- Monger Gold (MMG) lists on the Australian Securities Exchange, following a $5million initial public offering

- MMG offered 25 million shares at 20 cents, receiving double the offer amount but accepted the minimum of $5 million to maintain a tight capital structure

- The gold explorer has been examining historical results at its flagship Mt Monger North project, collating all available data to identify drilling targets

- Mark Hill, appointed as full time exploration manager, brings experience in mineral exploration and WA Archaean gold geology

- On the first day of trade, shares are up 35 per cent at 27 cents at 3:30 pm AEST

Monger Gold (MMG) has listed on the Australian Securities Exchange following a $5million initial public offering.

Under the IPO, the gold explorer offered 25 million shares at 20 cents each, receiving subscriptions up to $10 million.

However the company opted to accept the minimum amount of $5 million in an attempt to maintain a tight capital structure, which it said provided shareholders with maximum leverage.

Non-executive chairman Peretz Schapiro said the company’s tight capital structure was one of its biggest advantages and something it would endeavour to preserve.

Additionally, with only 28 million shares on issue in total, Mr Schapiro said: “Ensuring that we maintain a relatively low level of shares on issue means our share price can appreciate significantly should the Company experience any future positive developments.”

All investors are investing at the same valuation of 20 cents per share, indicating a market capitalisation of $5.6 million.

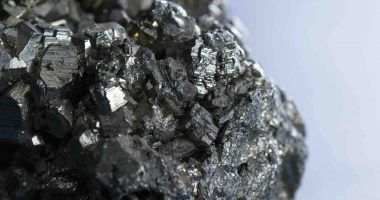

Monger Gold’s flagship Mt Monger North project is located near Kalgoorlie in the Goldfields region of WA.

The company is encouraged by historical results from the area. In particular, its primary target at the project sits along strike from Black Cat Syndicate’s (ASX:BC8) and formerly Silver Lake Resources’ (ASX:SLR) Wombola Dam open pit, which has produced 27,000 ounces of gold.

MMG said it had been examining historical results and building geological models around them to gather all available data and resources to identify the best exploration targets for an upcoming drilling campaign.

In other news, the newly listed company has appointed Mark Hill as full time exploration manager.

Commenting on the appointment, Mr Schapiro said although Mr Hill had been with MMG for a short period of time, the company was impressed with his knowledge and experience in mineral exploration, including his specialisation in WA Archaean gold geology.

“We are confident he is the right person to lead our company through this exciting phase of exploration as we seek to discover economically viable gold deposits.”

On the first day of trade, shares were up 35 per cent at 27 cents at 3:30 pm AEST.