- Software company LiveTiles has seen its subscription revenue grow $2.8 million from last quarter

- Over the year, company revenue hit $42.9 million — a 131 per cent uptake from 2018, and a whopping 860 per cent from 2017

- LiveTiles powers Microsoft’s Office 365 application which is used in workplaces around the globe

- Despite news of the growing revenue, the company’s shares are trading 1.43 per cent lower today at 34.5 cents per share

Workplace specialised software company LiveTiles has seen solid growth in its annual recurring revenue.

The Australian startup company, most known for teaming up with Microsoft to help power Office 365, revealed a $2.8 million increase in revenue from June to September.

“LiveTiles is pleased with its first quarter sales result, progress against our medium term target and early signs in the second quarter,” company Co-Founder and CEO Karl Redenbach said today.

“We are the global market leader in intranet software, targeting a potential total market of $13 billion in its very early stages of adoption,” he said.

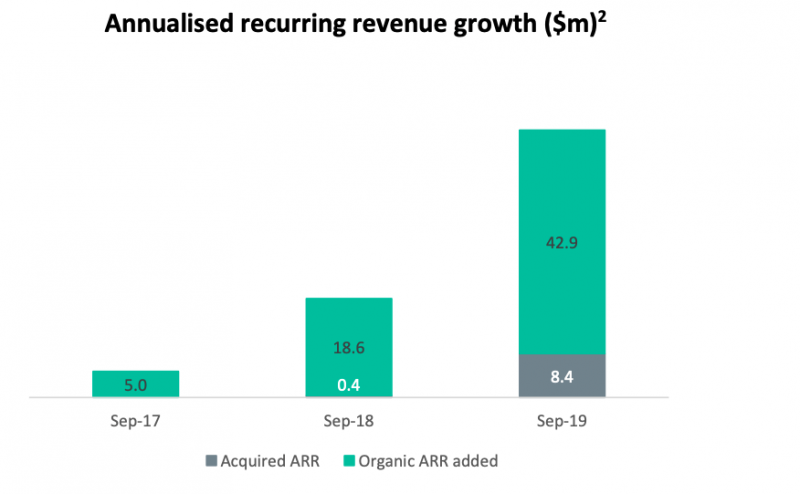

In a media release to Australian punters, the cloud-based tech company reported on $42.9 million in annualised recurring revenue at the end of September.

In the last year, this figure has grown 131 per cent, and a whopping 860 per cent in the last two years.

“With market penetration of 1% to date we see enormous opportunity to drive both intranet software adoption and extend the value of the intranet into areas such as AI [artificial intelligence],” Karl added.

“We are laying the foundations for future growth with our global market presence, with a strong focus on building new revenue streams, our partner channel and long term pipeline,” he said.

Image sourced from the company’s ASX media release today

Particularly, LiveTiles management was pleased with the growth in the Asia-Pacific region. However, the company claims “off-season” markets in Europe and America offset this performance.

Despite the claims of off-season business, the company managed to ink deals with healthcare manufacturers and financial services in Europe, as well as non-profit organisations and film companies in America as of late.

The company said today it expects the same ongoing revenue growth performance into the 2020 financial year.

Most notably for the company, in early-September, it teamed up with Microsoft yet again to co-sell products through the Microsoft Teams application.

Despite the company’s consistent growth and recurring revenue, LiveTiles’ share price has suffered 1.43 per cent today. The company’s shares are trading for 34.5 cents each in a $281.2 million market cap.