- ImpediMed (IPD) has reported increased revenue for the December 2019 quarter

- Total revenue is up 63 per cent, while revenue for its SOZO device is skyrocketed 216 per cent

- SOZO helps clinicians provide individualised care to patients experiencing arm and leg swelling

- More than 480 units have been sold since the SOZO launch, with a 100 per cent renewal rate on expiring contracts

- Despite increases across the board, ImpediMed’s share price is down 20.6 per cent with shares currently trading for 13.5 cents apiece

Medical software technology company ImpediMed (IPD) has reported increased revenue for the December 2019 quarter.

Total revenue for the second quarter of FY20 is up 63 per cent from the previous corresponding period, with sales jumping from $900,000 to $1.5 million. The company is also up 7 per cent in the quarter over quarter stats.

SOZO software

Sales for SOZO, the world’s most advanced, noninvasive bioimpedance spectroscopy (BIS) device were also exceptional.

The technology assess patients with secondary lymphoedema (swelling in the arms or legs caused by a lymphatic blockage) to deliver a precise understanding of fluid status and tissue composition in less than 30 seconds.

A single SOZO reading allows clinicians across multiple specialities to provide individualised, proactive care that can help improve patient outcomes.

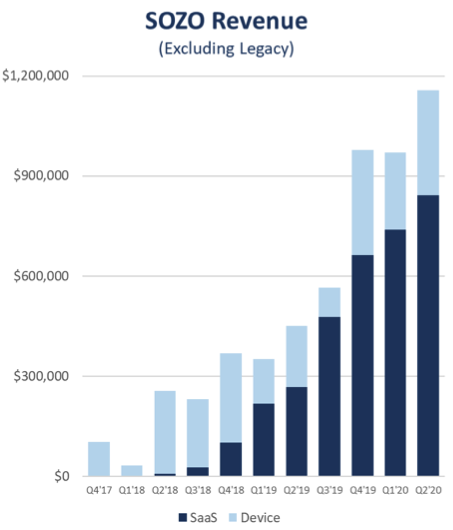

SOZO revenue for Q2 of the 2020 financial year sits at $800,000, representing a 216 per cent increase from last year’s sales of $300,000. The increase was also represented in the quarter over quarter figures, which experienced a rise of 14 per cent.

Since launch day, more than 480 SOZO units have been sold. ImpediMed has also experienced a 100 per cent renewal rate on existing contracts.

There was also 37 new contracted SOZO devices, 16 of which came from the expansion of existing accounts.

Annual recurring revenue is up 70 per cent from the previous period, skyrocketing from $2.5 million to $4.2 million.

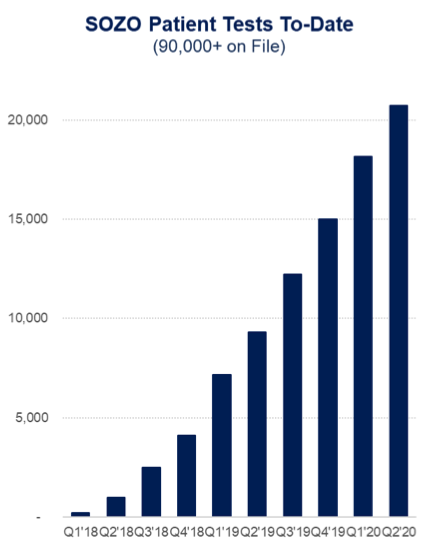

ImpediMed also conducted more than 20,000 patient tests last quarter, a 15 per cent increase on the quarter over quarter stats.

This bought the total patient tests on file to over 90,000, which demonstrates the growing awareness of the importance of lymphoedema prevention and adoption of SOZO.

ImpediMed is on track to achieve its FY20 low to midrange guidance of $7 – $8.5 million.

The high range was based on the timing of a number of expected growth accelerators and incorporation into the NCCN (National Comprehensive Cancer Network) Guidelines.

Lymphoedema Prevention Program

ImpediMed also launched its Lymphoedema Prevention Program, which caused some disruption to the Q2 FY20 results.

This program is aimed at ending cancer-related lymphoedema and uses ImpediMed’s Test, Trigger, Treat protocol for early detection and intervention of cancer-related lymphoedema.

Although it’s early into the launch, ImpediMed is already seeing promising signs of success.

Device sales are up dramatically and the trends for patient testing are moving higher and at a faster pace than originally expected.

ImpediMed is also currently using results from the recent heart failure trial to finalise the development of the SOZO Heart Failure application.

Stage 1 of the commercialisation launch is expected to begin later this year.

“The achievements in Q2, with the launch of the Lymphoedema Prevention Program and release of the initial Heart Failure data, will be pivotal to the future of ImpediMed,” Managing Director and CEO Richard Carreon commented.

“Although the Q2 unit volumes were slightly less than anticipated, they were higher value sales, as illustrated in the SOZO Revenue graph, and are reflective of the larger, higher volume institutions we are successfully targeting with the Lymphoedema Prevention Program,” he added.

Despite increases across the board, ImpediMed’s share price is currently down 20.6 per cent with shares trading for 13.5 cents at 12:57 pm AEDT.