- King Island Scheelite (KIS) has received binding commitments to raise over $2.5 million via a placement

- All up, roughly 46.7 million new fully-paid ordinary shares will be issued to institutional and sophisticated investors at 5.5 cents each

- Additionally, participants will receive one free attaching listed option for every two new shares issued, however, this is subject to shareholder approval

- King Island Scheelite will use the funds to further advance its Dolphin Tungsten Mine on King Island near Tasmania

- KIS is currently up a healthy 33.3 per cent with shares trading for 8 cents each

King Island Scheelite (KIS) has received binding commitments to raise $2,568,000 via a placement.

The company entered a trading halt on October 21 but did not disclose how much it would be raising at the time.

All up, roughly 46.7 million new fully-paid ordinary shares will be issued to institutional and sophisticated investors at 5.5 cents each.

Additionally, participants will receive one free attaching listed option for every two new shares issued, however, these will only be issued subject to shareholder approval.

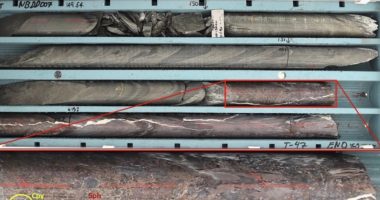

King Island Scheelite will use the funds to further advance its Dolphin Tungsten Mine on King Island near Tasmania.

“The Dolphin Project was first founded in 1911, they commenced mining there in 1917 and the mine operated there periodically until 1990 when, due to very very low tungsten prices, most of the Western World tungsten mines closed,” Executive Chairman Johann Jacobs told the Market Herald Deal Room.

“We’ve been involved with it now since 2012 with an attempt reopen the mine firstly as an open cut mine for 8 years then potentially going underground,” he added.

Johann went on to say that KIS has spent around $20 million on getting the mine back into production but ultimately believes it will be worth it.

“Up to now we’ve probably spent between $15 million to $20 million in term of drilling, dewatering the pit, additional metallurgical testwork and mining consultants,” he told host Sonia Madigan.

“The capital investment to re-establish the mine is about $65 million to $75 million, so that will need to be raised to reach financial close to get to mine re-established,” he said.

“It’s got a net present value at the moment of about $150 million, so it certainly pays back in about two-and-a-half to two-and-three-quarter years so it would be a very very good investment,” he concluded.

Johann Jacobs, Executive Chairman

KIS is currently up a healthy 33.3 per cent with shares trading for 8 cents each at 2:58 pm AEDT.