- ASX-listed fintechs are finding success in the increasingly crowded Australian market by focusing on technology

- As they automate operations and move away from traditional brick-and-mortar style banks these businesses are able to slash overheads

- One of the companies to engage this model is online credit business MoneyMe (MME), which offers its customers fast, easy access to personal loans and credit

- MoneyMe’s focus on technology has allowed the company to cut out the traditional middle-man in lending — the loan broker

- Its low overheads have also allowed the company to invest back into itself, increasing its offering and attracting a high number of repeat customers

- MME’s technology focus, low cost of lending, and high rates of customer satisfaction have primed the fintech stock for growing future success

- Shares in MoneyMe are trading at $1.42 each on December 15

As more and more ASX-listed fintechs join the increasingly crowded lending market, a key qualification has emerged for determining success — being tech-focused.

Lenders are moving operations online and away from the brick-and-mortar set-up of traditional banks and other credit institutions. By doing this, a company can slash its overhead costs and invest its savings back into its own growth.

One of the companies which have found success from this tech strategy is MoneyMe, a digital credit business which offers an ever-growing range of different loan products and credit cards to consumers.

By using technology to lower its operating costs, the company has been able to increase its revenue at a time when many other lenders are struggling.

It’s not a great time to be a bank

Not only is the lending market becoming more crowded, and as a result more competitive, but consumers are increasingly moving away from traditional methods of lending.

Data from the Reserve Bank of Australia shows in the last few years consumers have turned their back on personal loans in favour of other forms of credit.

The decline has been linked to the Federal Government’s Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry which found some consumers were being heavily taken advantage of.

The RBA also believed more people turned to mortgages offset and redraw accounts, which act as a line of credit, because these loans are attracting very low interest rates in line with the Reserve Bank’s own cash rate.

It’s likely the buy now, pay later market has also encroached on number of the personal loans and credit cards being issued in Australia, as evidenced by several of the big banks’ decision to launch their own zero interest personal credit options.

With consumers looking for more flexible lending options, how do ASX-listed businesses compete for a slice of this lucrative business?

The Ferrari of loan approvals, leaving other lenders in the dust

For MoneyMe, the answer has been simple — reduce its overhead costs and invest that money back into its own products and technology.

During the 2020 financial year, the business managed to spend a restrained $1.08 million on property, plant and equipment costs.

It’s not just low overheads, though — MoneyMe has also found success through its proprietary technology, which works to cut out the middleman and replace the traditional loan broker.

Anyone interested in signing up for an MME loan or credit card will have their application processed through the company’s Horizon Technology Platform using artificial intelligence.

This technology basically consumes data from multiple sources — such as credit bureaus or financial institutions — and then uses artificial intelligence to make an informed decision on whether the customer should be approved for a loan.

The whole application process takes around five minutes to complete, and, most importantly, can be done anytime and anywhere as it is highly automated.

This tech-focused style of application has dominated loan originations, with MoneyMe estimating more than 80 per cent of its loans come from automation, while 93 per cent of all payments are also processed automatically.

CEO Clayton Howes said MME was built for tech-savvy consumers in mind and its one of the founding pillars of the company’s success to date.

“A key part of our value proposition is our strong focus and commitment to delivering innovative and tech-driven experiences to customers throughout their credit life-cycle,” he explained.

Along with low overheads and an automated loan process, MoneyMe also had lower debt funding costs in its sights.

To achieve this, the fintech stock signed a $167 million warehouse funding facility with leading big-four bank Westpac (WBC).

The new facility would help MME significantly reduce its debt funding costs to below 3.95 per cent per annum, plus the bank bill swap rate (BBSW), on a fully drawn basis.

Combined with its other warehouse facility, the company planned to reduce its funding costs to below 5 per cent per annum plus BBSW — well down on the 11.4 per cent rate it was carrying at the end of FY20.

