Nanadie Well copper project to Cyprium Metals (CYM) for $1.5 million

- The sale price comprises an initial $250,000 cash payment, with the rest to be paid via the issuance of Cyprium shares upon the completion of certain milestones

- The company says it will focus primarily on establishing a stand-alone gold project in the Kalgoorlie and Coolgardie regions of Western Australia

- Completion of the sale is expected in the next four weeks, subject to Ministerial consent and the provision of mining information

- Horizon Minerals is up 3.85 per cent on the market today, trading for 13.5 cents per share

Horizon Minerals (HRZ) has agreed to sell its Nanadie Well copper project to Cyprium Metals (CYM) for $1.5 million.

Under the deal, the sale price comprises an initial $250,000 cash payment, which will be paid on closing, along with $400,000 in Cyprium shares.

A further $350,000 worth of Cyprium shares will be issued 12 months from the date of closing, with $300,000 worth of shares after 24 months, and $200,000 worth of shares upon a decision to mine.

Completion of the sale is expected to occur in the next four weeks, subject to a number of conditions, including ministerial consent, the provision of mining information and any third-party assignments.

Jon Price, Managing Director of Horizon Minerals, said the divestment of the Nanadie Well copper project will allow the company to focus more on its gold assets.

“Horizon’s core focus remains firmly set on developing a stand-alone gold project in the Kalgoorlie and Coolgardie regions and this divestment supports this objective while retaining exposure to both Nanadie Well and Cyprium’s current copper projects in the Murchison as a substantial shareholder,” Jon said.

“Cyprium have an excellent technical team which is actively exploring in the region and we look forward to further success at Nanadie Well as we continue growing our gold business,” he added.

In mid-November 2019, Horizon re-took 100 per cent ownership of the Nanadie Well project when its joint venture partner, Minex — a wholly-owned subsidiary of Mithril Resources — withdrew from a joint venture agreement.

Located 100 kilometres southeast of Meekatharra, the Nanadie Well project covers 45 square kilometres, consisting of exploration license E51/1040 and mining license M51/887.

Horizon Minerals is up 3.85 per cent on the market today, trading for 13.5 cents per share at 10:36 am AEST.