- Northern Minerals (NTU) has entered a subscription agreement with sophisticated investors to raise $22 million

- The placement will be completed in four phases, however, phases two, three and four will be subject to shareholder approval

- Phase one will see approximately 450 million shares be issued at a price of $0.02

- Money raised will fund the continued development of Northern Minerals’ projects, business operations, and general working capital

- The company will also be offering a share purchase plan to raise an additional $5 million

- Eligible shareholders will be able to purchase up to $30,000 worth of shares

- Northern Minerals has dropped 12.5 per cent and shares are currently trading for 2.1 cents each

Northern Minerals (NTU) has entered a subscription agreement with sophisticated investors to raise $22 million.

The $22 million placement will be completed in four phases, however, phases two, three and four will be subject to shareholder approval.

Phase one will see 450 million shares be issued at a price of $0.02 to raise $9 million and this phase is expected to be completed on April 24.

Phases two, three, and four will see a total of 650 million shares be issued at a price of $0.02 per share. This will raise $4.2 million, $3.4 million, and $5.4 million respectively.

The money raised will be used to fund the continued development of Northern Minerals’ projects, business operations, and general working capital.

Northern Minerals will also be offering a share purchase plan to raise an additional $5 million, before costs.

Eligible Australian and New Zealand shareholders will be able to purchase up to $30,000 worth of shares.

Shares will also be priced at $0.02 per share, which represents a 17.4 per cent discount to the five-day volume weighted average price.

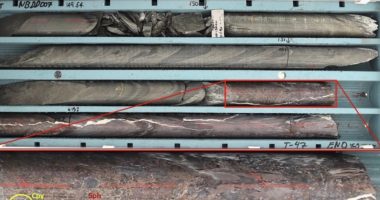

Money raised from the share purchase plan will be used for the continued development of Northern Minerals’ projects, business operations, care and maintenance of the Browns Range Pilot Plant, and general working capital.

“We are committed to a long and prosperous future at Browns Range and despite the recent decision to temporarily place the Browns Range Pilot Plant Project into care and maintenance due to impacts of COVID-19, the whole Northern Minerals team is focused on adding value for shareholders,” Managing Director and CEO George Bauk commented.

“These funds allow us to maintain care and maintenance, strengthen the balance sheet, complete the important ore sorter installation works and sets us up in a strong position to restart research and development testwork and production,” he said.

Northern Minerals has dropped 12.5 per cent and shares are trading for 2.1 cents each at 1:47 pm AEST.