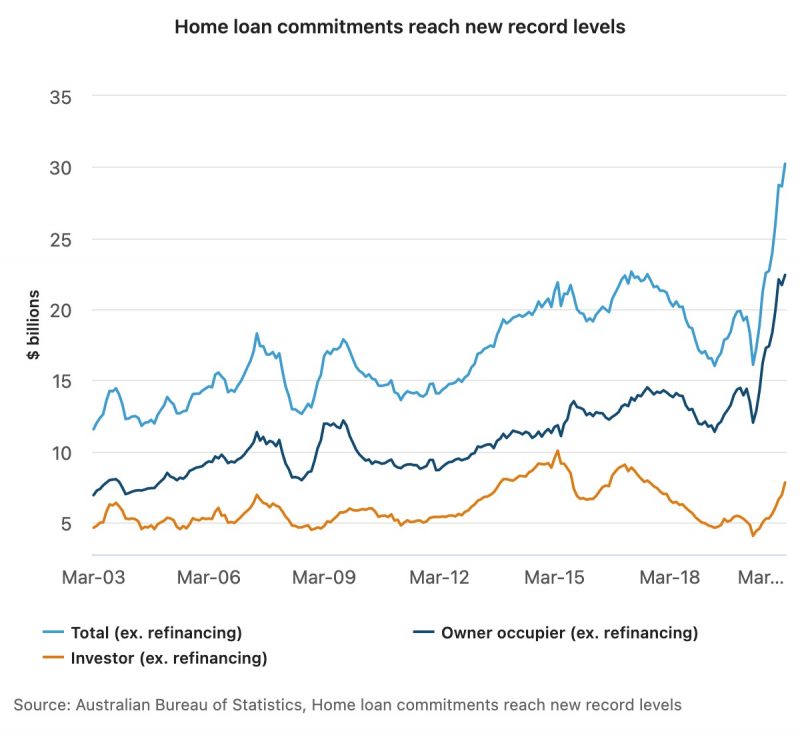

- Rising investor interest has helped push new loan commitments to record highs, according to new Australian Bureau of Statistics (ABS) figures

- New seasonally adjusted loan commitments for housing rose 5.5 per cent in March 2021 to a new record high of $30.2 billion, and lending to investors accounted for more than half of the March rise

- The value of new loan commitments for investor housing rose 12.7 per cent to $7.8 billion in March 2021 (seasonally adjusted) 54.3 per cent higher than in March 2020

- The value of owner-occupier loan commitments for the construction of new dwellings fell 14.5 per cent, the first fall since the HomeBuilder grant was introduced in June 2020

- The number of owner-occupier first home buyer loan commitments decreased 3.1 per cent in seasonally adjusted terms to $6.82 billion, below that of investors

Rising investor interest has helped push new home loan commitments to record highs, according to new Australian Bureau of Statistics (ABS) figures.

New seasonally adjusted loan commitments for housing rose 5.5 per cent in March 2021 to a new record high of $30.2 billion, lending to investors accounted for more than half of the March rise.

The value of new loan commitments for investor housing rose 12.7 per cent to $7.8 billion in March 2021 (seasonally adjusted), 54.3 per cent higher than in March 2020.

“Investor lending has seen a sustained period of growth since the 20 year low seen in May 2020,” ABS head of Finance and Wealth Katherine Keenan said. “The rise in March is the largest recorded since July 2003 and was driven by increased loan commitments to investors for existing dwellings.

“The value of new loan commitments for owner occupier housing rose 3.3 per cent to $22.4 billion in March 2021, 55.6 per cent higher than March 2020. This rise was driven by an 8.8 per cent rise in the value of loan commitments for existing dwellings,” she added.

The value of owner-occupier loan commitments for the construction of new dwellings fell 14.5 per cent, the first fall since the HomeBuilder grant was introduced in June 2020.

The number of owner-occupier first home buyer loan commitments decreased 3.1 per cent in seasonally adjusted terms to $6.82 billion, below that of investors.

The number of first home buyer loan commitments for investment purposes accounted for 5.1 per cent of all first home buyer commitments.