- National Australia Bank (NAB) has gone into a trading halt after announcing its half-year profits early as it looks to raise $3.5 billion from investors

- The bank has slashed its interim dividend to 30 cents as its first-half cash earnings dropped 51.4 per cent to $1.46 billion due to the uncertainty around COVID-19

- NAB is also looking to boost its balance sheet by raising $3 billion in a placement

- The company also aims to raise a further $500 million through a share purchase plan.

- The bank says the unemployment rate is expected to get worse, with June expected to be the hardest month

- CEO Ross McEwan said he has never seen such an immediate and deep impact on the economy and health of the global community

- NAB last traded on the market at $15.76 per share

National Australia Bank (NAB) has gone into a trading halt after announcing its half-year profits early and is looking to raise $3.5 billion from investors.

The bank has slashed its interim dividend to 30 cents as its first-half cash earnings dropped 51.4 per cent to $1.46 billion due to the uncertainty around COVID-19.

The interim dividend was cut from a fully franked 83 cents a year ago. The cut comes as NAB seeks to increase its collective provisions for forward-looking economic and targeted sector adjustments by $828 million to $2.14 billion.

The big four lender’s statutory net profit for the half-year was down 51.3 per cent to $1.31 billion.

CEO Ross McEwan said he has never seen such an immediate and deep impact on the economy and health of the global community.

“There is much uncertainty as to how long this period of dislocation will last and the outlook for recovery,” he said.

Capital raise

NAB is also looking to boost its balance sheet by raising $3 billion in a placement. The company also aims to raise a further $500 million through a share purchase plan.

The placement will be at a fixed price of $14.15 per share — an 8.5 per cent discount to its last closing price on Friday.

Loans

NAB has said it’s approved more than 70,000 home loan and 34,000 business loan requests from customers to defer repayments.

Due to the demand, the bank has put 811 colleagues to the front line, call centres and operation teams.

NAB Business Support Loan provides up to $250,000 unsecured lending for three years to help businesses impacted by COVID-19, with no repayments for 6 months and a reduced variable rate of 4.5 per cent per annum.

Uncertain economic outlook

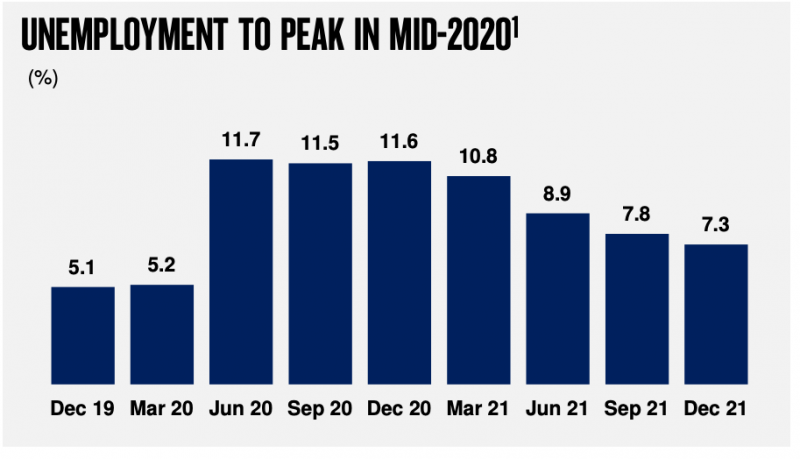

The bank says the unemployment rate is expected to get worse. The company is expecting unemployment to rise to 11.7 per cent by June and then progressively reduce in 2021.

NAB also says the gross domestic product (GPD) is not expected to go back to pre-COVID-19 days until early 2022.

“[The] GPD is expected to rebound in the fourth quarter but some sectors will face longer-term impacts and structural change,” the company told the market.

New executive appointments

NAB has also announced new appointments to its leadership team.

Rachel Slade has been appointed the Group Executive, Personal Banking. She is currently NAB’s Chief Customer Experience Officer.

Nathan Goonan has been appointed Group Executive Strategy and Innovation. He is currently the Executive General Manager of Group Strategy and Development.

“Rachel and Nathan are talented leaders with deep experience in banking and will play critical roles in delivering for our customers and our bank,” Ross said.

NAB last traded on the market at $15.76 per share.