- Lithium Consolidated (LI3) shares are up 300 per cent today after finding a large gold anomaly at its Warriedar West prospect in WA

- Initial analysis of the 5 by 2 kilometre anomaly, has confirmed the company’s view that the area is prospective for large-scale mineralised systems

- Currently, the company’s fieldwork is suspended due to the COVID-19 outbreak

- But, further sampling is planned at the prospect to establish drill targets and extend the project

- Lithium Consolidated is up 300 per cent on the market this afternoon, trading for 5.2¢ per share

Lithium Consolidated’s (LI3) shares are up 300 per cent today after finding a gold anomaly at its Warriedar West prospect in Western Australia.

Initial analysis of the 5 kilometre by 2 kilometre anomaly has confirmed the company’s view that the area is prospective for large-scale mineralised systems.

Based on the company’s review of the geological model, the gold mineralisation is expected to be an Intrusion Related Gold System (IRGS).

Due to the relatively new classification, IRGS are not widely explored for. Relevant examples of this kind of deposit include the Timbarra deposit in northern New South Wales (0.5 million ounces of gold), Kidston in northern Queensland (5.3 million ounces of gold) and Northern Star Resources’ 10 million ounce Pogo Mine in Alaska.

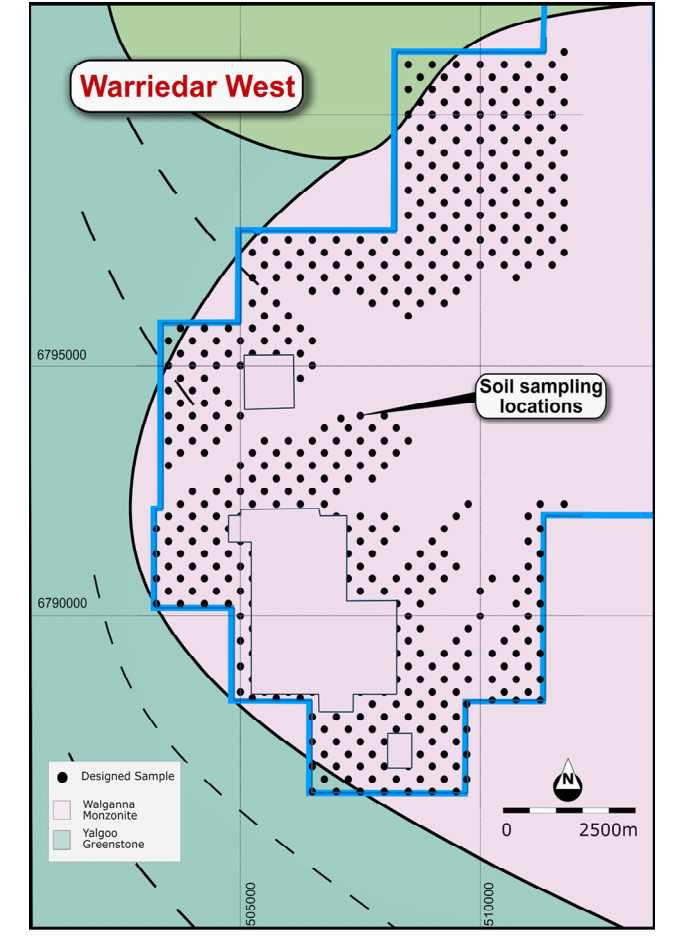

Warriendar West is located at the Warriendar project, within the Murchison region.

In February, the company conducted a mapping and sampling program at the prospect. Some areas required sampling techniques such as Rotary Air Blast (RAB) drilling.

The aim of the recent surface sampling was to obtain a better understanding of the geology of the Warriedar.

Unfortunately, parts of the program were not completed due to the outbreak of COVID-19. On April 6, Lithium Consolidated announced field work had to be suspended.

The company stated that in the mean time it would focus on technical and data work such as legacy data, processing data, drill targets and project studies.

Further sampling is planned at the prospect to establish drill targets and extend the project.

Lithium Consolidated is up 300 per cent on the market this afternoon, trading for 5.2¢ per share at 2:18 pm AEST.