- Lucapa Diamond Company (LOM) and its partner recover a 204-carat diamond in Lesotho

- The unique large stone was unearthed by Lucapa and the Government of the Kingdom of Lesotho from the Mothae Mine in Africa

- The 204-carat white stone is the eighth diamond of over 100 carats to be recovered from the Mothae mine since commercial mining began in January 2019 and the third of over 200 carats

- Lucapa Diamond Company is up 13.46 per cent, trading at 5.9 cents at 10:10 am AEST

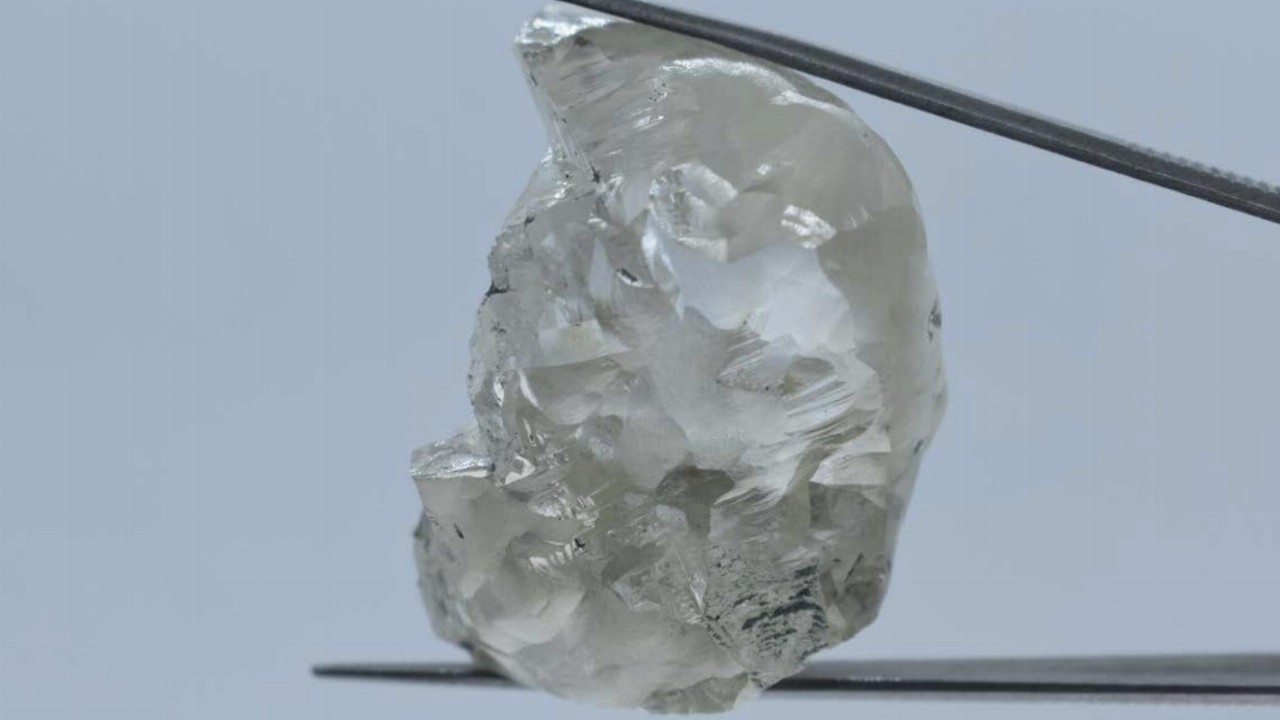

Lucapa Diamond Company (LOM) and its partner have recovered a 204-carat diamond from the Mothae mine in Lesotho.

The unique large stone was unearthed by Lucapa in collaboration with the Government of the Kingdom of Lesotho.

The company said the 204-carat white stone was the eighth diamond of over 100 carats to be recovered from the Mothae mine since commercial mining began in January 2019 and the third of over 200 carats.

Lucapa has interests in two producing diamond mines — one in Angola and one in Lesotho. Diamonds recovered from both the Lulo and Mothae mines have attracted some of the highest prices per carat for rough diamonds globally.

Meanwhile, the company has published an updated scoping study for its Australian Merlin diamond project. The project was acquired in 2021 through Lucapa’s wholly-owned subsidiary, Australian Natural Diamonds.

The mine contains a 4.4 million-carat JORC 2012 mineral resource, which is said to hold significant exploration potential, and a production target of 2.1 million carats.

Lucapa said it expected to finalise a feasibility study for the mine by the third quarter of 2022.

Shares in Lucapa Diamond Company were up 13.46 per cent and trading at 5.29 cents at 10:10 am AEST.