- Deloitte’s Stephen Smith says as businesses adapt to the new COVID normal, their attention is turning from external risks to internal ones

- According to Deloitte, corporate investment would expand in 2021-22 before accelerating in 2022-23, contributing about 1.5 percentage points to GDP throughout this time

- The value of publicly-funded infrastructure projects under construction has risen from a low of $131 billion in early 2015 to $202 billion in late 2021, Deloitte says

- This compares to only $66 billion worth of non-infrastructure investment projects currently under construction

The Delta outbreak has slowed but not stalled the investment rebound, with Australian firms adjusting to a new pandemic normal.

Operating in a pandemic-affected world in 2020, as well as knowing that Australia can recover from COVID repercussions, has translated into significantly less pessimism in the face of these current pandemic problems.

Releasing the latest edition of Deloitte Access Economics’ quarterly Investment Monitor, Deloitte Access Economics partner and lead author of the report, Stephen Smith, said as businesses adapt to the new COVID normal, their attention is turning from external risks to internal ones.

“This involves attracting and maintaining important personnel, carrying out goals, and introducing new technology,” he said.

“The COVID period has also dramatically changed where, when, and how people work. This is likely to shape the types of investments required over the coming decades. The proportion of people working from home is expected to remain permanently above pre-COVID levels, with flow-on effects for investment in transport networks and our CBDs.”

According to Deloitte Access Economics, corporate investment would expand in 2021-22 before accelerating in 2022-23, contributing about 1.5 percentage points to GDP throughout this time.

Public investment is expected to expand at double-digit rates in 2021-22 before declining in 2022-23 as the quantity of infrastructure development in the pipeline hits a peak.

Mr Smith said with restrictions now easing, the pace of business recovery depends on certainty provided by governments.

Ongoing state border restrictions, quarantine requirements for travellers and the threat of snap-lockdowns present a challenging backdrop for new investment.

“At the same time as business investment is recovering, the focus of government spending is shifting from consumers to construction,” Mr Smith said.

“That shift got off to a slow start, but government investment has now reached a record high as a share of the economy.”

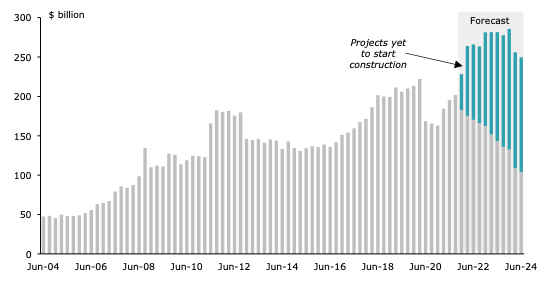

The value of publicly-funded infrastructure projects under construction has risen from a low of $131 billion in early 2015 to $202 billion in late 2021, representing a more than 50 per cent increase, according to Mr Smith.

This compares to only $66 billion worth of non-infrastructure investment projects currently under construction.

Value of infrastructure investment projects under construction

“This disparity is forecast to widen, with the value of infrastructure projects underway set to rise from approximately $200 billion in 2021 to $285 billion in 2023,” Mr Smith continued.

“This will see the value of infrastructure investment surpass the peak in activity seen during the mining construction boom.”

Mr Smith said the Delta outbreak has put pressure on the construction industry, which is suffering from a labour shortage exacerbated by closed borders.

According to Mr Smith, the high degree of global infrastructure investment implies that when international borders are reopened, Australian contractors may not receive quick relief.

“To make matters worse, there have also been construction materials shortages, with prices increasing for key inputs such as timber, rebar and steel,” he said.

“While some prices have abated more recently, others remain high, and there may be further increases with supply chain issues set to extend into 2022.”