- Office buildings that go green can command a ‘green premium’ of 18 per cent on sales prices in Sydney and Melbourne, new research shows

- The findings of the Knight Frank 2021 Active Capital Report show a global trend towards the ‘green premium,’ which is congruent with the emergence of environmental, social, and governance (ESG)

- According to the findings, Sydney and Melbourne office buildings with an energy rating of up to 4.5 stars have an eight per cent premium on sales price over unrated buildings, while those with extremely high ratings enjoy an 18 per cent premium

- Separately, the report forecasts that cross-border real estate investment will hit all-time highs in 2022

Office buildings that go green can command a ‘green premium’ of 18 per cent on sales prices in Sydney and Melbourne, new research shows.

According to the Knight Frank 2021 Active Capital Report, the ‘green premium’ on office building pricing is a growing worldwide trend, with Australia leading the way with an 18 per cent premium on sales prices for green-rated office buildings in Sydney and Melbourne.

The Active Capital Report report, now in its sixth year, forecasts global real estate investment patterns for the coming year using data and proprietary modelling.

For the first time this year, Knight Frank established the impact on a sales price that is specific to a building’s green grade.

The findings of this study show a global trend towards the ‘green premium,’ which is congruent with the emergence of environmental, social, and governance (ESG).

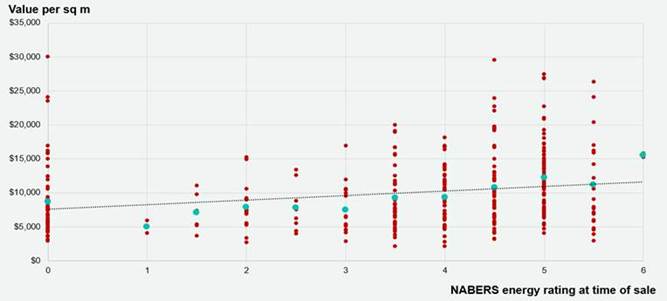

According to the findings, Sydney and Melbourne office buildings with a NABERS Energy rating of up to 4.5 stars have an eight per cent premium on sales price over unrated buildings, while those with extremely high ratings enjoy an 18 per cent premium.

The research takes into account the fact that various other factors influence pricing, such as location, building height, and grade, and so provides an indicator of the unique impact of the NABERS rating has once these other aspects are taken into account.

The growing relevance of ESG factors in real estate is well acknowledged, but it is less frequently appreciated that sustainability certifications are already having a considerable influence on building values, according to Knight Frank Australia Chief Economist Ben Burston.

“The finding clearly demonstrates that ESG considerations are a very real consideration for investors today,” Mr Burston said.

“Tenants are increasingly gravitating toward stock that offers a high degree of energy efficiency and this is impacting rental performance and allowances for downtime in buildings with vacant space.”

At the same, according to Mr Burston, investors are taking a forward-looking approach when assessing building value and view strong sustainability credentials as key to minimising risk.

“The importance of energy efficiency and its impact on building values can only be expected to increase as more tenants and investors adopt specific environmental targets,” he added.

“Under-performing assets will come under greater pressure from a reduced pool of potential tenants and buyers and this is likely to increase the differential in values between high and low performing assets in years to come.”

Separately, the report forecasts that cross-border real estate investment will hit all-time highs in 2022.

The research employs modelling approaches to estimate capital flows by country, the types of investors driving the money, and the important industries within each destination country.

The US, UK, Germany, and France are forecast to be the top destinations for cross border real estate investment in 2022, with Australia ranking tenth.

Australia is forecast to see US$7.4 billion (A$10 billion) of capital inflow into commercial markets, 25 per cent up on the expected total for 2021.