- National rents have recorded the highest annual growth in over a decade, while regional rents have the largest annual increase on record

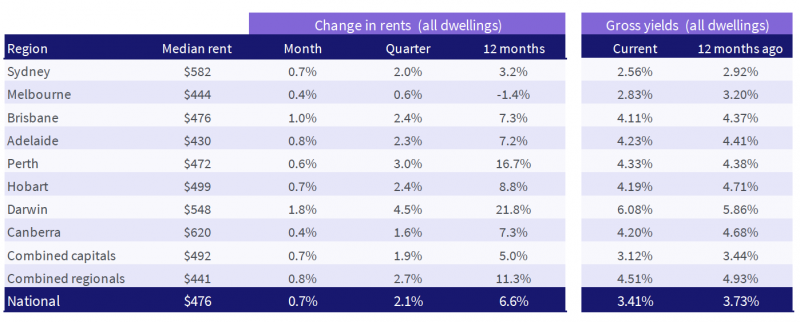

- CoreLogic’s Rental Review for the June 2021 quarter shows the latest figures take national rental rates 6.6 per cent higher over the year

- Regional rents continued to outpace capital city rents, rising by 2.7 per cent in Q2 compared to a 1.9 per cent rise in capital city rents

- Despite the easing in growth in recent months, regional Australia’s annual rental growth hit 11.3 per cent in June 2021

Despite recent slowdowns in rental growth, national rental rates are growing at the fastest rate in over a decade, with regional rents witnessing the highest annual growth on record.

Despite the growth, CoreLogic’s Rental Review for June 2021 showed national rental rates are 6.6 per cent higher over the year, dwarfed by the 13.5 per cent increase in dwelling prices.

In the three months to June 2021, CoreLogic’s national rent index increased by 2.1 per cent, down from 3.2 per cent in the previous quarter.

As housing prices exceed rental growth, national gross rental yields fell to 3.41 per cent in the June quarter, down from 3.55 per cent in the March quarter and 3.73 per cent a year ago.

Regional rents continued to outperform capital city rentals in the second quarter, gaining 2.7 per cent compared to 1.9 per cent for capital city rents, both of which were down quarter-on-quarter.

Despite a recent slowdown in development, yearly rental growth in rural Australia reached 11.3 per cent in June 2021. With CoreLogic’s rental index dating back to 2005, this is the greatest yearly growth result on record.

CoreLogic’s Head of Research Australia, Eliza Owen, says Australia has not seen rental value increases this high for over a decade.

“Following subdued rental performance through much of the 2010s, the Australian rental market has seen an increase in values due to many of the same factors that have led to the current housing price upswing,” she said.

“These factors include increased government stimulus through COVID-19, accumulated household savings through lockdown periods, the swift economic recovery seen as restrictions eased, and a lack of rental supply in some markets have also exacerbated rental price increases, particularly in major centres of regional Australia”

Ms Owen said it is interesting to note that rent prices are seeing a deceleration in growth at the national and capital city level.

“This may reflect affordability constraints, but there could also be higher levels of rental supply as investor activity in the market increases,” she said.

“Over May, ABS data showed a 13.3% increase in new finance lent for the purchase of investment property.”

Ms Owen said that some areas of the rental market are still sluggish, owing to the various affects COVID-19 has had around the nation.

In Sydney and Melbourne, unit rents are continuing to decline, -1.1 per cent and -6.4 per cent, respectively.

Both markets have shown signs of establishing, with Sydney witnessing a 1.8 per cent uplift in the three months to June.

“Overall, I think we can expect a similar outcome for the Australian rental market as the purchasing market,” Ms Owen said.

“Very high rental growth is unsustainable while income growth remains subdued. The result will likely be more subdued growth rates in the coming quarters, especially as investor participation trends higher, delivering more rental supply.”