- John Hancock is throwing his weight behind Magnis Energy Technologies (MNS), helping the company raise $20 million in funds

- Mr Hancock has announced the firm he advises, The Lind Partners, has joined SBC Global Investment Fund to support the convertible note facility

- MNS plans to use the funds to grow its stake in the lithium-ion battery sector, with $17.6 million to go towards its iM3NY Battery Plant in New York

- The company came out of a trading halt to announce today’s news, with shares trading up 11.1 per cent at 30 cents each at 11:51 am AEST

John Hancock is throwing his weight behind Magnis Energy Technologies (MNS), helping the company raise $20 million in funds.

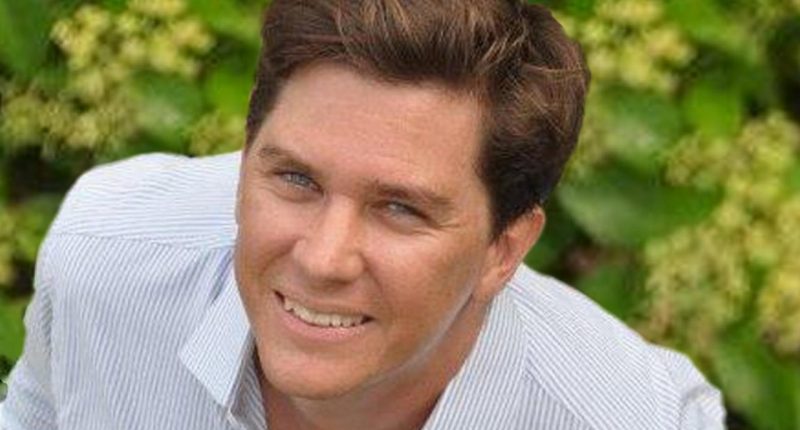

The son of mining magnate Gina Rinehart has announced the investment firm he advises, The Lind Partners, will spend $10 million on a convertible note facility.

Fellow US-based institution SBC Global Investment Fund has also announced $10 million in funding via the facility.

All the extra funds will go towards helping Magnis grow its stake in the emerging lithium-ion battery sector.

This includes $17.6 million being spent on potentially expanding Magnis’ iM3NY Battery Plant in New York.

Commenting on the investment, Mr Hancock said there was a lot of potential within the sector and he was pleased to be backing MNS.

“We are very pleased to fund Magnis Energy Technologies, an innovative Australian company focusing on producing green high performing lithium-ion batteries and developing technologies for rapid charging,” Mr Hancock said.

“The global lithium-ion battery market is expected to grow at a compound annual growth rate of 15 per cent from 2020 to 2026, and US$41.1 billion in 2021 to US$116.6 billion by 2030.

“Companies that can deliver better-performing batteries at scale will be rewarded with market share, and we look forward to being part of Magnis’ journey in this space.”

MNS has come out of a trading halt to announce today’s news, with shares now trading up 11.1 per cent at 30 cents each at 11:51 am AEST.