- Hyperion Metals (HYM) has struck up a partnership with Colorado-based Energy Fuels over monazite sands from Hyperion’s Titan project in Tennessee

- Mozanite is a group of minerals that contain rare earth elements (REE) like uranium, thorium, cerium and more

- A memorandum of understanding (MOU) signed this week will see the companies evaluate the potential supply of monazite sands to Energy Fuels

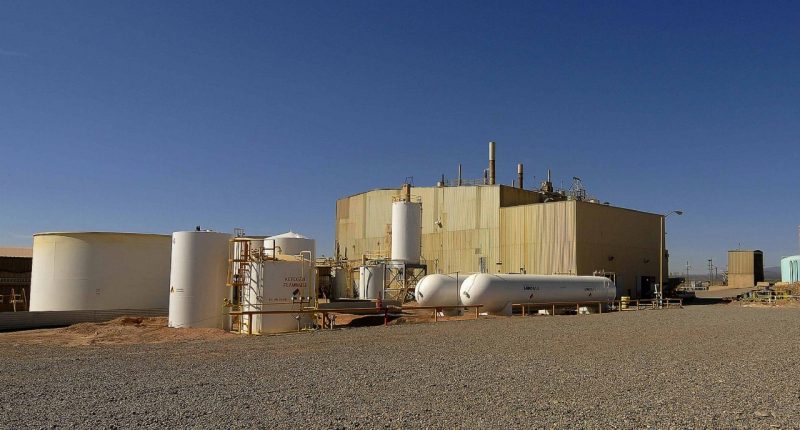

- The product will then be processed by Energy Fuels into a clean, mixed REE carbonate at the White Mesa Mill

- This is part of Energy Fuels’ plans to create a new U.S. rare earth supply chain

- Further to this potential supply deal, Hyperion and Energy Fuels have also agreed to explore a collaboration deal over the rare earth supply chain

- Hyperion is busy completing a major drilling program and bulk sampling program at the Titan Project to form a mineral resource estimate for the project

- Shares in Hyperion Metals are trading 13.4 per cent in the green at 93 cents per share

Hyperion Metals (HYM) has struck up a partnership with Colorado-based Energy Fuels over monazite sands from Hyperion’s Titan project in Tennessee.

A memorandum of understanding (MOU) signed this week will see the companies evaluate the potential supply of monazite sands from the Titan project to Energy Fuels’ White Mesa Mill in Utah. The plan is for the monazite sands to be used in the production of rare earth products.

Further to this, Hyperion and Energy Fuels have agreed to explore a potential collaboration deal — such as a teaming, joint venture, equity investment or other arrangement — to advance Energy Fuels’ initiative to build a “mine to market” rare earths supply chain in the U.S.

Why monazite?

Monazite is a red-brown phosphate mineral that contains rare earth elements (REE).

Due to its chemical composition, monazite is considered a group of minerals — meaning it has no direct use itself but is an important source of uranium, thorium, cerium and other rare earth elements. The mineral is often produced as a by-product of mining heavy mineral deposits.

In Hyperion’s case, the company’s Titan Project covers a large area of titanium and zircon prospective heavy mineral sands properties in Tennessee.

Hyperion also plans to produce monazite from the project as a component of its heavy mineral sand concentrate product. Under this week’s MOU, the monazite product could be sent off to Energy Fuels to be processed into a clean, mixed REE carbonate at the White Mesa Mill.

Energy Fuels’ President and CEO Mark Chalmers said the company, along with its partners, are busy creating a new U.S. rare earth supply chain.

“For this initiative to achieve its full potential, we are actively seeking new, ethically-produced sources of Monazite, with sources from the U.S. being our first priority,” Mark said.

This is where Hyperion and its Titan Project come in.

“Through their association with Piedmont Lithium’s project in South Carolina, members of the Hyperion team have demonstrated to us that they have the know-how and resources to bring U.S. critical mineral projects into production,” Mark said.

“We look forward to working with the Hyperion team and potentially seeing our relationship grow through their participation in a fully integrated, low-cost U.S. rare earth supply chain in the future,” he added.

Hyperion Managing Director Anastasios Arima said the company’s collaboration with Energy fuels highlights the importance of the Titan Project as a U.S. leader in critical minerals.

“We are excited to progress the potential supply to Energy Fuels of American Monazite for its rare earths supply chain right here in the U.S.A, bringing back sustainable American industry and skilled jobs for generations,” he said.

“The import dependence of the U.S. for key critical minerals, including rare earths and titanium, presents a huge threat to the security of key domestic industries, including defence, space, aerospace, renewables and electric vehicles,” he added.

Titan work

Hyperion is busy completing a three-phase drilling and bulk sampling test program at the Titan project, with results to date having confirmed the high grade and significant thickness of mineralisation in the project area.

One of the best assays from drilling at the project is a 47.2-metre hit at 3.69 per cent total heavy mineral (THM), which itself included a 10.7-metre zone of 8.09 per cent THM and another 10.7-metre zone at 5.47 per cent THM.

Other notable assays include a 36.6-metre intersection at 3.37 per cent THM and a 35.1-metre hit at 3.04 per cent THM.

The 70-hole drilling program and the bulk sampling program will form the basis for Hyperion’s initial mineral resource estimate for the project, which is expected to be delivered before the end of June 2021.

Shares in Hyperion Metals are trading 13.4 per cent in the green at 93 cents per share at 11:04 am AEST.