- The Consumer Price Index (CPI) climbed 1.3 per cent in the December 2021 quarter and 3.5 per cent year-on-year, placing further pressure on the Reserve Bank of Australia to lift interest rates

- Annual trimmed mean inflation, the Reserve Bank of Australia’s preferred measure of inflation, rose to 2.6 per cent in the third quarter, up from 2.1 per cent in the previous quarter

- Michelle Marquardt, ABS Head of Prices Statistics, said the most substantial price increases in the December quarter were for new residences and fuel

- The new data means that the CBA has put off its call for RBA to commence normalising the cash rate from November 2022 to August 2022

The Consumer Price Index (CPI) climbed 1.3 per cent in the December 2021 quarter and 3.5 per cent year-on-year, placing further pressure on the Reserve Bank of Australia to lift interest rates.

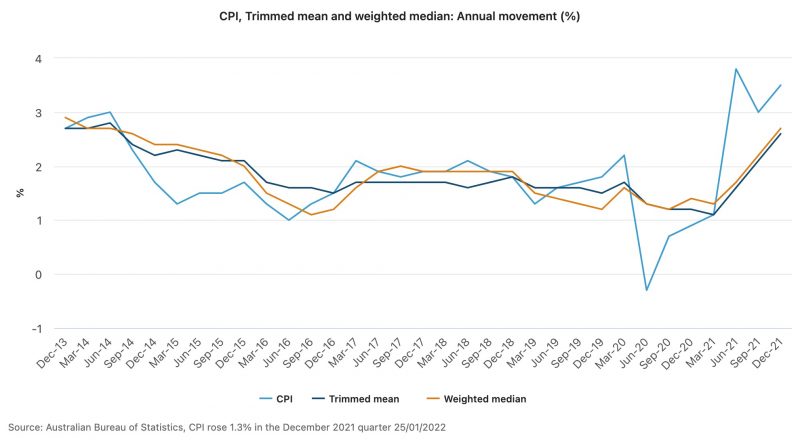

The Australian Bureau of Statistics (ABS) data shows that the impact of irregular or transient price increases in the CPI is mitigated by underlying inflation indicators.

Annual trimmed mean inflation, the Reserve Bank of Australia’s preferred measure of inflation, rose to 2.6 per cent in the third quarter, up from 2.1 per cent in the previous quarter.

The trimmed mean is much higher than the RBA’s projection (0.6 per cent/quarter) and significantly higher than the consensus forecast (0.7 per cent/quarter).

RBA governor Philip Lowe has previously indicated that inflation must exceed two per cent in order for the bank to be convinced of continued price pressures that might lead to interest rate rises. The interest rate is now at an all-time low of 0.1 per cent.

Michelle Marquardt, ABS Head of Prices Statistics, said the most substantial price increases in the December quarter were for new residences (4.2 per cent) and fuel (6.6 per cent).

Domestic holiday travel and lodging (4.8 per cent) also contributed to the December quarter CPI increase, suggesting higher demand as a result of the lifting of domestic border restrictions in late October and the run-up to the Christmas holiday season.

The CPI grew 3.5 per cent year-over-year, with motor fuel (32.3 per cent) accounting for the majority of the increase. Prices for commodities increased by 4.3 per cent year on year, while prices for services increased by 2.3 per cent.

Commonwealth Bank analysts now expect the bank to drop their forward guidance on the cash rate.

“A further, but only gradual, pick-up in underlying inflation was expected. The central forecast was for underlying inflation to reach 2.5 per cent over 2023,” the RBA said in its most recent communication.

The new data means that the CBA has put off its call for RBA to commence normalising the cash rate from November 2022 to August 2022.

The analysts noted that the RBA will likely want to see two strong quarters of growth on the wage price index before lifting the cash rate.