The ‘Active versus Passive’ debate continues to rage on unabated, regardless of the ravages caused by the Covid 19 pandemic.

At Evergreen, we use both approaches, depending on client requirements and objectives. However, we consider both the asset class and the market environment when making allocation decisions of this nature. We think we’re currently in a situation where the use of active management seems to be particularly attractive and do support its use more than we might otherwise.

Let’s turn first to the asset classes where we tend to prefer active exposure, regardless of market dynamics. We often steer away from passive index funds in fixed income and credit. There is a perverse relationship that occurs in these sectors, namely, those governments or companies that issue more debt are more highly represented in the index. In our view, this may not make for an ideal investment allocation.

In considering the current market environment, in our view, the aftermath of the pandemic has left asset markets full of idiosyncratic opportunities. During crises, or market dislocations, markets tend to ‘throw the baby out with the bathwater’, meaning all securities, good or bad, are sold down significantly. Sometimes we see better quality assets sell off more than those of lesser quality. This is an ideal environment for active management. Skilled managers should be able to pick their way through the debris, find the babies, throw out the bathwater and generate good returns in excess of the index in subsequent periods.

A great current example of this is in credit, including distressed credit opportunities. Distressed credit sounds scary and it can be. There is no doubt that default rates are rising and will rise across the spectrum of credit. This will mean that there will be securities that will be worth zero, or something close to this, that are currently being bought by investors, including index funds. Experienced managers are often better equipped to actively seek out those securities in the asset class that offer true value, and selectively purchase those. After the GFC, many active managers in this asset class did just that and were able to produce extraordinary returns. So much so that a number of new distressed debt funds are currently being launched in order to take advantage of the current opportunity set.

Another example currently playing itself out in Australian equities is the alpha that can be generated by participating in value-creating capital raises. Since the first sharp drawdown in markets in February and March, many companies have issued capital at prices that represent extraordinarily good value. Unfortunately, many of those issues have only been made available to institutional investors, or your local friendly fund manager. Given the bounce we’ve had in markets, many of those offers already represent remarkable gains. Index funds are precluded from participating, providing active managers with a unique potential to outperform in this environment.

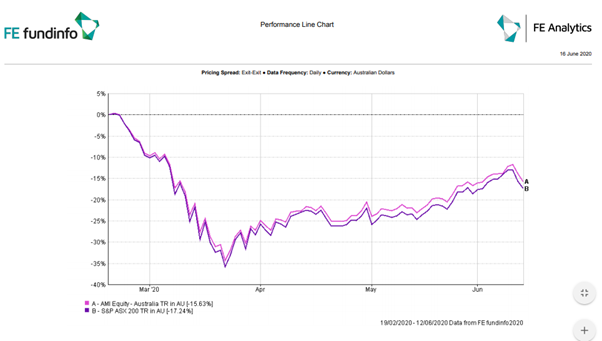

The numbers seem to reinforce our argument. Since February 19, the high point in markets, the average Australian equity fund outperformed the index by more than 1.6%, after fees. This is shown in the graph provided below. The average fund fell less in the fall and has risen more since. Part of this outperformance, in our view, is due to managers’ ability to downweight those obvious problem areas (retail, airlines, travel) quickly, to hold tactical cash allocations and their ability to selectively participate in those capital raisings that were attractive.

In summary, Evergreen believes there is a place for index funds. Their cost and simplicity make them a compelling choice for many investors. However, in times of crisis, when the ability to choose securities is most important, we believe that active funds can provide a much more effective exposure to asset markets.