- Investors lead the way as new housing loan commitments reach a record high of $32.6 billion in May 2021

- According to statistics released today by the Australian Bureau of Statistics (ABS) the value of investor loan commitments rose 116 per cent in the year to May 2021, after falling to a 20 year low in May 2020

- In May 2021, the increase in investor loan commitments was focused in New South Wales and Victoria, which increased by 12.1 per cent and 17.4 per cent, respectively

- HIA economist Angela Lilicrap said despite loan commitments for new dwellings falling for the third consecutive month, they are still at elevated levels compared to pre-COVID levels

- While the number of loans committed to first-time home buyers by owner-occupiers decreased by 0.8 per cent to 15,050, it remained at historically high levels

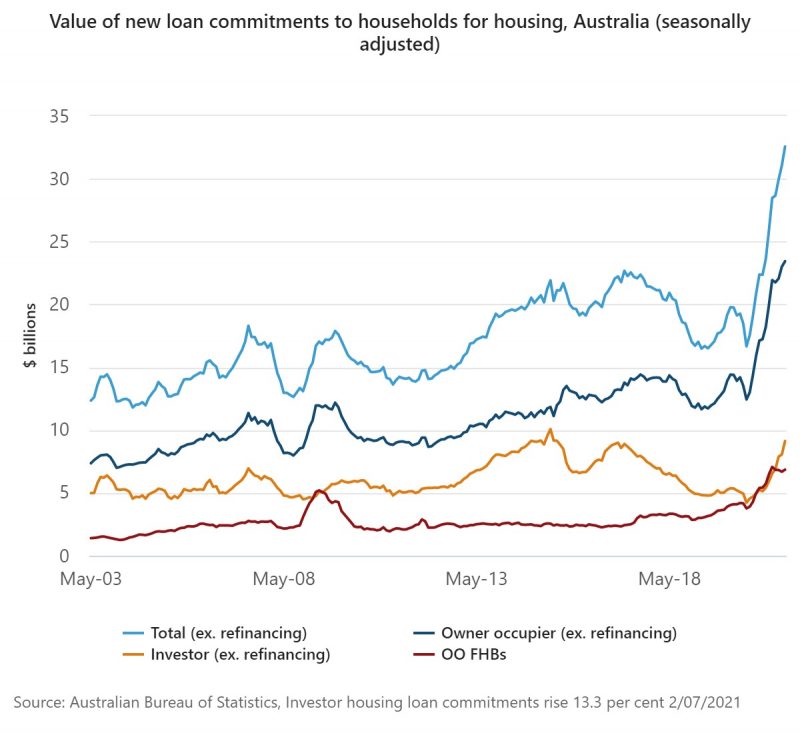

New housing loan commitments climbed 4.9 per cent to a record high of $32.6 billion in May 2021 (seasonally adjusted), once again led by strong investor home loan commitments.

According to statistics released today by the Australian Bureau of Statistics (ABS) the value of investor loan commitments has posted an impressive recovery, rising 116 per cent in the year to May 2021, after falling to a 20 year low in May 2020.

“The value of new loan commitments for investor housing rose 13.3 per cent to $9.1 billion in May 2021, which was the highest level since April 2015,” ABS head of Finance and Wealth Katherine Keenan said.

“Investor loans equated to 28 per cent of the total value of housing loan commitments in May 2021, compared to 46 per cent in 2015. This reflects the very strong growth in owner occupier loan commitments over the last year.”

In May 2021, the increase in investor loan commitments was focused in New South Wales and Victoria, which increased by 12.1 per cent and 17.4 per cent, respectively.

Owner-occupiers are also enjoying the market, with new loan commitments for owner-occupiers rising 1.9 per cent to $23.4 billion, the highest level since the series began.

However, the value of loan commitments for residential land and the building of new homes fell for the third month in a row.

HIA economist Angela Lilicrap said despite the dip, loan commitments for new dwellings are still elevated compared to pre-COVID levels.

Confidence in the housing market alongside low interest rates and price growth has seen loans for established dwellings grow, according to Ms Lilicrap.

“This has seen the number of loans for established homes increase by 10.3 per cent in the three months to May, reaching the third highest level since the series began in 2002,” she said.

“The strength of the broader housing market is also drawing investors back to the market after being largely absent in 2020.”

While the number of loans committed to first-time home buyers by owner-occupiers decreased by 0.8 per cent to 15,050, it remained at historically high levels.

“First home buyer activity remained at high levels in New South Wales and Victoria. However, the number of first home buyers has fallen over the last few months in Queensland, Western Australia and South Australia, following the cessation of HomeBuilder and state government initiatives, such as the Building Bonus Grant in Western Australia,” Ms Keenan said.