Less than two months after signing the Westpac loan deal, MoneyMe achieved its goal — reporting it had lowered its debt funding costs to 4.8 per cent after receiving an additional $57 million in mezzanine funding and refinancing its Velocity warehouse.

Faster approvals, faster growth in customer base

Not content to rely on its technology and low-cost lending operation, MME has also been investing heavily in diversifying its own personal loan and line of credit offerings.

The thought behind the strategy is that in order to remain successful, the company needs to retain its customers by offering them options which suit their lifestyle and current financial situation.

It’s a move which is already beginning to pay off, with 35 per cent of MME’s current sales coming from returning customers.

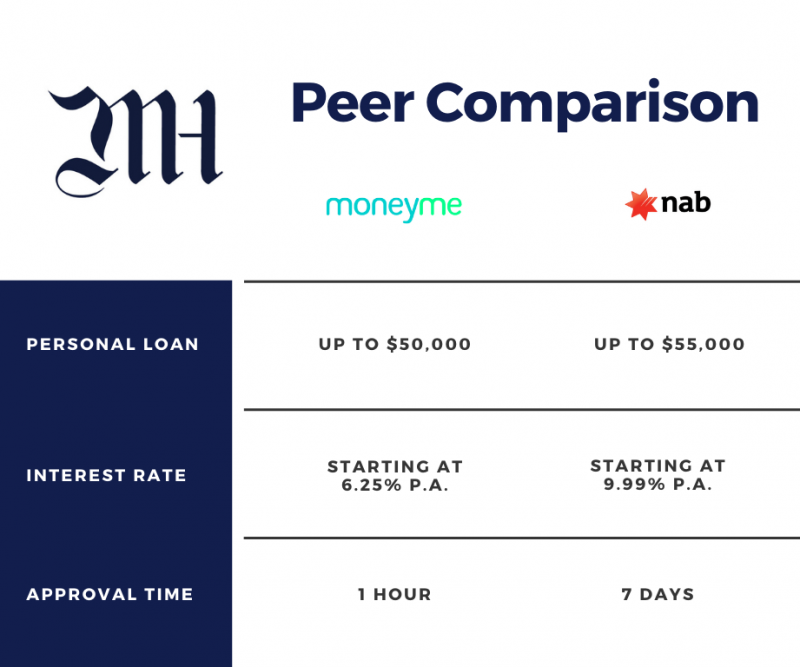

Among MoneyMe’s new offerings is an extension to the company’s maximum personal loan amount. It increased to $50,000 in September after MME received the green light from a new warehouse facility.

It’s able to offer its loans with rates as low as 6.25 per cent per annum, well below the Australian average variable and fixed rates for personal loans, which come in at 14.41 per cent and 12.42 per cent, respectively.

Additionally, the company has also branched into the ‘pay later’ market, targeting businesses and real estate agents through its ListReady and RentReady products.

A standout among peers

The unwavering focus on innovation, technology and customer satisfaction has made MoneyMe a standout among the crowded fintech market.

The company has enjoyed increases in growth, with MoneyMe announcing that its October originations were up 8 per cent compared to September, totalling $19.3 million.

That’s the highest originations the fintech stock has recorded since January, before COVID-19 decimated the economy.

It’s also posted strong profits for FY20, including a net profit after tax of $2.8 million — a huge increase from the previous year’s loss of $1.1 million.

Revenue has followed the same trajectory, rising from $31.9 million in FY19 to a solid $47.7 million in the 2020 financial year. That latest figure is already on-track to be eclipsed this financial year, with MME posting a first-quarter revenue of $12 million.

However, MoneyMe doesn’t just measure its success in financial metrics, the company also believes increasing customer satisfaction is key to long term growth and profitability.

At the end of September, the company boasted a net promoter score of 75 plus and a 4.8 out of 5-star google review average.

With a strong tech-focused strategy in place, MoneyMe is able to effectively target and grow its customer base by offering low-cost, simple lending solutions.

Shares in the rising fintech stock are trading at $1.42 on Tuesday, December 15.