- Low-interest rates are not solely responsible for strong property price growth, according to Property Investment Professionals of Australia (PIPA)

- PIPA Chair Peter Koulizos says strong demand from buyers and low levels of supply are driving strong market conditions currently

- According to Mr Koulizos, a cash-rate rise does not guarantee that prices would decline — or even stop rising — in many areas

A new examination of cash rate fluctuations over the past two decades suggests property price growth isn’t dependent on low-interest rates, according to the Property Investment Professionals of Australia (PIPA).

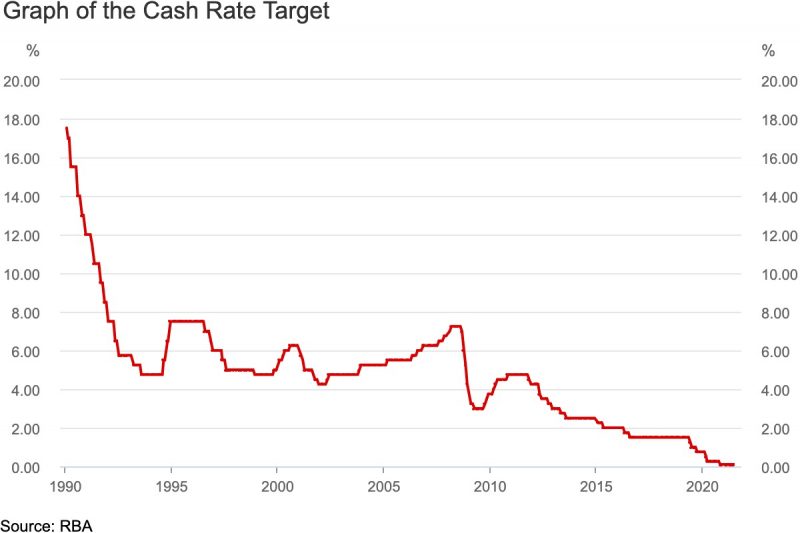

The cash rate is now at a record low, with many assuming that this is the primary cause for the country’s good market conditions, according to PIPA Chair Peter Koulizos.

“While the cost of borrowing has never been cheaper, when the cash rate is exceptionally low it means that the economy needs some extra financial stimulation, which has been the case pretty much since the GFC way back in 2008 and beyond,” Mr Koulizos said.

“The current market conditions are unusual, given markets are rising in lockstep around the country, but this is predominantly due to extremely strong demand from buyers and a low supply of property for sale, rather than the fact that the cash rate is really only marginally lower than it was before the pandemic hit.”

In February 2020, the Reserve Bank of Australia’s cash rate was 0.75 per cent, before eventually being lowered to 0.1 per cent in November 2020, where it has remained.

Mr Koulizos said that while the cash rate will begin to rise as the economy improves, this does not guarantee that prices would decline — or even stop rising — in many areas.

“Homebuyers and investors need to understand that market conditions are determined by a number of factors, with interest rates being just one,” he said.

“Demand versus supply is an important determinant, as is the strength or weakness of a local economy, plus internal, interstate, and international migration patterns.

“However, supportive lending conditions are also vital because if good borrowers can’t access finance to purchase properties – like what occurred from 2017 to relatively recently – then there is less competition for dwellings, and prices remain subdued.”

Mr Koulizos’ examination of the Australian Bureau of Statistics’ Established House Price Indexes during three periods where interest rates were stable over the past two decades revealed that low-interest rates don’t always imply large increases in property values.

According to ABS statistics, from September 2016 to September 2019, while the cash rate was just 1.5 per cent, the weighted average of eight capital cities’ established home price index increased by only 1.24 per cent.

Similarly, between September 2013 and December 2014, the majority of capital cities had mild price rises at a period when the cash rate was at a historic low of 2.5 per cent.

“What my analysis showed is that low interest rates don’t light a fire under property prices,” Mr Koulizos said.

“Sure, sometimes prices in some locations might start to strengthen at the same time as interest rates are low, but this is usually due to a number of other economic factors being in play, such as strong population and jobs growth, or simply more demand than supply.”

| Time period | Weighted average of eight capital cities | Cash rate | ||||||

| Sept 16 to Sept 19 | 1.24% | 1.50% | ||||||

| Sept 13 to Dec 14 | 11.53% | 2.50% | ||||||

| June 02 to Sept 03 | 23.73% | 4.75% |

Source: Australian Bureau of Statistics 6416.0 Established House Price Indexes: Eight Capital Cities and PIPA