- Metro Mining (MMI) comes up around $8.64 million short in the retail segment of a $25.5 million capital raising plan

- The junior bauxite miner planned to raise just over $15 million from mum and dad investors as part of the entitlement offer

- This would top off the $10.45 million raised from institutional investors earlier this month

- Retail investors subscribed for around $6.5 million worth of shares, so the shortfall will be allocated to sophisticated and professional investors

- Shares in Metro Mining closed grey at 1.7 cents each this afternoon

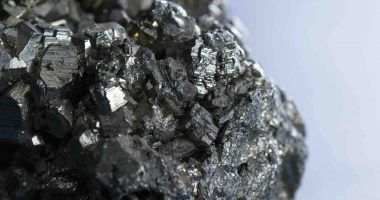

Junior bauxite miner Metro Mining (MMI) has come up around $8.64 million short in the retail segment of a $25.5 million capital raising plan.

The company planned to raise just over $15 million from retail investors through a one-for-one entitlement offer, but Metro said today investors subscribed for just under $6.5 million worth of shares.

Original applications under the offer came in at $4.2 million, with another $2.29 million raised under a top-up facility as part of the capital-raising plan.

As such, alongside an institutional placement and entitlement offer completed earlier this month to raise $10.45 million, Metro has successfully raised around $17 million of its planned total.

The shortfall of shares under the retail segment of the entitlement offer will now be allocated to sophisticated and professional investors, according to Metro management, with a preference to long-term holders who are “likely to be in a position to contribute further capital”.

The entitlement offer shares subscribed for by mum and dad investors will begin trading on the ASX on Friday, July 23.

Strengthening the balance sheet

Metro Mining first announced the raise on June 25, with plans to issue nearly 1.6 million shares at 1.6 cents each to raise the funds.

This price represents a discount of almost 43 per cent to the company’s last closing price before the cap raise was announced.

As part of the terms of the cap raise, Metro had to raise a minimum of $10 million or else the whole thing would be called off. Metro raised this minimum through the institutional offer, with $3.3 million raised through a share placement and the rest through a one-for-one entitlement offer.

The retail offer to raise the remaining funds was the final part of the capital raising plan.

The company said the funds would be used to strengthen its balance sheet as it completes important exploration work at its Bauxite Hills Mine in northern Queensland.

Shares in Metro Mining closed grey at 1.7 cents each this afternoon. The company has a $42.5 million market cap.