- Newcrest Mining (NCM) trades green following the release of its annual report for the 2021 financial year

- In the report, Newcrest highlights a 17 per cent increase in total revenue to around US$4.6 billion and an underlying profit of US$1.16 billion

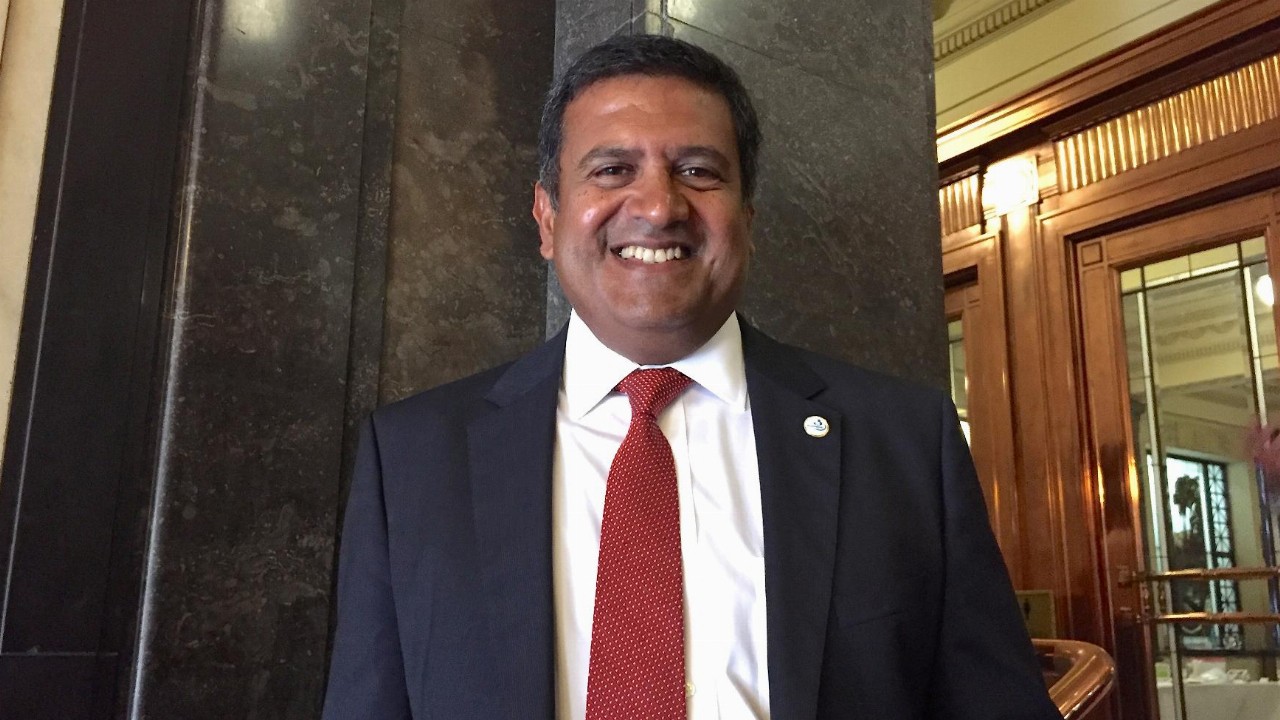

- Managing Director and CEO Sandeep Biswas says high gold and copper prices helped drive the strong financial year performance

- Newcrest bolsters its final dividend to 40 US cents per share (56 Australian cents) — 129 per cent higher than last year’s final dividend

- Shares in Newcrest ended Thursday’s session trading 1.07 per cent higher at $25.54

Australia’s biggest gold miner, Newcrest Mining (NCM), is trading green today following the release of its annual report for the 2021 financial year.

The ASX 200-lister flagged a 17 per cent increase in total revenue to just shy of US$4.6 billion (A$6.4 billion) compared to US$3.9 billion (A$5.4 billion) over the 2020 financial year.

The revenue was largely driven by gold sales, which contributed US$3.58 billion (A$4..97 billion) to Newcrest’s bottom line. Copper revenue came in at just over US$1.1 billion (A$153 billion), while Newcrest made just US$26 million (A$36 million) from silver sales.

Total earnings before interest, tax, depreciation and amortisation (EBITDA) grew by 33 per cent to US$1.77 billion (A$2.46 billion), with earnings per share up 71 per cent on the previous financial year to US$1.425 (A$1.98).

The result was a 55 per cent increase in year-on-year underlying profit to US$1.16 billion (A$1.6 billion).

Newcrest Managing Director and CEO Sandeep Biswas said the strong financial year performance was driven by high copper and gold prices combined with an all-in sustaining cost of US$911 (A$1265) per ounce.

He added that a strong focus on safety and responsible mining helped support Newcrest’success.

“We are now nearly six years free of fatalities and life-changing injuries and have reported a 12 per cent improvement in injury rates compared to the prior year,” Mr Biswas said.

“Notwithstanding the challenges brought by COVID-19, our extensive precautionary measures and focus on safety has enabled us to achieve our full-year guidance.”

In light of this, Newcrest has bolstered its final dividend to 40 US cents per share (56 Australian cents) — 129 per cent higher than last year’s final dividend.

This takes the gold miner’s total dividend for the year to 55 US cents (76 Australian cents), representing a 41 per cent payout of 2021 financial year free cash flow.

Newcrest has increased its total annual dividend every year for the past six years in a row.

What’s next?

Announced in tandem with today’s annual results is the release of a pre-feasibility study at the company’s Cadia project in New South Wales.

According to Newcrest, the early-stage study updates and defines a “significant portion” of Cadia’s future mine plan, particularly in light of the development of the PC1-2 cave in the area.

This means Newcrest is now set to move on to a feasibility study stage for the project.

As for the company’s other operations, Newcrest said it expects to produce between 1.8 million and 2 million ounces of gold over the 2022 financial year, alongside between 125,000 and 130,000 tonnes of copper.

Newcrest expects all-in sustaining costs to land between US$1720 and US$1920 per tonne for FY22 production, though the company said its financial year guidance was subject to market conditions and assumed no COVID-19-related interruptions.

Shares in Newcrest ended Thursday’s session trading 1.07 per cent higher at $25.54. The company has a $20.65 billion market cap.